Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.

Featuring 8 key futures markets that combined add up to more than 50% of the entire weighting of the Bloomberg Commodity Index (23 markets total) and augmented by analysis of the Bloomberg Index and the US Dollar Index, this report offers the preeminent heavyweight commodity sector portfolio.

For more information please contact Michael here.

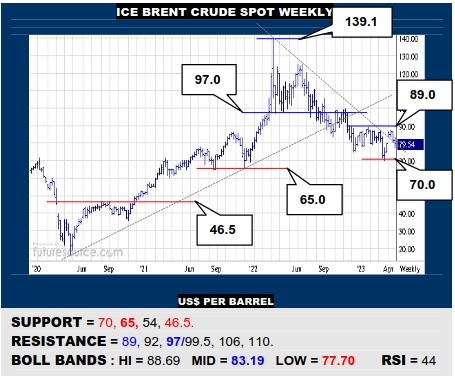

ICE BRENT CRUDE OIL SPOT WEEKLY

An Opec gap downtrend escape to start Q2 failed to follow through across 89 and Brent has veered back under the gap into the 70’s. If it could still mop up clear of 70, ’23 could retain some basing potential even if 89 would be the ultimate exit point. Alas, breaking 70 could well domino on below 65 and yield a further significant drop to 46.5.

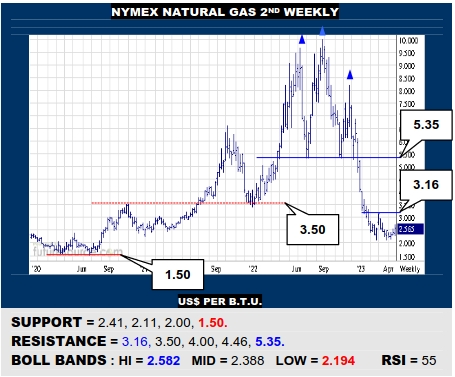

NYMEX NATURAL GAS 2ND WEEKLY

The Q1 braking effort has finally delivered a turn back over initial 2.50 resistance in Nat Gas. This buoys the corrective prospects and trains focus on 3.16, the conquest of which would even build a new early ’23 base that could propel the recovery on into the low 4’s. Only an abrupt twist back under 2.41 could undercut this and endanger 2.11 again.

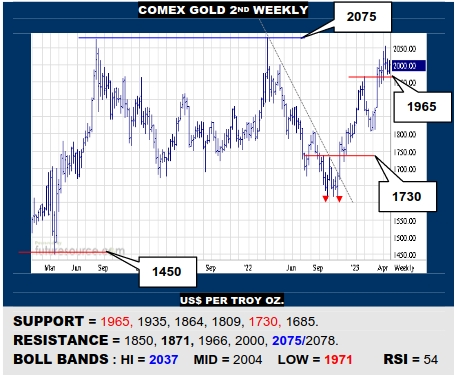

COMEX GOLD 2ND WEEKLY

Gold took a breather this past fortnight but has sustained prior defeat of the 1965 area and has now posted an inside week. This suggests trying to gather up the setback so there remains hope for a third dice with the 2075/2079 peaks in search of a longer term breakout. Only snapping 1965 would render a toppier scene aimed back to 1864.

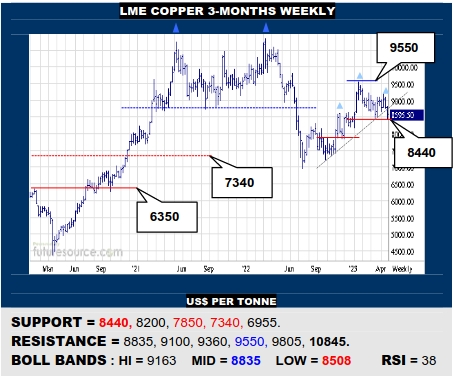

LME COPPER 3-MONTHS WEEKLY

An early ’23 basing effort has floundered and Copper has slipped off its mid term uptrend to threaten a new six month H&S. If 8440 gave way to resolve that top and the Dollar lunged up into the 103’s, duly beware a harder hit back to the monthly base rim at 7340. Must otherwise see the Dollar slump from triple digits to invite escape over 9100 after all.

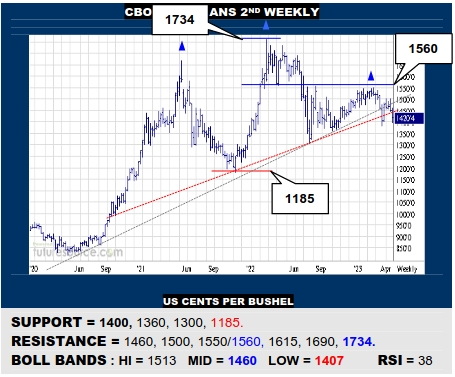

CBOT SOYBEANS 2ND WEEKLY

The Q1 long term uptrend derailment has led on to a major weekly H&S taking shape in Beans. Confirming dismissal from the 1400’s would then warn of further substantial steps down to 1300 and 1185 in due course. Only a Dollar dive from triple digits and a hike back over 1500 here would signal a rescue that could go on to defeat the 1560 resistance.

CBOT CORN 2ND WEEKLY

A similarly broad ’21 to ’23 H&S has formed on Corn and it was feeling the negative repercussions this week. This is threatening to soon topple the 560 pivot as well and continue an extensive retracement to much lower 440’s support. Otherwise it will likely take a Dollar fall from the 100’s to offer any chance to claw back to the 636/647 resistance.

NY SUGAR #11 SPOT WEEKLY

A storming Q2 has breezed by a prior decade high at 23.90 and onto disrupt the next monthly rung at 26.80, a broad path beckoning Sugar to a millennium high at 36₵. No cause to question the advance still then but slightly twitchier London Whites just merit an eye on 25.50 for any early sign of distress that could preempt a correction back to 23.90.

NY COFFEE 2ND WEEKLY

Coffee bounced from the main 140 support at new year and has lately tested the major H&S resistance beyond 200. Respecting the mainstay confines then and, after the 200’s refusal, must watch a 183 ledge. Hold it and another try of 200 could still follow. A clean snap back below 183 would instead call a more lasting crest and pave the way down to 165.

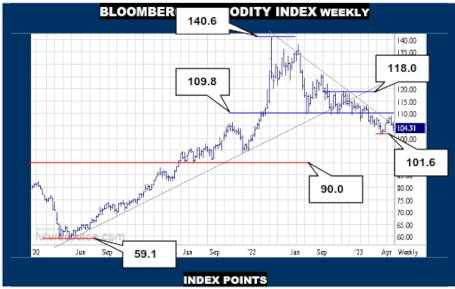

BLOOMBERG COMMODITY INDEX WEEKLY

An Opec production cut gap to start Q2 gave the B-Berg a jolt free of its ’22 downtrend but it couldn’t shore this up with a further vital escape across hefty 109.8 resistance and has tailed back into the mire. The net appraisal currently errs for having simply taken a corrective breath that has now crested so 101.6 needs close watching (in sync with the 103 Dollar downtrend). A breakdown through there would ostensibly pay homage to ‘22’s large triangle top north of 109.8 and open a path on south into the low 90’s. Meanwhile it feels as if the commodity complex needs the Dollar ousted from the 100’s to have a legitimate chance to react back over 109.8 and take a bolder stand.

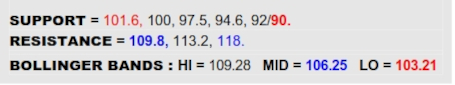

US DOLLAR INDEX WEEKLY

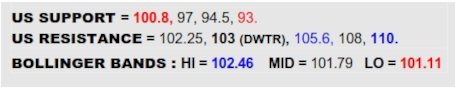

No disputing the Dollar has had a tough six months where Fed rate hike fears eased and it has whittled back into a big monthly chart base under 103. However some rumbles of rebellion have come via two 100.8 troughs in early ’23 so Forex seems to be at a pivotal juncture that will be critically relevant to commodities too. If the greenback popped an initial 102.25 cap to go on to dispatch its six month downtrend (103), it would reemerge from that monthly base to threaten a rejuvenation that could be very destructive to the B-Berg. Must otherwise see values tumble over 100.8 here to instead reassure the downtrend and pave the way towards 93, giving commodities a new gulp of air.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading undertaken based on the analysis or suggestions provided herein. This information is intended solely for the personal and confidential use of the reader and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis as principal of TechCom. Copyright © 2022 Technical Commentary.