Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For more information please contact Michael here.

NEW YORK SUGAR #11 OCTOBER 2023

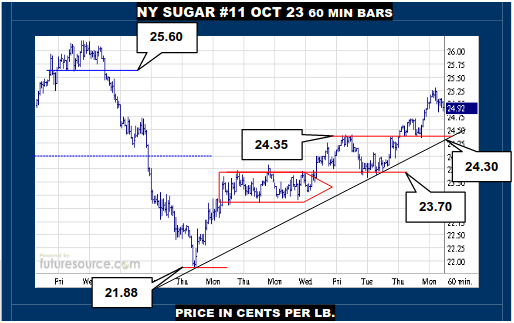

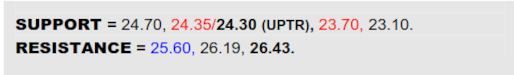

NY has managed a good pull up from the prior 23.70 pennant edge but wasn’t initially being welcomed to the 25’s Monday. No immediate cause to read much into this yet however as the B-Berg is meanwhile making tracks towards a next big crossroads at 109.8 with the aid of Crude Oil so just taking a breather in the high 24’s here would do no harm, keeping the path to the 26.43 high open. Concerns would grow however if the Dollar pierced the 101.60’s and this market broke back under 24.35, then on watch for another more dangerous encounter with 23.70.

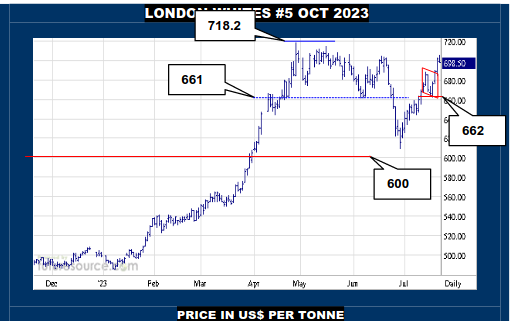

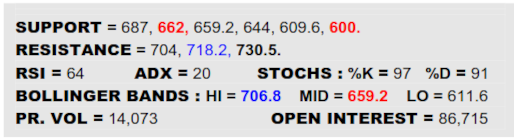

LONDON WHITES #5 OCTOBER 2023

Likewise, after a solid drive from the low 660’s last week, London just feathered the gas pedal a bit Monday. This does no harm as yet to a market that only just emerged from a flag-like dip and so the 718.2 high continues to beckon while Q2 meantime shows potential as a big monthly chart flag as well that could become a springboard to the 800’s in due time. Only if quick to double back under 687 would the nearby daily flag be cast into doubt, bringing the 662 trough into consideration again as the tripwire for a more enduring reversal.

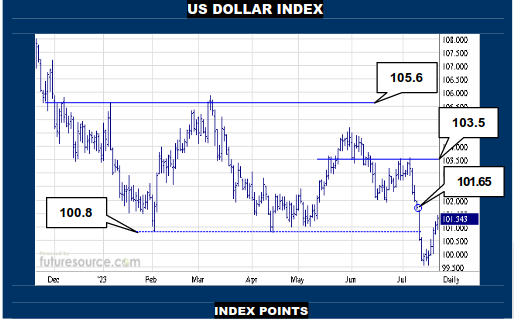

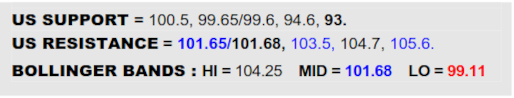

US DOLLAR INDEX

Notwithstanding the B-Berg in the hunt for 109.8 as Crude and Grains make gains, there is due cause to be minding the Dollars’ comeback from the mid 99’s as it has exceeded prior 100.8 troughs and has the 101.60’s gap in range just as the mid band is arriving there. If it could overthrow that area, it would tag the gap as purely of the ‘measuring’ variety beforehand and call the delve to the 99’s a false breakdown, in that case opening the hatch to higher levels that could readily be expected to fortify the wall at 109.8 for the B-Berg. Needing to see the swell here crest in the face of the 101.60’s to instead set the stage for another dive to double digits that could pop the 109.8 lid for commodities.

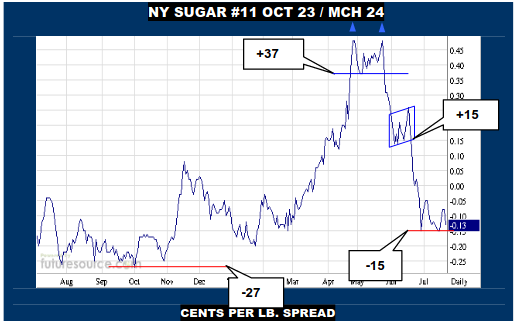

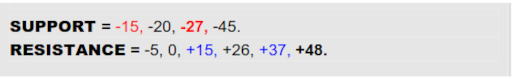

NY SUGAR #11 OCT 23 / MCH 24 SWITCH

VALUE : -13

Quickly attaining a -8 projection from a Jun bear flag, Oct/Mch has since applied the brake at -15 during Jly but this seems a pretty hollow gesture given that flat price has meantime revived 3₵. Even so, with the mid band now arriving at current levels, -5 would still be watched as a possible trigger but it seems Oct will likely have to pop the 26.40’s to have a shot back up to the +15 underside of the former flag here. Meantime beware any flay price backswing that disrupted the 24.30’s while causing the switch to press on beneath -15, in that case resulting in another bear flaggish event that would technically project on down to -45.

NY SUGAR #11 OCT 23 INTRADAY SNAPSHOT

Despite over a week of pennant congestion in the 23’s early in Jly en route, NY kept its poise and has continued to undulate steadily higher. This really only leaves one other minor rung of resistance at 25.60 on the way to the Jun apex of 26.19 and the intraday 60 minute interval RSI has been endorsing the climb with a new high on Fridays’ stretch to 25₵. Nothing currently to preempt serious trouble then as a Crude driven B-Berg makes tracks for 109.8 but would become a bit more uneasy if the path snaked back under 24.70, especially if the Dollar adjacently bust across the 101.60’s, then watching the 24.35 ledge just now hosting the near term uptrends’ arrival as a tripwire to cause a more ominous disruption.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.