- Risk off in the sugar market as speculators sell.

- A new downtrend seems to have begun, which should help consumers after 18 months of pain.

- The longer-term bull view remains intact for later in 2022.

Short Term: Why Has the Sugar Market Fallen?

- We spend most our time understanding what’s happening in the sugar market to try to forecast future price direction.

- It can therefore be extremely frustrating to acknowledge that all financial markets are also driven at some level by the US Dollar.

- Through the middle of 2021, the sugar market was abuzz with reports of frosts and extreme dry weather in CS Brazil.

- Worries over supply pushed futures prices above 20c, with the flames being fanned by several of the world’s larger trade houses.

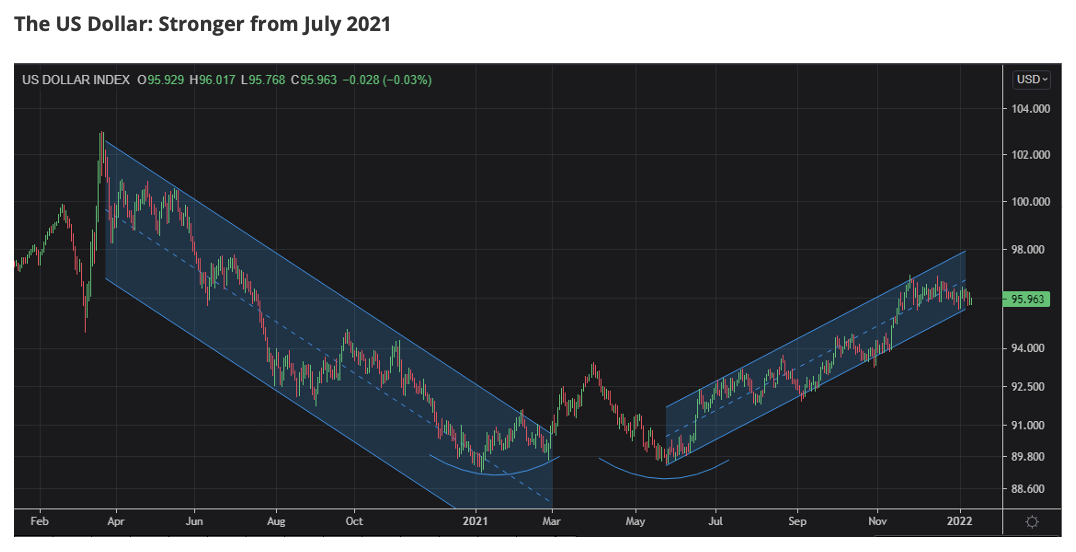

- But at the same time the market was in a fundamental frenzy, the US Dollar stopped weakening and started to strengthen again.

Source: Refinitiv Eikon

- All other things being equal, a stronger Dollar is negative for commodities.

- Not long after, the sugar market itself stopped strengthening and settled into a sideways trend for much of H2’21.

- Indeed, the post-COVID uptrend quietly broke finally in November 2021.

Source: Refinitiv Eikon

- And now, even the sideways trend of the last six months has broken.

- 2022 has begun with a major risk-off event as the wider markets digest the news that the Federal Reserve is preparing to reduce the huge liquidity it’s supplied since COVID first went, erm, viral.

- As well as tapering their quantative easing, the Federal Reserve has also indicated that it’s preparing to increase interest rates three times in the next 18 months.

- No wonder the US Dollar has been strengthening…

- We first flagged the risk of US rates rising in May 2021, then followed up with a note on US Dollar strength in October 2021, and then covered the uptrend break in November 2021, in addition to this weekly Market View report.

- We therefore hope that we’ve provided enough prior warning for you to manage your market risk effectively.

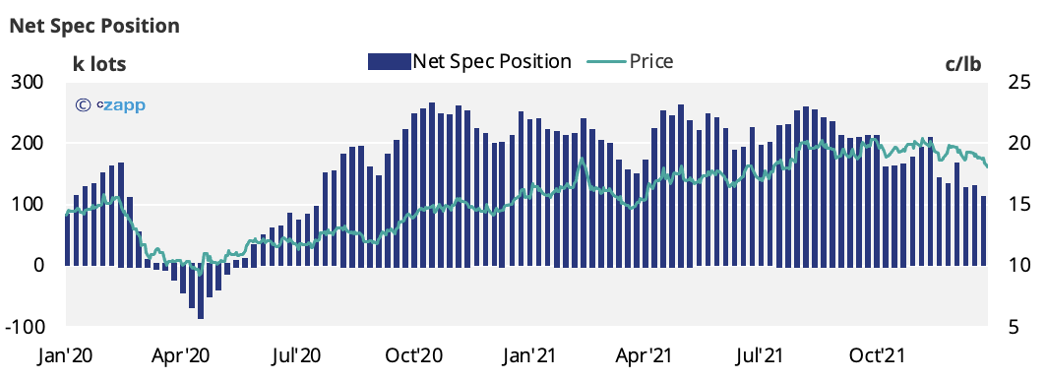

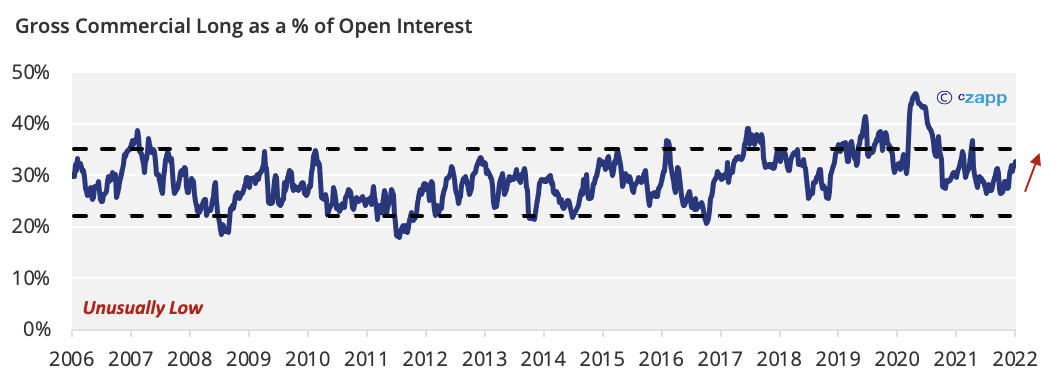

- The risk-off event has led to weakness in the US bond and equity markets and has also led to speculators aggressively selling their sugar longs.

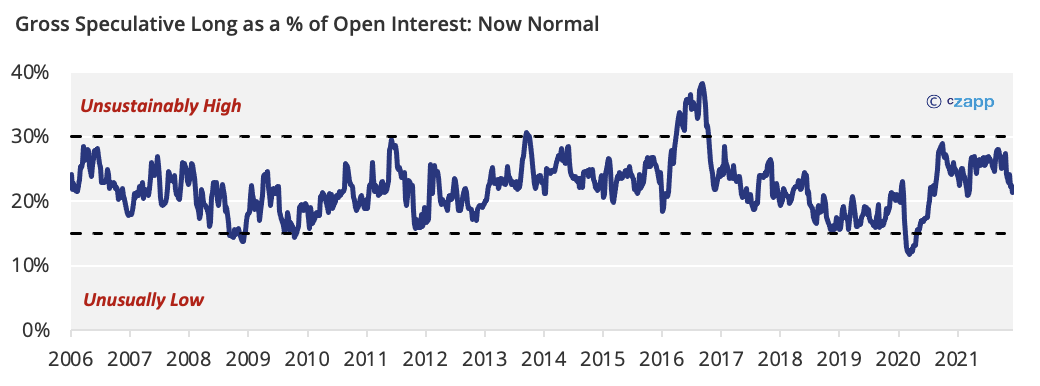

- The speculative position in sugar is now completely “normal” (if such a thing exists) having been heavily long (bullish) since the middle of 2020.

- Now the speculators have exited the market, they’ll need a decent fundamental story to bring them back.

How Do Lower Prices Affect the Market?

- As the speculators have sold in recent weeks, raw sugar refiners and white sugar end users have been buying; after all, sugar is getting cheaper.

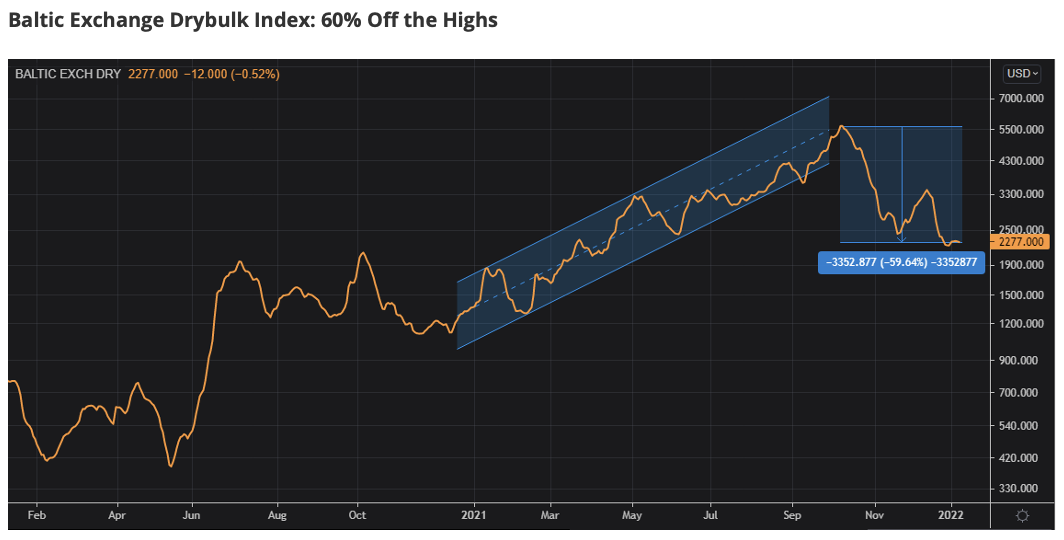

- In addition, dry bulk freight indices are less than half what they were at the peak of last year’s supply chain crisis in October.

Source: Refinitiv Eikon

- In particular, Monday’s break below 18c uncovered a lot of physical sugar buying, with Chinese refiners rumoured to have bought 5-8 cargoes for later in 2022.

- Other Asian refiners were also rumoured to have increased cover on the dip lower.

- This suggests that futures prices could attempt to re-test the 18.50c old support level in the short term.

- However, in the medium term, a new downtrend has now formed and it’s most likely sugar continues to trade lower until further buying support can be found.

Source: Refinitiv Eikon

- Refiners and consumer actually seem to have a decent level of cover on for 2022 already.

- Added to this, rainfall in key cane growing region, CS Brazil, has been excellent so far in the off-crop, which is essential for good cane growth (and therefore sugar production).

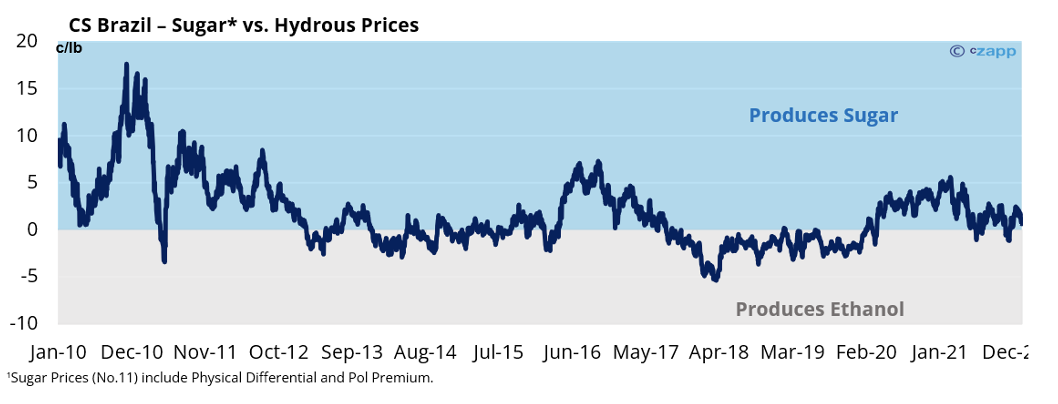

- It’s possible the raw sugar market needs to trade towards a level at which there’s a possibility of producer buy-backs, or Brazilian mills changing their production mix from sugar to ethanol.

- Given what we know today, this implies raw sugar could fall towards 17c before finding support.

- Alternatively, if the USD uptrend breaks, perhaps the wider market becomes a bit more risk-seeking and the commodity inflation story can run again…?

Longer Term: The World Needs More Sugar

- A major problem for the sugar market is India’s swing from sugar exporter to ethanol consumer.

- Low-cost subsidised sugar from India will no longer be supplied to the world market in the future.

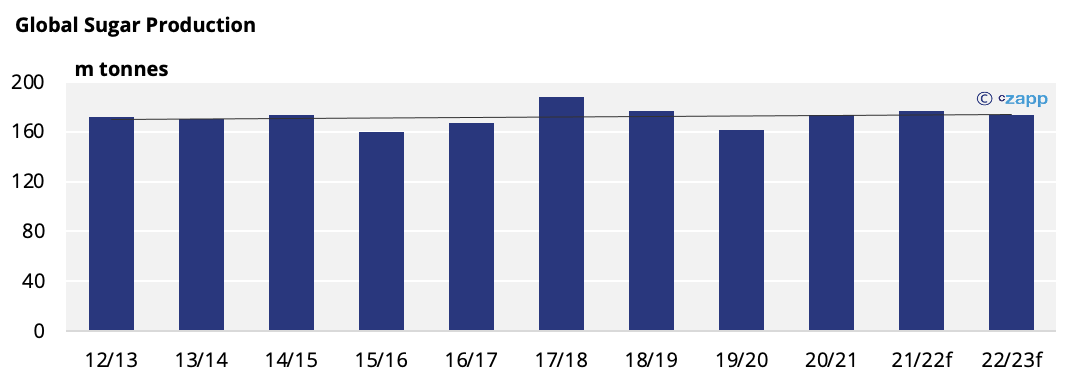

- Moreover, global sugar production has barely expanded in the past decade thanks to low investment/falling price.

- This means there’s no other production coming on stream to balance India’s withdrawal from the market.

- In the longer term, sugar prices need to be high enough to reverse this, especially as India’s ethanol programme grows.

- We’ve written a series exploring which countries could expand their cane or beet acreage in the coming years.

- But we believe higher sugar prices are likely at some point in 2022 given the possible stress to sugar supply.

How to Manage Your Market Risk

- The market’s new downtrend means 2022 starts with an excellent opportunity for sugar buyers after 18 months of pain.

- We think buyers should start adding to cover below 18c and become increasingly aggressive should the market fall close to 17c.

- Producers that need to hedge in the short term should sell above 18c; those that can wait for the current weakness to pass (>6 months, perhaps) should wait for better returns.

- Given the lack of Thai and European refined supply for 2022, we think the white premium should trade at a level which incentivises toll (re-export) refiners to operate at high throughput.

- We therefore think the white premium should trade between 80-100 USD/mt, with regional physical values enabling refiners to hit their profitability targets; current white premiums for 2022 are starting to feel fair value.

If you have any questions, please get in touch with us at Jack@czapp.com

Other Insights That May Be of Interest…

The World Needs More Sugar…Who Can Help?

The World Needs More Sugar…Can India Help?

The World Needs More Sugar…Can Brazil Help?

The World Needs More Sugar…Can Thailand Help?

Explainers That May Be of Interest…

Thailand’s White Sugar Industry