This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

US sugar sales slowed, and prices continued to fall last week. The industry defended moderate sugar use amid health criticism. High supplies and weak demand keep the market bearish.

Refined Sugar Sales Slow Amid Criticism

Spot and forward bulk refined sugar sales were slow during the week ending April 25. Spot prices weakened further, and comments from US Secretary of Health and Human Services Robert F. Kennedy Jr. indicated that added sugars may be the next target of the Make America Healthy Again movement after dyes.

“Sugar is poison, and Americans need to know that it’s poison,” Kennedy said at an April 22 news conference. He said people should consume zero added sugar but added that it was unlikely the federal government would be able to eliminate sugar from US food products.

The sugar industry stressed that sugar in moderation is key and encouraged the government to maintain its promised gold standard in scientific reviews.

Bearish Domestic Market Weighs on Sugar Prices

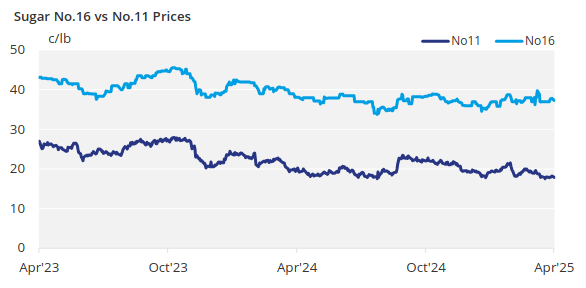

Meanwhile, the domestic sugar market remains bearish. Spot prices for beet sugar are trading below 40c/lb for the first time since January 2022, and refined cane sugar prices are at their lowest since April 2022. There are reports of some buyers honouring contracts and putting the sugar into storage since they don’t need it currently, although that is minimal since most food manufacturers don’t have sugar storage capacity.

“There is no spot sugar market right now unless someone needs fill-in supply,” a sugar seller said.

The bearish spot market is adding pressure to forward pricing and sales. Midwest beet sugar prices for both periods are about flat, although sellers are more apt to hold forward prices steady in hopes of staying near growers’ cost of production. While forward sales are progressing and beet processors’ percentage of prospective 2025–26 production is moving higher, sales have been slow compared with the past couple of years.

Beet Stocks at Record

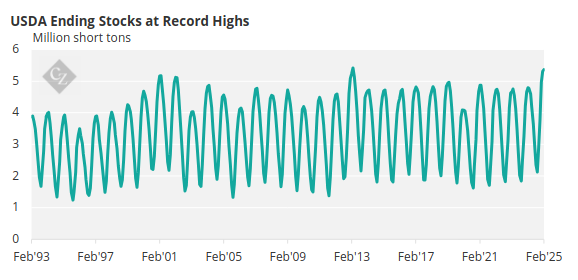

Both supply and demand are at play. Beet sugar stocks at the end of February were record high, per the USDA’s Sweetener Market Data (SMD) report. Refined cane and total sugar supplies also are at or near record highs.

Source: USDA

The increase in prospective 2025 beet sugar plantings continues to baffle the trade amid ample sugar supplies and sharply lower prices. News of the closing of the Brawley, California, beet plant and the expected loss of beet acres in California won’t impact this year’s supply, since the plant will run through July to process the fall-planted crop.

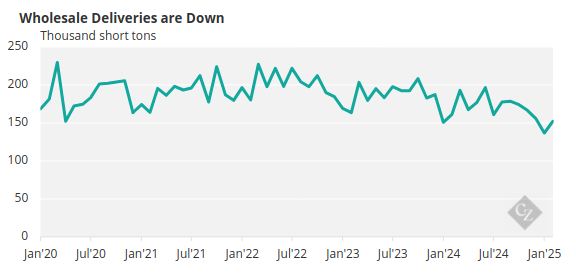

Sugar demand is a major concern, especially when coupled with excess supply, particularly in 2025. Many in the trade believe 2024–25 sugar deliveries for human use will be closer to the October–February deliveries reported in the latest SMD report (down 3.6% from the same period last year) than to the full-year forecast (down 1.5%) reflected in the April WASDE Report.

Trade sources indicated that deliveries have improved somewhat from earlier in the year but attributed that to seasonality, with most noting that deliveries of bulk sugar are below expectations.

Source: USDA

Sugar beets in the four largest producing states were 21% planted as of April 20, up from 11% a week earlier and just ahead of 20% as the 2020–24 average, the USDA said. Completion raced to 83% in Idaho (54% as the average), rose to 28% in Michigan (35%), and was underway in Minnesota and North Dakota, with strong progress expected in the Red River Valley over the next few weeks.

Good-to-excellent ratings for the Louisiana sugar cane crop improved to 43% as of April 20 but still were the lowest since 2018. Conditions in Florida’s cane area were dry, modestly reducing output at the tail end of the harvest there.

The corn sweetener market was quiet.