Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

The 24.35 ledge per se lost its relevance Thursday but NY had a decent performance all the same as it scooped up a dip without hurting the mid band (23.88). So as so often seems the case, it is coming down to the fate of that feature to grade the impact of this weeks’ setback. There is a degree of anxiety since the Dollar is starting to probe beyond the 101.60’s gap and if that effort takes root, the mid band could be in trouble here with heavier fallout threatening beneath. Willing to call the dip corrective meantime though and entertain another leg up if the mid band held tight.

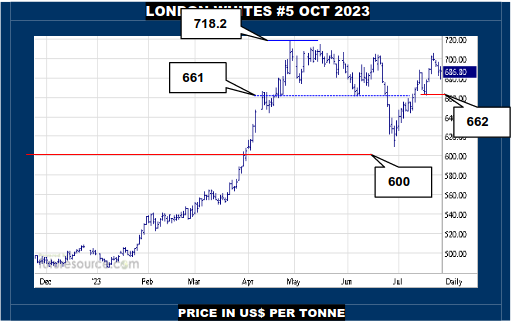

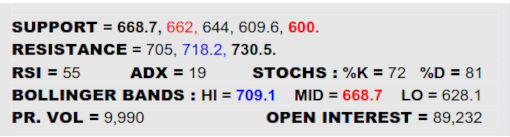

LONDON WHITES #5 OCTOBER 2023

Like its stateside cousin, London has eroded away immediate 687 support this week but to no seriously destructive effect as it kept well clear of the mid band Thursday (668.7). Accordingly the nearby retreat retains that sense of restraint for the moment as opposed to a mass bundle for the exit. Suffice to say, if the Dollar strode on from its gap conquest and the mid Bollinger succumbed here, that impression could promptly end and the shadows of the low 600’s would beckon. Okay for now though and piercing 705 could claim another flag-like step up.

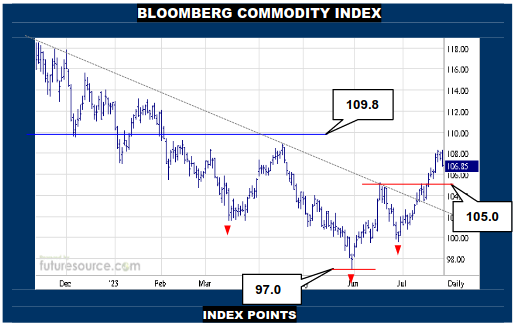

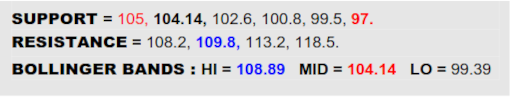

BLOOMBERG COMMODITY INDEX

“Trubble at (tut) mill!” Well, trouble at Forex to be precise as the Dollar provisionally stabbed out over the prior 101.60’s gap and caused key Euro support at 1.10 to splinter Thursday. The impact on the B-Berg was to cause an outside day retreat from the 108’s and so must now be on watch for a dip to test the main underpinnings of the Jly revival, which span 105 to the mid band (104.14). If able to mop up there and preferably meanwhile see the Dollar quickly stumble after its gap fill, there may yet be more to the commodity upswing. Alas however, swerving back under the mid band here while the greenback marched onward would signal an ominous reshuffle in the macro.

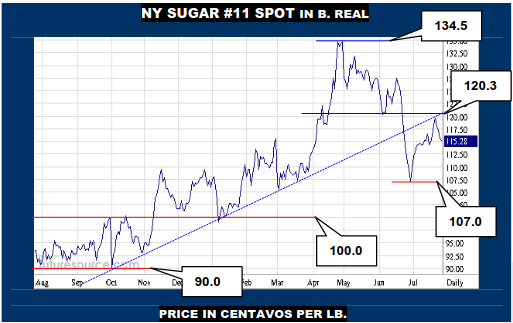

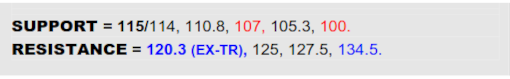

NY SUGAR #11 IN BRAZILIAN REAL

In Real priced Raws the Jly recovery has floundered right at the 120 intersection of the Q2 top and the ex-uptrend. Needless to say, that isn’t the optimal performance from the primary export origin when the Sugar market is trying to prove its return to health and this has abruptly shifted onus back onto the mid band (115). If able to dig in fast here, so it would be valid to stay open minded to taking another swing at 120 where a break-through could make all the difference. A wavering situation meanwhile though and if instead the mid band collapsed and took the 114 ledge with it, there would be warning of what was just a Jly corrective bounce unraveling and a road on below 107 towards 90 would start to call.

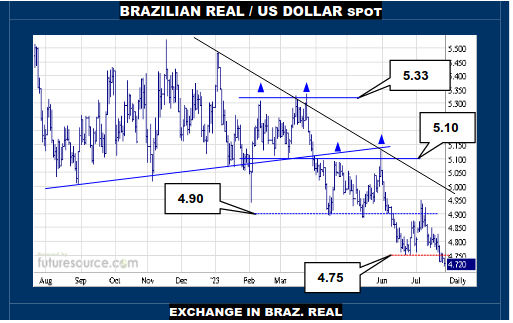

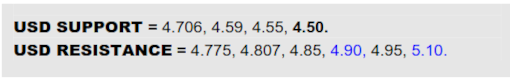

BRAZILIAN REAL / US DOLLAR SPOT

VALUE : 4.72

A brief prod into the 4.90’s early in Jly ultimately just served to prove the restrictive influence of the Q2 dual top lurking there and the Dollar has chiseled on through Jun’s 4.75 trough lately. Even so, the emphasis is on the word ‘chisel’ here because it hasn’t been the most punishing of new breakdowns and the RSI is signaling divergence while meantime the lower Bollinger band is close underfoot (4.706). Must immediately acknowledge that band is dropping so it isn’t a rigid restraint and there is a view on down to the 4.50 decade uptrend. Nonetheless, being a tentative slip warrants an eye on the 4.77’s for the off-chance of a reflex back up that could start to change the outlook.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.