Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

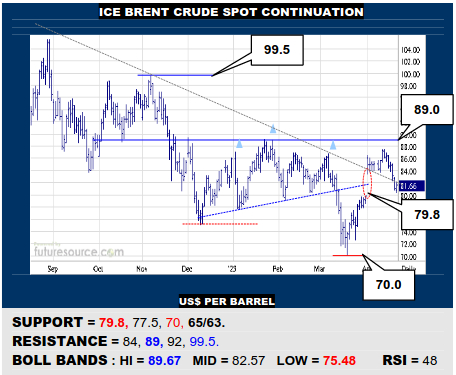

ICE BRENT CRUDE OIL SPOT

While initially shedding the broader downtrend, Brent failed in the face of the main 89 resistance and has veered back into the Opec gap. If it just filled it and immediately dug in and rallied away into the 84’s, things would look good to still escape across 89 after all. A sustained gouge back out of the 80’s would be damaging though to reveal 70 again.

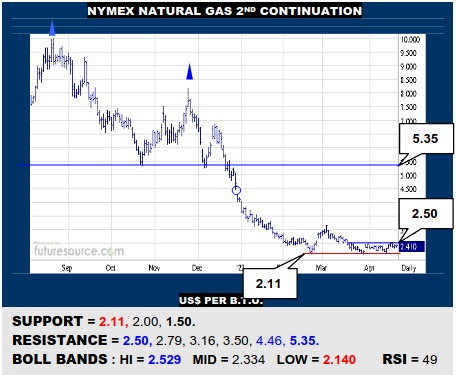

NYMEX NATURAL GAS 2ND CONTINUATION

The leveling out in Q1 has led to a stab over nearby 2.50 resistance but Nat Gas couldn’t initially get a grip. That is still the transitional divide therefore to install a preliminary base that could launch a next stage of gains to 3.16, even eying the mid 4’s in due time. Alas, while foiled at 2.50, keep minding 2.11 support as a tripwire on down to 1.50.

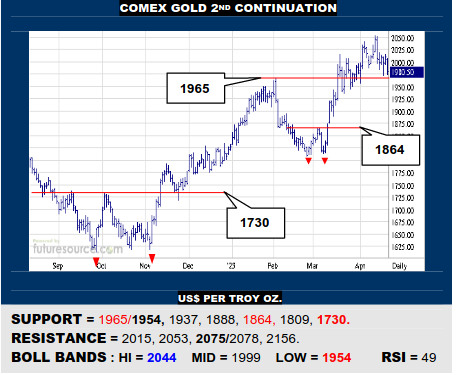

COMEX GOLD 2ND CONTINUATION

The Gold advance has stagnated in early Q2 and the mid band has frayed, exposing the prior 1965 Q1 base rim as the lower Bollinger band starts to tail away just beneath it. That suggests 1965 will be a key underpinning then. Hold it and a new try for 2075 would be on but break through and a more extensive retreat to 1864 would threaten.

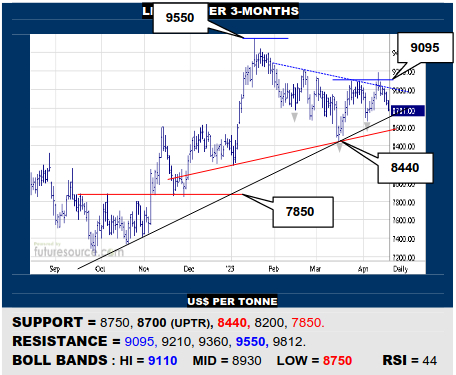

LME COPPER 3-MONTHS

A glimpse out of a new inverse H&S failed to grip and Copper has since whittled back down to be nearing key lower Bollinger (8750) and mid term uptrend support (8700). Must sweep up here and see the $ index held below 102.25 to buoy hopes of a new try for 9095+. If the trend snapped, beware pressing for 8440 and an altogether toppier outcome.

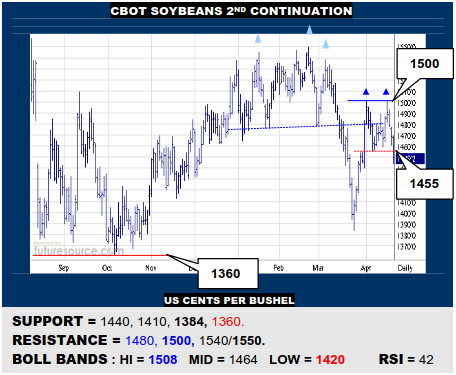

CBOT SOYBEANS 2ND CONTINUATION

A second stab into the 1480+ H&S was stumped at 1500 and Beans have reeled back through the mid band and 1455 support to post a new early Q2 dual top. This projects down to 1410 but beware gouging on through 1384 to build a far larger monthly chart top that would point towards 960. Only reaching the 1500’s would make genuine repairs.

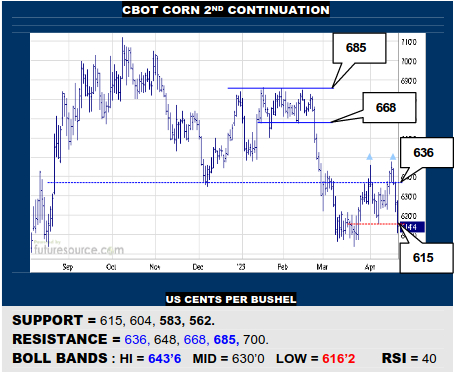

CBOT CORN 2ND CONTINUATION

After just another quick poke into the 636+ top, Corn has twisted back to fray the latest 615 trough and thus teeter on the brink of a new nearby double top. A clearer break of 615 would resolve this, in which case aiming for 583 with risk of a big monthly top if 562 later gave way. Must instantly grip at 615 to avert the nearby top and keep the 640’s in range.

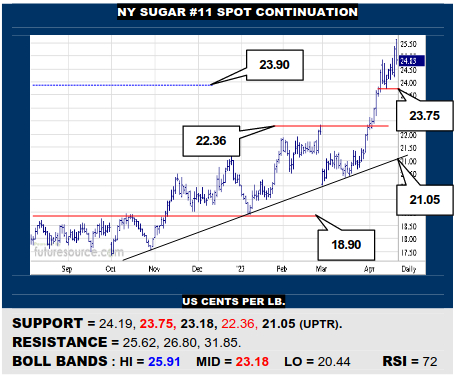

NY SUGAR #11 SPOT CONTINUATION

More new highs late this week but RSI is signaling divergence and thus raises concern of this being a false breakout in Sugar. Duly eying 24.19 as a nearby trigger and 23.75 as a more enduring pivot back down to potentially break the mid band (23.18). Needing the B-Berg to bounce immediately from its 105.5 gap fill to improve the grip here in the 24’s.

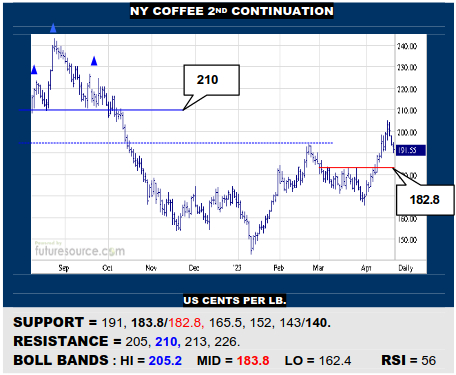

NY COFFEE 2ND CONTINUATION

A foray beyond 195 still floundered shy of the former H&S beyond 210 and Coffee has swerved south. Would be prepared for this flinch to test the mid band (183.8) to 182.8 support ledge. If the market could steady the boat there, a new bid towards 210 could still ensue. Reeling back through that 183 area would signal a longer lasting crest and retreat.

B-BERG / US DOLLAR RATIO

The B-Berg fumbling shy of 109.8 has coincided with the Ratio being headed off on the very brink of merging the past 10 months into a broad new inverse H&S. This now has the mid band fraying (1.04) and would duly watch the most immediate preceding trough at 1.037 as the confirming tripwire, in which case vulnerable to peeling on back to the lower band (1.01) and generally being faced with a lot of work to try to restore the basing pattern. Only if able to quickly dig in around 1.04 (105.5 B- Berg) and produce that drive clear of the 1.07 neckline here would the inverse H&S still be brought to fruition to build substantial macro foundations for a recovery to 1.20.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.