Insight Focus

- The week was mainly neutral for wheat and corn.

- The latest WASDE report painted a picture of high grains stocks.

- However, USDA figures differ greatly from official estimates in Argentina and Brazil.

It was a mixed week for grains following a neutral April WASDE report. Wheat, corn and soybeans fell after the publication of the WASDE, but corn was mostly pulled lower by wheat and soybeans due to higher stocks. The April WASDE overall was neutral to the market with limited support for corn, but it does not change the big picture of a comfortable supplied market, which should cap any upside in prices.

Globally, there is a grains stock build of 16.3 million tonnes coming from a 16.1 million-tonne stock build in corn, 12.9 million tonnes in soybeans and a stock draw of 12.7 million tonnes in wheat. But there should be no downside risk given the risk of lower production in South America and potential slower planting in the US and Europe.

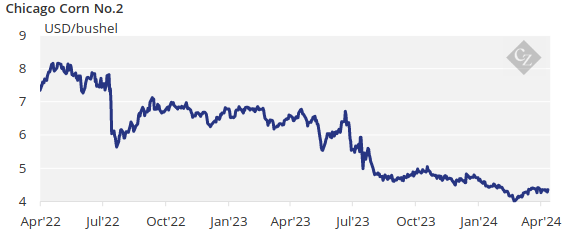

There is no change to our Chicago corn forecast for the 2023/24 (September/August) crop to average in a range of USD 4.15/bushel to USD 4.40/bushel with an upside bias. The average price since September 1 is running at USD 4.57/bushel.

Corn Ending Stocks Set to Dip

Corn traded sideways finally closing higher week on week.

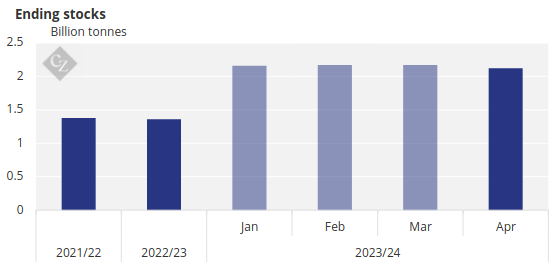

The April WASDE report released last Thursday reduced ending stocks of US corn by 50 million bushels, half of which came from higher corn for ethanol consumption and the other half from higher feed consumption.

Source: USDA

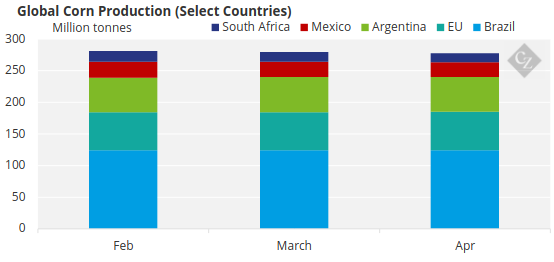

World corn stocks were 1.35 million tonnes lower with some revisions in different geographies. Argentina lost 1 million tonnes, South Africa lost 1.5 million tonnes and Mexico was down 700,000 tonnes. Meanwhile, the USDA raised forecasts for the EU by 900,000 tonnes.

Source: USDA

The USDA’s downward revision in Argentina was small when compared with BAGE figures. BAGE revised its figures downwards by 2.5 million tonnes to 49.5 million tonnes versus the 55 million tonnes estimated by WASDE. In Argentina, the corn crop is 15.3% harvested and the condition is 19% good or excellent, 3 percentage points up week on week.

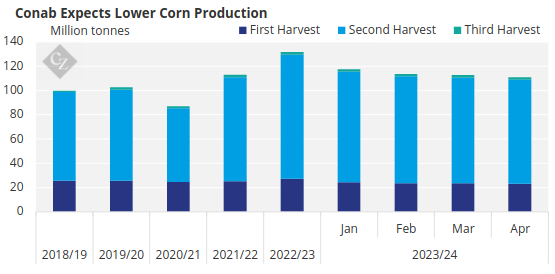

Interestingly, there was no downgrade in Brazil, which remained at 124 million tonnes versus the 111 million tonnes forecasted by Conab. Conab lowered its corn production forecast to 111 million tonnes, down from 112.7 million tonnes, a projection that is in line with other local analysts. Soybean production was also reduced marginally by just 400,000 tonnes to 146.5 million tonnes.

Source: Conab

In Brazil, the first corn crop is 51% harvested vs. 51.2% last year, and Safrinha corn planting is virtually finished, ahead of last year’s pace. US corn is 3% planted — on par with last year and slightly ahead of the five-year average of 2%.

Russian corn is 5.8% planted up from 1% the previous week. Ukrainian corn planting has started and is 3% completed. French corn is 3% planted, a much slower pace than last year and the five-year average.

Wheat Rounds Out Negative Week

Chicago wheat began the week negative on the back of comfortable supply. Following news of the good condition of US wheat, the market also closed the week negative. European wheat was slightly up.

The April WASDE report projected 25 million bushels more of ending stocks in a combination of 30 million bushels of lower feed consumption and 5 million bushels of lower imports.

World wheat stocks were marginally reduced by 560,000 tonnes, which was immaterial to the market.

US wheat condition was 56% good or excellent, the same as the previous week and up significantly on the 27% last year. French wheat condition was 64% good or excellent or 1 percentage point lower week on week. However, it is still down from 94% last year.

The US is expected to continue receiving ample rains in the Corn Belt, disrupting field work but improving soil moisture. About 23% of the corn area is under drought condition, down 1 percentage point week on week. Meanwhile, 18% of wheat area is under drought condition, unchanged week on week. Brazil and Argentina are expected to receive rains again. European rains could start to delay spring planting.