Insight Focus

- Raw and refined sugar futures prices have traded sideways over the past week.

- Futures positioning was broadly unchanged.

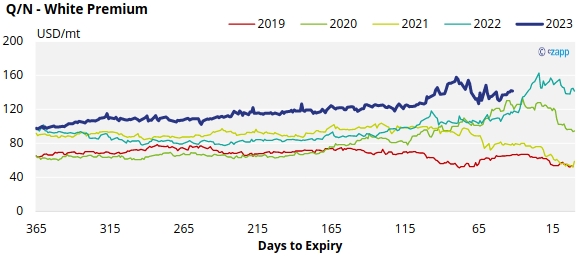

- Q/N sugar white premiums have strengthened, standing at 141USD/mt.

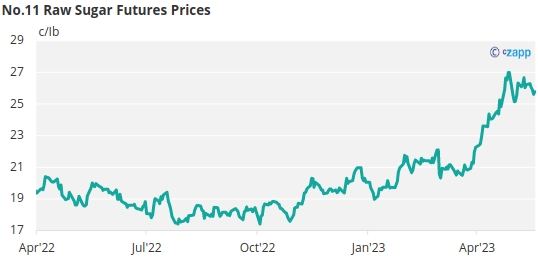

New York No.11 Raw Sugar Futures

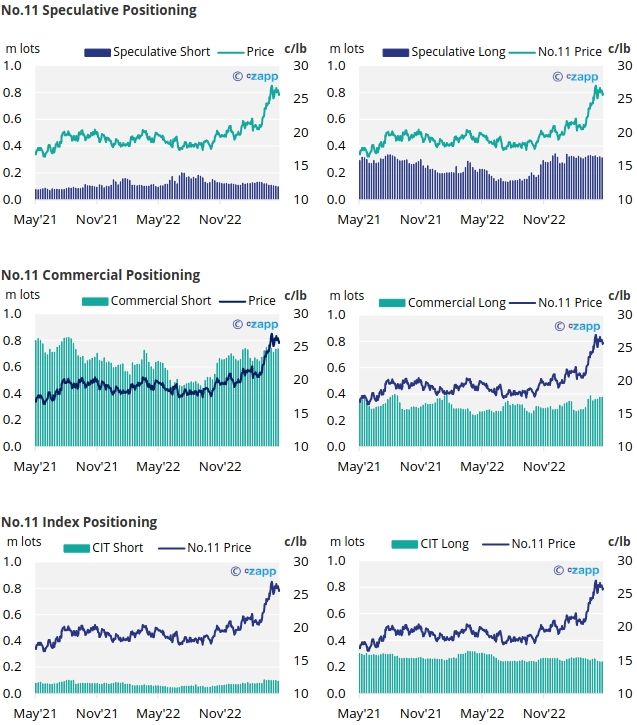

Following two weeks trading sideways around 26/lb, No.11 raw sugar futures briefly reached a high of 26.6c/lb at the start of last week, before closing close to 25.8c/lb by Friday.

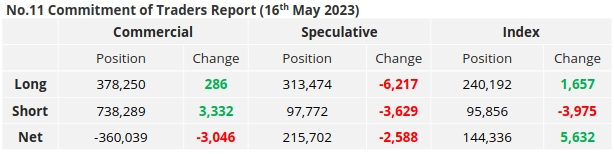

By the 16th of May (the most recent CoT CFTC report), raw sugar producers have added 3.3k lots of new hedges, whilst consumers have added a modest 0.2k lots of additional hedges.

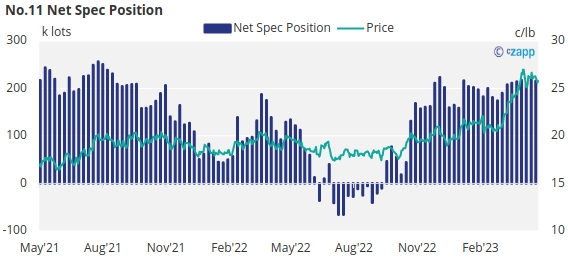

Turning our attention to the speculators, a slight slip in the No.11 futures price has resulted in the speculative long position to retreat by 6.2k lot. With some spec short positions closed too, the net spec position has fallen just under 216k lots long.

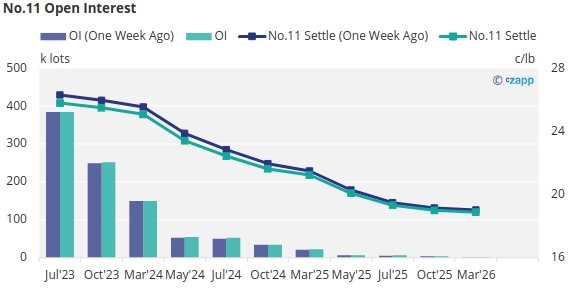

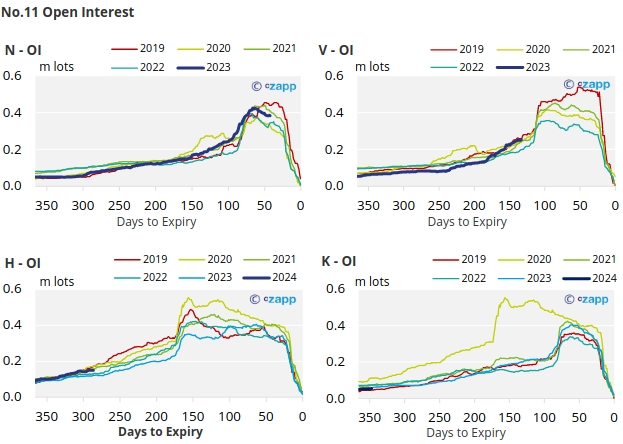

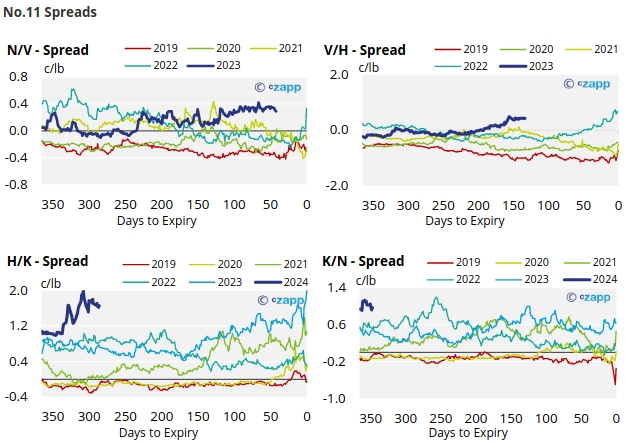

With prices down the board weakening over the last week, the No.11 forward curve remains backwardated.

London No.5 Refined Sugar Futures

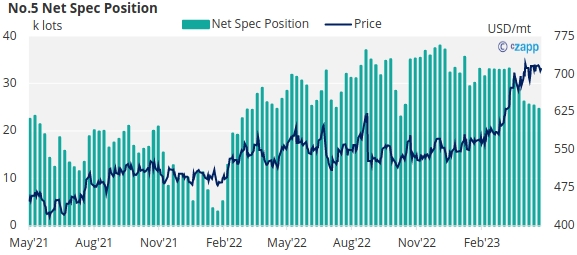

Following a similar trajectory to the No.11, the No.5 sugar futures also experienced 2 weeks of sideways trading before closing last Friday at 710 USD/mt.

By the 16th of May (latest CoT data), refined sugar speculators reduced their net long positions by 0.7k lots; with prices already at multi-year highs, speculators may be wary of the prospects for further price increases.

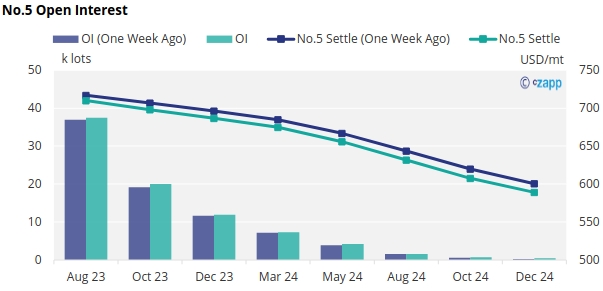

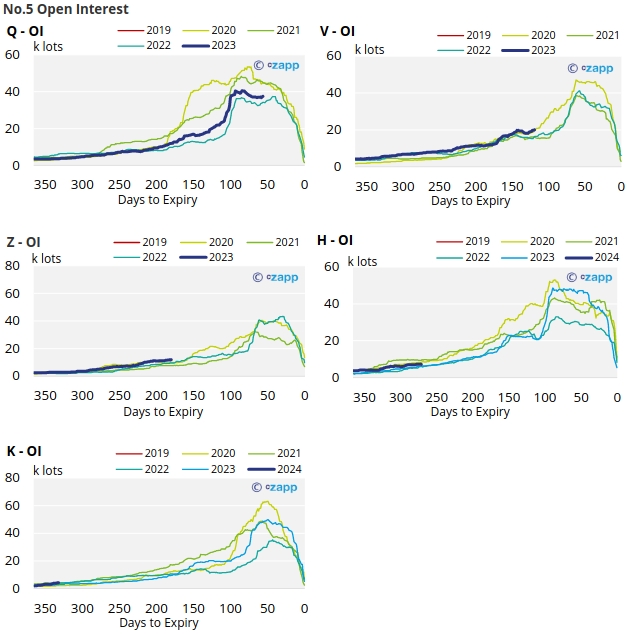

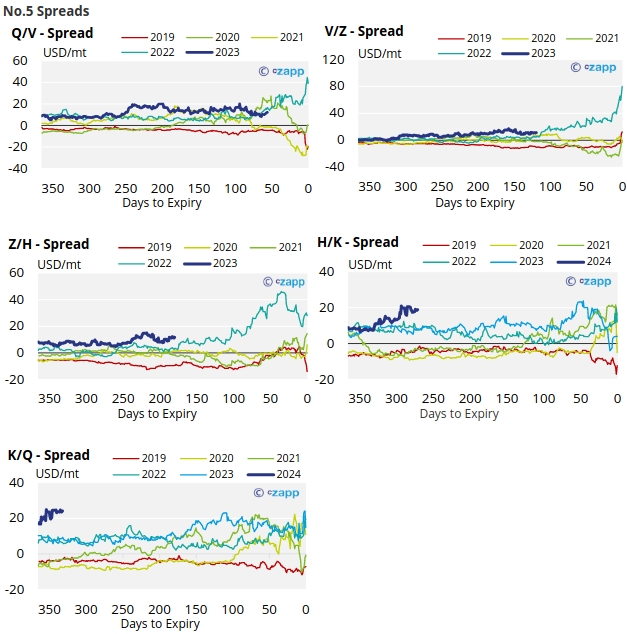

The No.5 forward curve remains strongly backwardated as far ahead as Dec’24, suggesting a slowly easing market tightness over the next few years.

White Premium (Arbitrage)

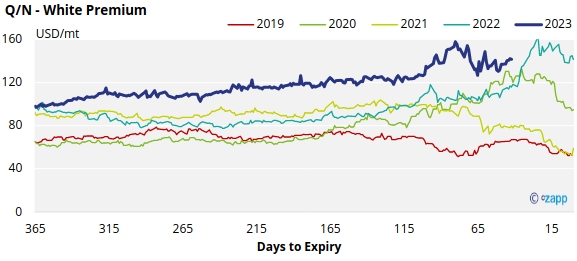

The Q/N sugar white premium increased slightly over the past week, now trading at 141USD/mt.

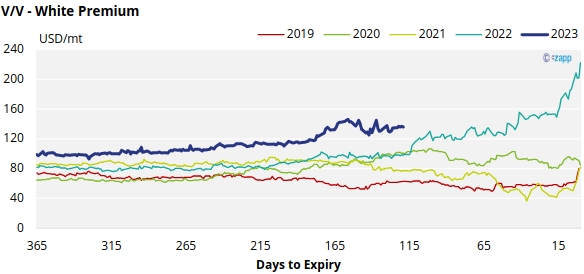

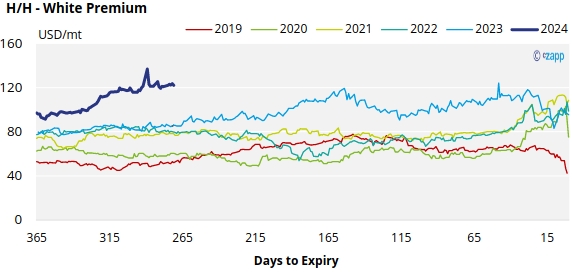

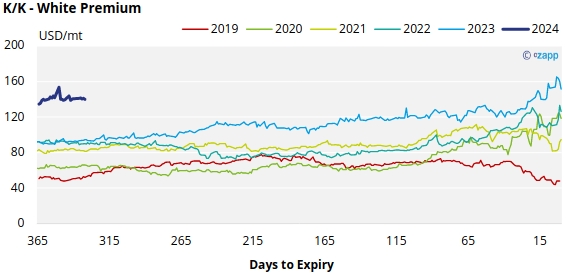

The refined sugar market is expected to be slightly undersupplied for the majority of 2023, as evidenced by comparatively strong V/V and H/H white premiums, which have also been rising and now approach 136 USD/mt and 122 USD/mt, respectively.

With global energy prices falling, we believe re-exports refiners require around 120-135 USD/mt above the No.11 to produce refined sugar profitably.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

No.5 (White Sugar) Appendix

White Premium Appendix