Opinions Focus

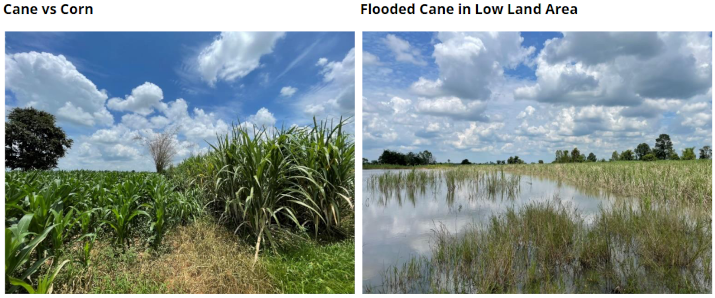

- Cane area expansion still limited by cassava, corn, and rice.

- We observed improper management of cane fields in some areas.

- Thailand’s 2022/23 crush won’t grow significantly.

We have continued our road trip in lower Northeast Thailand. For those who missed the first part of the trip, check out our tour in upper Northeast.

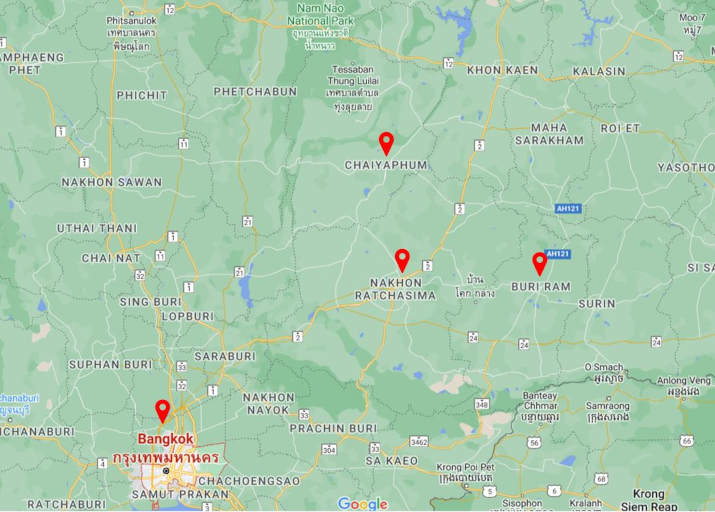

This time we’ve decided to drive from Bangkok and visit the key production areas of sugarcane in Chaiyaphum, Nakhon Ratchasima and Buriram. Luckily for us that there was no rain at all throughout the trip but is a concern for cane.

With this, we have noticed that this area didn’t receive enough rainfall even though the amount of Thailand’s cumulative rainfall is 21% higher than previous year. Irregular rains have caused a similar issue to the upper Northeast with the weeds and cane becoming leafy. The actual stalk (containing the sucrose) in a lot of fields was undersized.

We also spotted some of the improper management of cane fields in this region, but not a lot compared to the upper Northeast which we expected given this area has more small scale farmers.

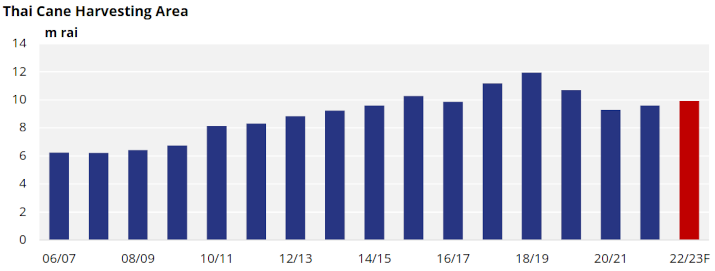

Overall, cane observed was in moderate condition. Given the strong competition with cassava, rice and corn, cane area hasn’t expanded a lot. However, we still expect to see some area expansion in other regions due to crop rotation and risk of flooded low land (cassava and corn are not tolerant to flooding).

We think that cane harvesting area will slightly increase at 3.5% year-on-year.

The rallies of fertilizer prices and issue with “fake fertilizer” are still a big threat, causing farmers to apply less fertilizer or apply poor quality fertilizer this year. However, the good overall rainfall across the country should help to maintain the agricultural yield this year at 9.78 mt/rai (up 1.2% year-on-year)

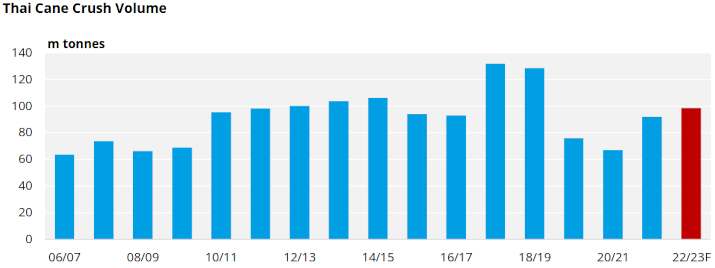

We previously thought Thailand would crush 105m tonnes of cane in 2022/23. All in all, we have observed more negative factors that strongly affect the upcoming crushing season. We have therefore revised our cane crush forecast to 98.5m tonnes this year.

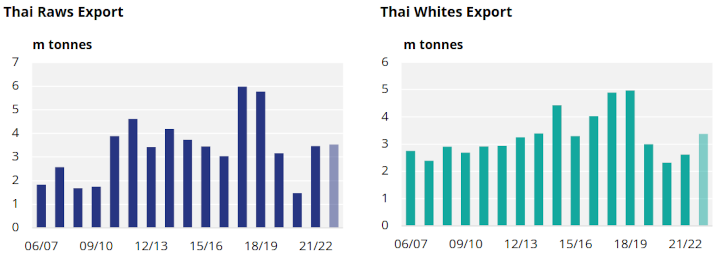

This means Thailand will have less bagasse left to power the remelt from raws to whites, less molasses for domestic ethanol production, and less sugar supply to the world market. We think Thailand’s potential raws export will remain below 4m tonnes and whites below 3.5m tonnes in 2022/23.