This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

The US sugar market continues to drag at a slow pace. While deliveries are down due to GLP-1 drugs and other factors, planting progress and crop conditions are going strong. The new Make America Healthy Again report released by the White House has sugar producers on the look out for new, potentially restrictive policies.

The Make America Healthy Again report was released last week by the MAHA Commission, which is led by Health and Human Services Secretary Robert F. Kennedy Jr. The report raised concerns about the use of food additives in the US food supply chain, along with other factors, that may be having a negative impact on the health of Americans, especially children.

Source: White House

The report referenced sugar usage in US diets, connecting it as one of the driving forces behind the rising rates of childhood chronic diseases. The sugar trade along with other organizations representing agriculture and food manufacturers will be watching to see how consumers and the market respond to this report.

Sugar Deliveries Slow but Ongoing

The cash sugar market mostly was quite in the week ended May 23. Forward sales were steady but slow, and the spot market maintained its moribund status.

Sugar beet buyers remained hesitant to lock in contracts for 2025-26. Many likely were still chewing through 2024-25 supplies, either having overbooked or bearing the consequences of slower-than-expected demand for their own products—or both.

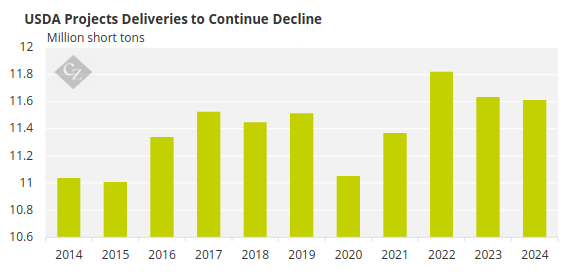

In its May 16 Sugar and Sweeteners Outlook report, the US Department of Agriculture said sugar deliveries have been slowing annually since 2021-22. During that post COVID-19 pandemic period, deliveries rose 2.5% year-over-year. The delivery pace was flat in 2022-23, then edged 0.4% lower in 2023-24, and was forecast 2.2% lower for the current marketing year.

Source: USDA

The Department said several factors have contributed to the slowdown, including lower grocery sales due to inflation and a shift in eating habits amid the rising adoption of GLP-1 drugs.

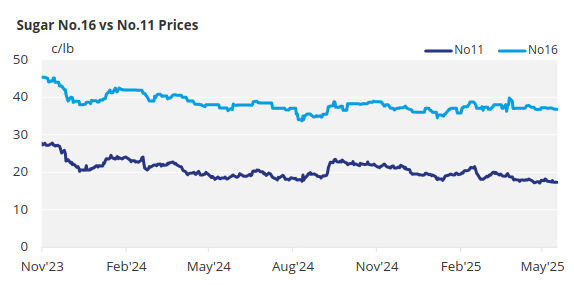

The USDA said deliveries for cane sugar were slower compared with beet sugar deliveries. The latter had dropped to its slowest pace since 2019 during November and December 2024. But beet sugar deliveries resumed a more average pace in the January-March period. Cane sugar has not experienced a similar recovery pace in any month, likely due to its wide pricing premium to beet sugar, which is about 10¢/lb.

Planting Progress Continues

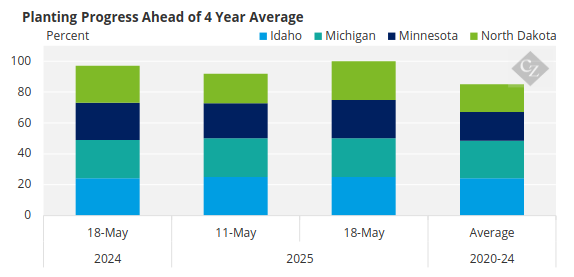

Sugar beet planting was nearly complete. The USDA in its weekly Crop Progress report said sugar beet planting in the four largest states was 100% complete as of May 18, compared with 97% a year earlier and 81% as the 2020-24 average.

Source: USDA

A number of states issued crop condition ratings. Good-to-excellent ratings were 95% in Idaho (71% a year ago), and 83% in Michigan (93%), with Wyoming at 92% (82%) and Oregon at 70% (73%). Colorado beets were rated 58% good-to-excellent. Neither Minnesota nor North Dakota issued condition data, but crops in those states were rated 96% and 100% good-to-excellent, respectively, in the prior year’s Crop Progress report for the same period.

Sugar cane condition ratings in Louisiana fell to 56% good-to-excellent, shrinking back from the prior week’s jump up to 60%, which was the highest rating for the season so far. The rating was compared with 73% a year ago and was the lowest since 55% in 2021.

The corn sweetener market was quiet.