Opinions Focus

- The USDA forecast normal EU protein meal and vegoil output.

- This is despite extremely high power prices across the continent.

- We will wait and watch for signs the EU is importing rather than producing itself.

USDA agricultural economists updated their global vegetable meal and oil supply and demand forecasts this week via the monthly World Agricultural Supply and Demand Estimates report (WASDE).

Per multiple prior posts I have indicated that in the coming year it is worth everyone’s time (everyone in the global vegetable meal and vegetable oil business that is and that includes all you new participants from the US renewable diesel industry!) to pay very close attention to the USDA’s forecasts for indications that USDA economists believe oilseed processors in the European Union may:

1) slow oilseed crushing operations due to outrageously expensive, if available at all, and not globally competitive power costs,

2) replace lost domestic meal and oil production with imports which would be very supportive to processing margins for major origins namely the 3 Argentina, Brazil, and the US, in that order, and

3) reduce total consumption of vegetable oils for biodiesel production due to an economic shock as a result of higher motor fuel prices.

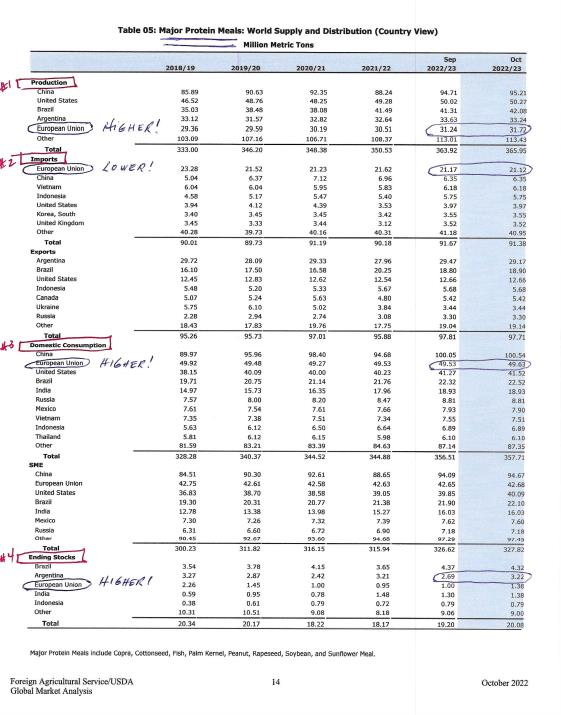

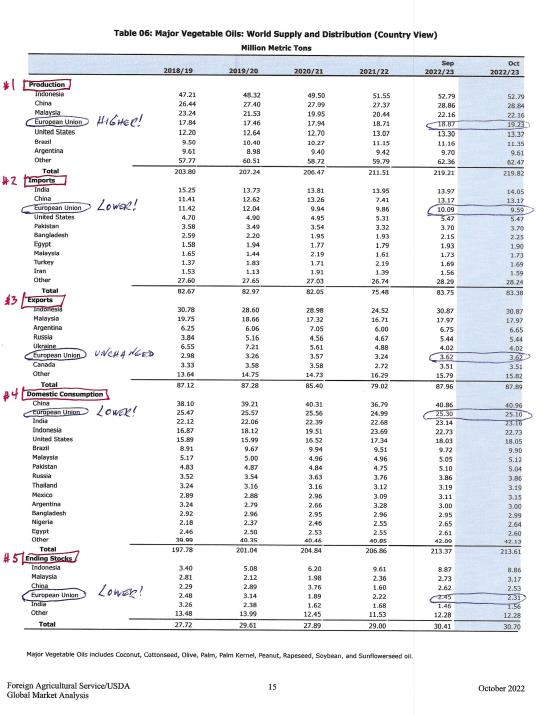

The following bullet points detail the USDA economists’ updated forecasts as produced in the October 2022 Oilseeds: World Markets and Trade. See the report’s supply and demand tables in the following pages marked up with the corresponding numbers below.

For Major Protein Meals:

1. Higher EU production than the September forecast, so no anticipated production declines due power prices or power availability

2. Lower EU imports due the above higher domestic crush rates, i.e., not importing cheaper energy via imported meal

3. Higher EU domestic consumption for protein meals so food inflation not impeding demand

4. Higher ending stocks as expanded production exceeds the increase in domestic consumption

For Major Vegetable Oils:

1. Same message as number 1 for protein meals, production rated not an issue

2. Same message as number 2 for protein meals

3. Export forecasts remain unchanged

4. Domestic consumption moves slightly lower

5. Ending stocks move slightly lower on the decline in imports

USDA economists’ message: “nothing to see here folks, move along, remain calm, move along.”

The last 8 weeks have featured European power prices surging, EU politicians discussing necessary curtailment of power to consumers, and natural gas supply chains for utilities interrupted (and destroyed) but the USDA forecasts normalcy for the EU’s oilseed processing industry? Okay, I guess.

To date there is no reason to disagree with the USDA (it is a fool’s errand to disagree with the USDA as their global agricultural supply and demand research resources and budgets far exceed any other entities’). Trade flows as detailed by weekly USDA export sales reports certainly do not suggest imminent meal and oil import demand from Europe for US production.

So, we wait, and we watch, because the EU’s power supply issue is not going away any time soon and the ability of the global processing industry to meet sharply increase import demand from the EU would demand significant rationing via much higher prices for meal and oil and steep inverses to curtail demand, In the meantime, remain calm.