GLP-1 drugs such as Ozempic seem to help weight loss by curbing impulsive behaviour. As they become more widely available this could have implications for food consumption. We examine what might happen.

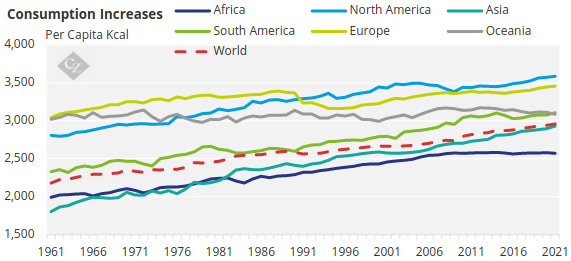

The World Consumes More

As the population increases, the world needs more calories. In many parts of the world, per capita consumption is increasing with greater food availability, pushing up the global average.

Source: FAOSTAT, World Bank

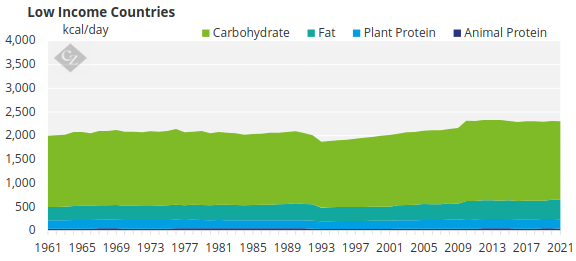

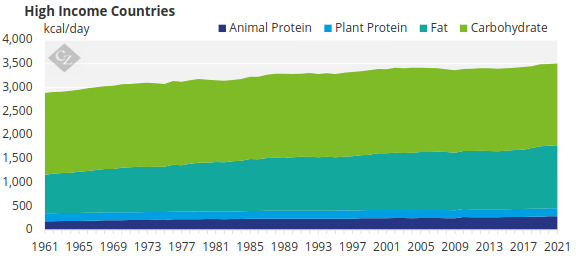

In high-income countries in particular – such as the US – calorie intake is approaching 3,500 calories per day compared with about 2,300 calories per day in low-income countries.

Source: FAOSTAT

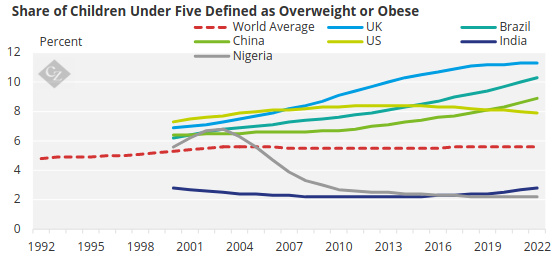

This is also much higher than health experts recommend and has driven higher rates of overweight and obesity. This has led to a rise in NCDs, primarily in the developed world.

Source: WHO

Several solutions have been proposed for the problem. One solution that is in its infancy but has shown promising results for reducing consumption habits is GLP-1s.

Weight Loss Drugs Penetrate Market

Thanks to new weight loss drugs, we may end up with significantly fewer calories being consumed per day. These drugs – known as GLP-1s – also go by their brand names such as Ozempic, Rybelsus or Wegovy.

The drug was first approved in the US for use in 2017 but was initially designed for type 2 diabetic patients, as a way to improve glycemic control. However, in time, it was discovered that the drug could aid weight loss by curbing appetite. It was approved for this expanded use by the FDA in early 2024.

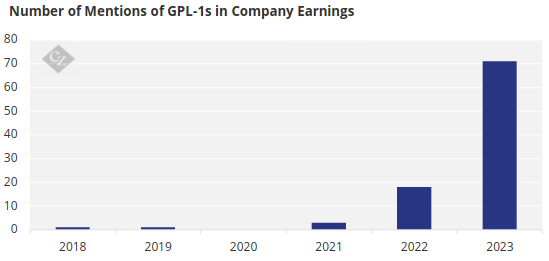

This of course has huge implications for food and beverage manufacturers. Already, mentions of GLP-1s in company earnings has skyrocketed as the industry struggles to determine how it could impact consumption patterns.

Source: Ro

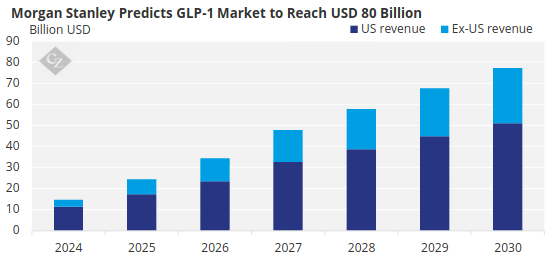

While it is still unclear how GLP-1s might penetrate the market, some predictions show that demand could reach as high as USD 80 billion by 2030, with the majority of revenues concentrated in the US.

Source: Morgan Stanley

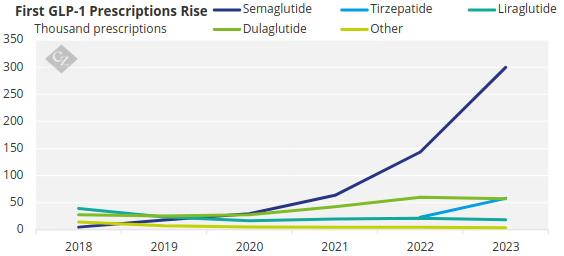

Prescriptions of semaglutides have increased significantly in the US, according to a study performed by healthcare data company Truveta.

Source: Truveta

Tirzepatides, liraglutides and dulaglutides are all variations of medications that can lead to weight loss. Some are approved only for diabetes, while others can be prescribed for weight loss. The most popular by far are semaglutides – marketed through the brand names Wegovy and Ozempic.

Could GLP-1s Impact Consumption?

Over the past few months, there has been a huge buzz about how weight loss drugs could reshape markets. A Barclays analysis showed that use of GLP-1s could lead to a reduction in sales volumes equating to 1.2% for food companies and 3% for alcohol companies.

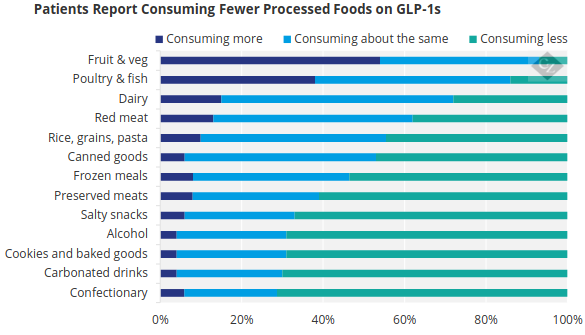

Already, some studies are confirming that the drugs lead to increased consumption in “healthy” food categories such as fruit and vegetables and poultry and fish. Meanwhile, processed foods, confectionary and carbonated drinks are becoming less popular among patients prescribed the drug.

Source: Morgan Stanley

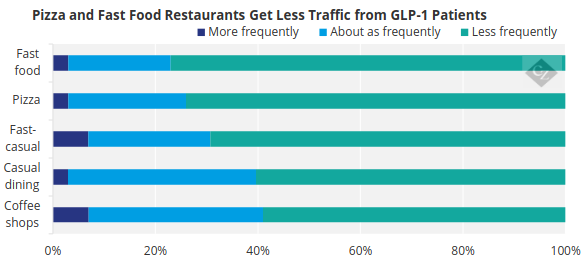

Likewise, those prescribed GLP-1s reported eating less frequently at fast food and pizza restaurants. Even casual dining and coffee shops seemed to take a hit in the survey by Morgan Stanley.

Source: Morgan Stanley

It’s not just food and beverage consumption that needs to be considered. While the healthcare industry could see increased demand for GLP-1s, this could be offset by losses in NCD treatments. With more controlled diets, prevalence of diabetes, obesity and heart disease are likely to decrease.

And it goes further than that. According to the research that currently has been conducted on GLP-1s, they work by controlling impulsive or potentially addictive behaviours. That could mean that a host of other industries could be under threat, including entertainment. With less of a propensity to drink, gamble and shop online, leisure, retail and hospitality could see slashed demand.

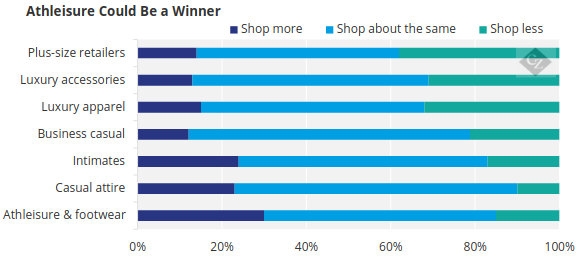

But the flip side is that there could be more winners from the GLP-1 trend. Morgan Stanley’s research found that people on the medication were much more likely to exercise, meaning gyms and shops selling fitness apparel could see a boost.

Source: Morgan Stanley

The Tale of the Super Consumers

While we often talk about average consumption, we often don’t consider impacts of so-called “super consumers”. These consumers, while on the face of things represent a small group of the population, actually account for a huge amount of consumption. This is known as the Pareto rule – 80% of the consequences come from 20% of the causes.

There is some evidence that the Pareto rule exists in the food and beverage environments. Let’s take a look at the below chart from a 2017 research paper. This shows that, for cigarettes and light beer, the top 20% of consumers use far more than others.

Data Source: Kim, Singh & Winer 2017

When it comes to alcohol, research also shows that consumption is highly concentrated. While 30% of Americans do not drink at all, the top 10% account for about 75% of the alcohol consumed.

Source: Paying the Tab by Philip J Cook

We don’t therefore need a large proportion of the population to move onto GLP-1 weight loss drugs for them to have a major impact on food and drink consumption. We only need a good proportion of each category’s super consumers to do so.

Drugs Have Mixed Expectations

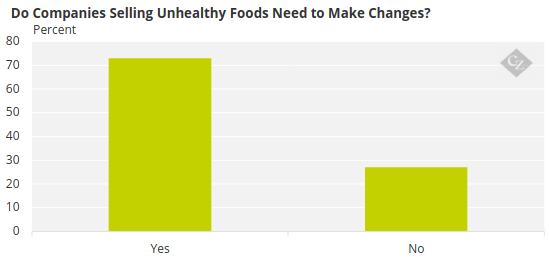

Some food manufacturers are already aware that they need to change strategies. In a Bloomberg survey, over 70% of respondents agreed that companies selling unhealthy foods need to make changes.

Source: Bloomberg MLIV Pulse Survey Feb 12-16 with 303 respondents

Food and beverage company investors were surprised last October when Walmart CEO John Furner in an interview with Bloomberg said the retailer was already seeing an impact from GLP-1s on consumption habits. He said GLP-1 users were buying “less units, slightly less calories.” While some have expressed concern that consumption could be impacted, others are less worried. In the company’s third quarter 2023 earnings call, Nestle executives were unconvinced by the threat of GLP-1s.

“The rollout of these drugs is going to be taking a long time given the cost and capacity constraints,” said Mark Schneider, Nestle’s CEO. “It’s unknown at this time how many people were up for this. It’s unknown at this time how long people will stay on this, given some of the very serious side effects. And it’s unknown also what their specific needs are when these treatment regimens are over.”

However, in the following earnings call for the company’s full-year 2023 earnings, Nestle seems to have pivoted to try to capitalise on GLP-1s. It has launched a series of products to “support the nutritional needs” of GLP-1 consumers, including muscle mass preservation products, those of micronutrient deficiencies and some of gastrointestinal health.

PepsiCo CEO Ramon Laguarta on the other hand said in the company’s third quarter earnings call that the impact of GLP-1s on the business was “negligible”.

Concluding Thoughts

- The growth of GLP-1s could have a significant impact on food markets – as well as many others.

- However, there are also opportunities for other industries that could capitalize on the changes.

- Companies are already reshaping portfolios and product lines.

- So, will weight loss drugs really change consumption patterns? Right now, there are a lot of unknown variables.

- For instance, GLP-1 research is still in its infancy and the complete list of side effects has not yet been explored.

- We also don’t know how long patients can healthily consume them. By all accounts, as soon as the prescription ends, consumption increases again.

- What we can say is that, even if GLP-1s reduce certain aspects of consumption, there are likely to be other areas where higher consumption will offset negative growth trends.