Insight Focus

- There exists a huge economic opportunity for US eSource: US Energy Information Administrationthanol exports internationally.

- This would greatly bolster the US corn industry.

- However, several barriers exist in scaling up this opportunity.

A diverse group of ethanol supporters in the US have recently joined their voices to calls for the removal of trade barriers affecting ethanol and other biofuels. Those behind the push include members of the US Congress, ethanol producers, corn growers and others who believe that removing the trade barriers would open new export markets.

“Opening new markets and reducing barriers to existing markets for biofuels is crucial to growing demand for corn growers,” said National Corn Growers Association President Harold Wolle.

Ethanol Exports Feed Corn Market

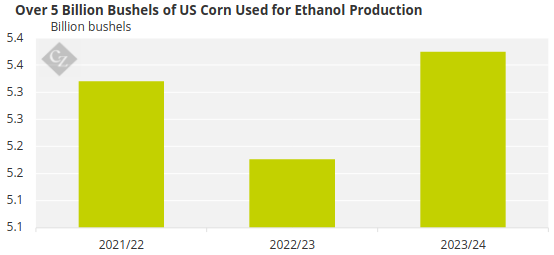

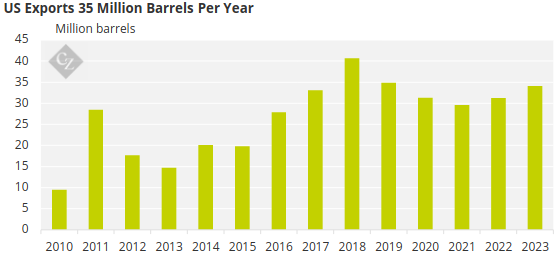

In a letter recently sent by 20 members of Congress to President Joe Biden and the US Trade Representative (USTR), the authors noted that the US exports approximately 1.5 billion gallons of ethanol annually, using 500 million bushels of corn that is predominantly supplied by US farmers.

Source: USDA

The value of the exported ethanol is US 4 billion, and the value of the corn purchased to produce it is USD 3 billion. The US ethanol industry also exports 11 million tonnes of dried distillers’ grains (DDGS) worth about USD 4 billion.

Source: US Energy Information Administration

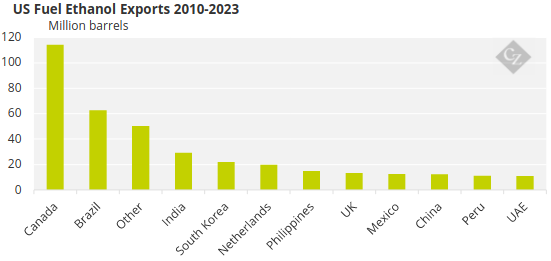

The letter referenced several countries that have created roadblocks for US exports, including Brazil, which has levied an 18% tariff on ethanol imported from the US, and India’s ban on the import of fuel-grade ethanol.

In February 2023, the Brazilian Foreign Trade Chamber reinstated an import tariff on US ethanol shipped to Brazil. The tariff is concerning to ethanol supporters because of the duty-free treatment Brazilian ethanol exports receive in the US market.

International Opportunities Exist for US Ethanol

Canada is the largest importer of US ethanol and is a market that is expected to grow. In 2022, Environment and Climate Change Canada (ECCC) finalized its Clean Fuel Regulation (CFR). The CFR will rely heavily on the use of low-carbon biofuels like ethanol as the country moves toward 15% renewable content by 2030.

Source: US Energy Information Administration

India is blending over 10% ethanol into fuel with a national blending goal of 20% by 2025. To achieve this goal, India will need to allow for the import of fuel grade ethanol, which is currently banned. India only imports industrial grade ethanol. The USTR will ask the nation to adhere to its E20 goal and eliminate the ban of fuel grade ethanol.

Brazilian ethanol producers have access to the US Renewable Fuel Standard and California’s Low Carbon Fuel Standard program, which recognize the inherent value of low-carbon biofuels. Despite years of effort though, no US ethanol producer has been qualified for Brazil’s biofuel program, RenovaBio.

Even if qualified, US producers would need to be certified because default carbon intensity (CI) scores are 2.5 times worse than typical CI scores. The US wants Brazil to eliminate the tariff and allow US producers fair access to the RenovaBio program.

The UK in 2021 moved to an E10 mandate and since then US ethanol exports have increased by about 400%. However, starting in 2027, there is a cap on crop-based biofuels that gradually decrease from 7% to 2% over a five-year period.

The UK government wants to switch to a waste-based system, effectively reducing the amount of US ethanol that can compete for this market. The US is encouraging the UK to modify its cap on crop-based ethanol as future increases in ethanol demand are expected to arise from new markets such as sustainable aviation fuel.