This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

Sugar sales slowed last week with minimal activity. Prices remained unchanged, and buyers hesitated amid ample supply. Strong beet planting and global price drops added market pressure.

Sugar Sales Stall as Buyers Hold Back

Forward cash sugar sales were slow last week, and spot sales were nil. Prices were unchanged, with a weak undertone amid slow deliveries and strong sugar beet planting progress.

The spot beet sugar market was moved to nominal amid a lack of sales, with some traders indicating sugar can’t be sold at any price as users’ needs are filled. A load or two here or there may have been sold, but no large volumes. Quoted 2025 refined cane sugar prices were unchanged, but indications were that sales were booked below quoted levels. Both beet and cane sugar stocks remain at or near record highs.

Beet and refined cane sugar prices for 2025-26 were also left unchanged. Users were hoping to buy sugar below quoted levels, or at a minimum saw limited upside potential anytime soon.

Beet processors’ sales of prospective 2025–26 sugar production crept higher. Some estimated that 50% or less of prospective 2025–26 beet sugar production has been sold, which historically is in line with normal for the date but is well behind the past two years. The slow sales add to a bearish market when coupled with ample 2024–25 stocks for most processors and strong imports of high-tier sugar this marketing year.

Sellers indicated some proposals have been out for several weeks, with buyers putting off signing deals for various reasons. One processor noted an uptick in forward sales in the past week or so, but it was mostly small and mid-size volumes. Many larger buyers appear content to wait or to only add partial coverage.

There also were indications that prices for 50-lb bags of sugar were weakening to nearer bulk sugar prices. Bags typically sell a few cents above bulk.

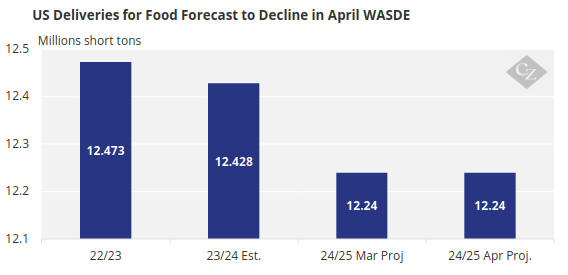

Spot deliveries remained slow, with many in the trade expecting deliveries for human consumption in 2024–25 to be lower than the 1.5% decline forecast in the USDA’s April WASDE report.

Source: USDA

Beet Planting Accelerates

Sugar beet planting made strong progress, with the four largest producing states an aggregate 54% complete as of April 27, up from 21% a week earlier, behind 60% a year ago and well ahead of 38% as the 2020–24 average, the USDA said. Sources said progress has since moved well above those numbers and nears completion in some states.

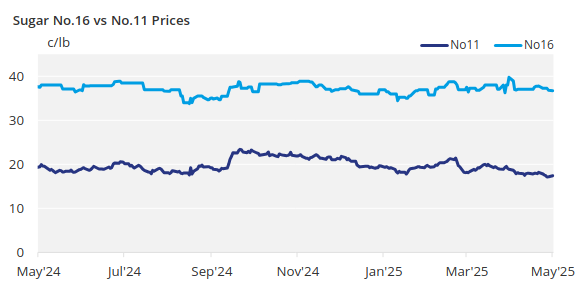

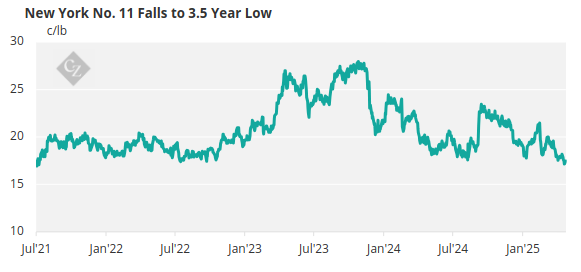

The spot New York No. 11 world raw sugar future fell to a three and a half year low amid a strong start to Brazil’s 2025–26 cane harvest and concerns about demand related to economic uncertainty. US cash sugar prices also were at three-year lows.

Discussion continued about the closing of the beet processing plant in Brawley, California. Some suggested the increase in 2025 Minnesota sugar beet area indicated in the USDA’s Prospective Plantings report reflected the loss of acres in California, since production was allocated to the Southern Minnesota Beet Sugar Cooperative, owners of the Brawley plant.

Corn sweetener markets remained quiet.