Main Focus

- Ethanol price dropped 20% since last month.

- Even with the fall, ethanol remains uncompetitive against gasoline.

- Mills are looking for alternatives in the biofuel sales strategy.

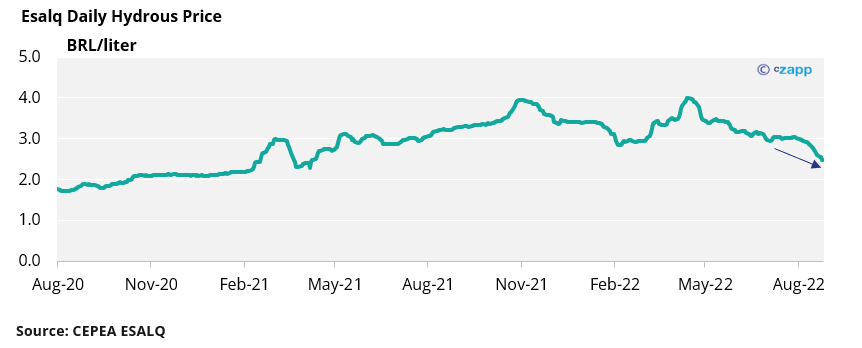

After the tax changes and Petrobras adjustment in gasoline prices in July, the ethanol price has since witnessed a free fall.

Hydrous has depreciated by 20% in the last month, going from BRL3/liter to BRL2.42 – PVU basis, net of taxes.

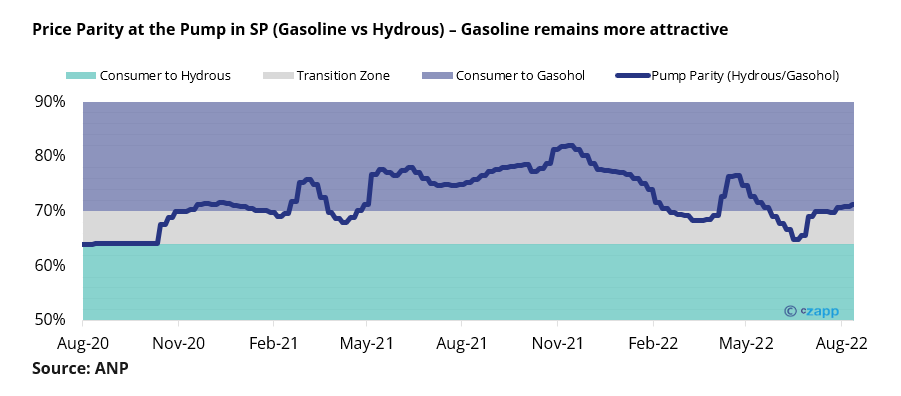

The main reason is the pump parity at the gas stations. Even with the fall, ethanol did not regain its competitiveness against gasoline.

Today, in the state of São Paulo, the pumps parity is 71%, a value that has remained at this level for at least a month.

With biofuel at BRL2.42/liter at the mills, if everything else held up, the parity was expected to drop to 68% next week. But today we had news that Petrobras made another reduction in gasoline prices. The result should be more pressure on the ethanol prices and a longer delay for the parity to fall below 70%.

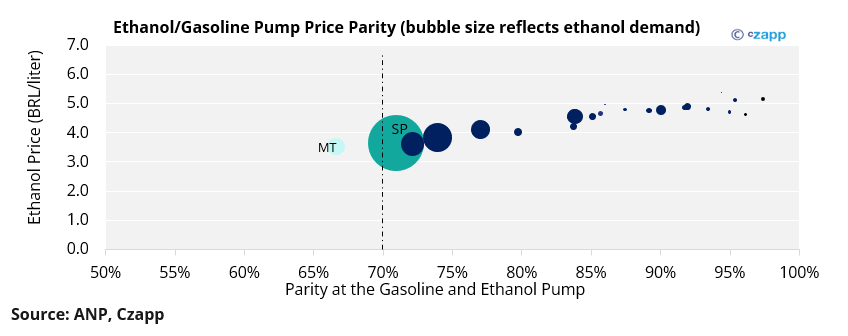

The only state where the ethanol price is more attractive than gasoline is Mato Grosso, with parity at the pumps averaging 67%.

However, the representativeness of the state for biofuel is small, with an ethanol consumption around 5% in relation to the country’s total demand.

Another factor for the pump parity taking a while to fall is the margins of the stations. ANP data show that in July the difference between the price of distributors and the price at pumps had risen to more than 0.6/liter – the average is usually around 0.35/liter. This slows down the ethanol response at the pumps even more.

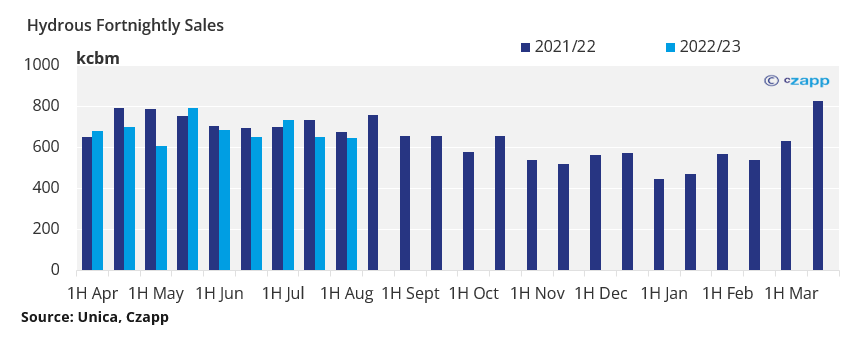

With ethanol at a disadvantage, hydrous sales by mills in the Center-South have been falling since the beginning of July.

In the last Unica’s fortnightly report, 645 thousand liters of ethanol were sold in the first half of August – 6% less than 1H August 2021.

With unsatisfactory ethanol prices, mills are looking for alternatives for better returns from ethanol sales.

Some mills are choosing to carry ethanol and sell it in the off-season in hopes that the price of the biofuel will recover.

However, the reality is uncertain as ethanol prices in the off-season will not necessarily recover significantly to be able to offset the carrying cost amid high interest rates.

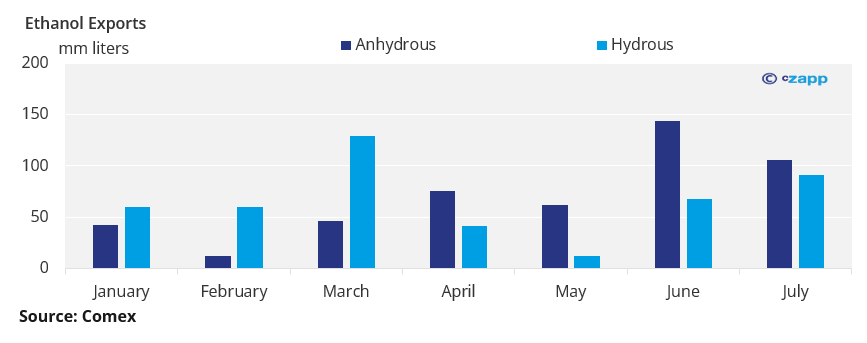

Another alternative, for some mills, is to export biofuel.

According to Comex, 197 million liters of ethanol were exported in July. As for the month of August, the line-up shows around 234 million liters nominated in August.

However, exporting ethanol is complex, especially to Europe where there is a demand for the biofuel, since few mills are able to produce European standard anhydrous and even fewer of them have the required certificates.

To give you an idea, today, only 62 mills are certified to export to Europe.

Worries Ahead

To worsen the biofuel situation, Petrobras announced that starting tomorrow (02/09) gasoline prices at the refinery will be reduced by 7%.

All of this implies a bearish vision for ethanol, forcing biofuel to drop even further in order to gain competitiveness with gasoline.

It remains to be seen now what the floor for biofuel prices will be for the next months.

But we will discuss this shortly in an upcoming report.

Dashboards that you might like