Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.

For those seeking more than just analysis of the Dollar Index as a benchmark for currencies as a whole, this report looks at 8 major spot Forex pairings that make up the lions’ share of the vast global FX marketplace while ensuring that critical diversity key to the successful investor.

For more information please contact Michael here.

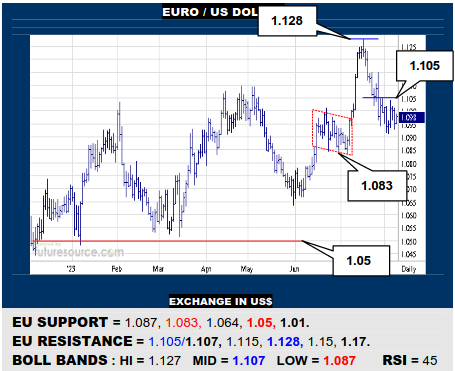

EURO / US DOLLAR

The prior sub-1.10 flag still seems to be giving the EU cushioning and nearby action hints at a tiny inverse H&S but it will take a lunge back over the mid band (1.107) to resolve that pattern and try a new run for 1.128. Still can’t rely on such a turn meantime and would watch 1.083 as a tripwire on down to the broader support shelf at 1.05.

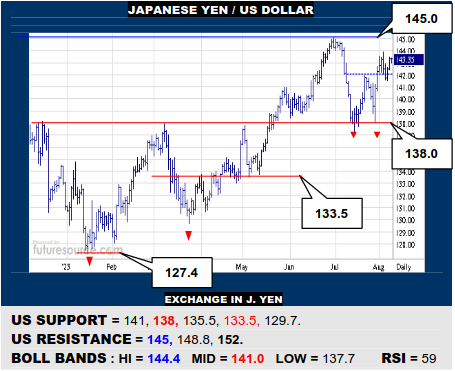

JAPANESE YEN / US DOLLAR

The US retrieved two Jly dips to 138 to create a new dual bottom and early Aug congestion implies a flag forming aboard the base. That keeps focus on 145 for now and escape beyond would pave the way on up to 152 again. Meanwhile also minding the mid band (141) as the trapdoor to undercut the double bottom and return scrutiny to 138.

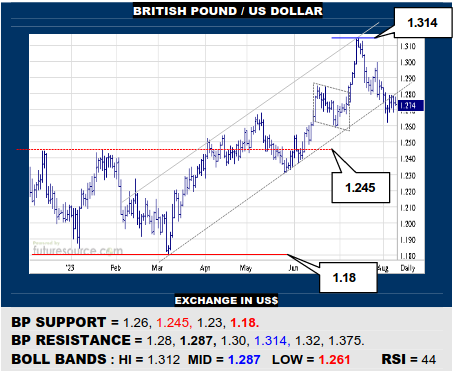

BRITISH POUND / US DOLLAR

The BP gnawed through its interim uptrend but without any serious impact and has undertaken some 1.27’s consolidation. Still watching 1.26 as a bear flag trigger that could bring harsher repercussions and a break on through 1.245 but do also keep the mid band (1.287) in mind as a release back upwards to try for 1.314 again instead.

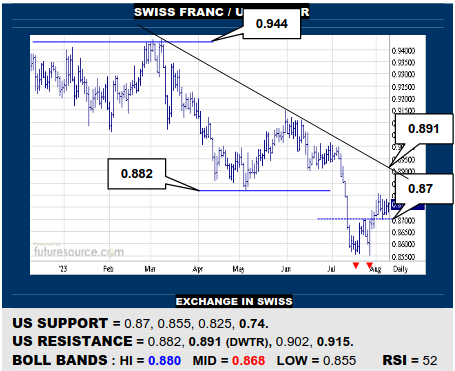

SWISS FRANC / US DOLLAR

The US has bounced back via a small double bottom but needs to reassure this effort by also piercing 0.882, then sounding an attack on the interim downtrend (0.891). Meantime minding the 0.87 base rim and mid band just behind (0.868) as key bracing, any reversal below diluting the base and exposing the 0.855 troughs once more.

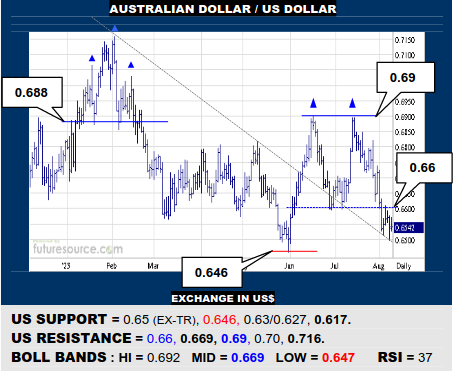

AUSTRALIAN DOLLAR / US DOLLAR

Loss of 0.66 built a new mid-year double top but subsequent pressure on the AD has thus far been buffered by the ex-downtrend (0.65). This would gain relevance with a reflex over 0.66 to question the top and at least allow access to a challenge of the mid band (0.669). If 0.646 gave way though, the dual top would prevail and point on down to 0.63.

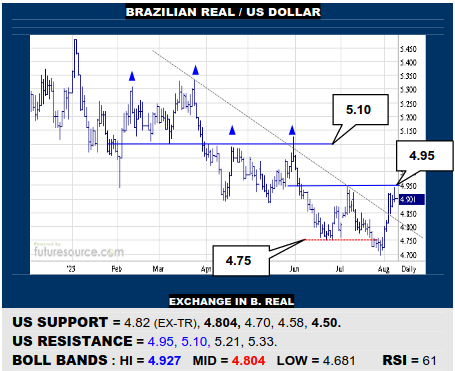

BRAZILIAN REAL / US DOLLAR

The US has ripped free of the interim downtrend but needs to soon pop 4.95 to really drive home the achievement with a double bottom, which could instill more zest to attack 5.10. Be cautious if the rest of the week played out shy of 4.95 though, then turning attention back to the ex-trend (4.82) and mid band pulling in towards meeting it (4.804).

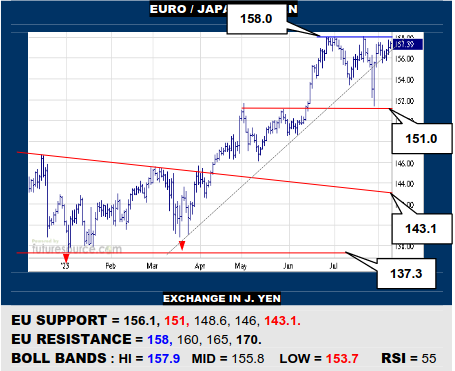

EURO / JAPANESE YEN

After a vigorous reflex back up from 151, the US has posted a flag-like shape but now needs rapid conquest of the 158 resistance to reaffirm this and beat the grass on into the 160’s, eying eventual passage to the 170 millennium high. Always with an eye on the mid band (156.1) meantime for any signs of distress to warn of a new turn back to 151.

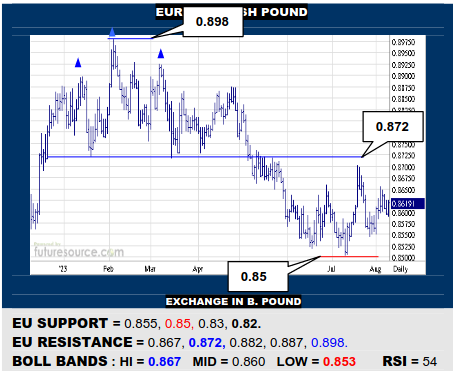

EURO / BRITISH POUND

An early Aug stab higher was curbed by the upper Bollinger band (0.867 now) but that band is starting to rise. Alas, it will ultimately demand escape across the 0.872 neckline of the early ’23 H&S to make a lasting impact to more broadly turn the tide. If instead 0.85 gave way, a new top shape would point on down to 0.83.

Every effort has been made to ensure accuracy but no guarantee is offered by Technical Commentary or Mike Ellis against errors or omissions and no liability will be accepted for any trading based on the analysis and suggestions provided herein. This information is intended solely for the personal and confidential use of the designated recipient and may not be redistributed, retransmitted or disclosed, in whole or in part, or in any form or manner, without the written consent of Mike Ellis. Copyright © 2023 Technical Commentary.