A slightly higher start was not sustained, and the market drifted back to unchanged for a period before looking back up to the 19.30 area. Fridays COT report had shown another increase in the net speculative short to stand at -34,450 lots (-11,374 for the week) and this may have been a factor in the lack of selling coming through wit much of the position held by smaller specs as the larger hedge funds remain aside. Still the market was not recovering by too much and the early afternoon arrived still confined to a narrow band with a brief dip back into the 19.20’s seen. From this point on the game changed entirely, with the final few hours seeing the market embark upon a very positive move higher. Having jumped above 19.60 there was a consistent upward bias until the end of the session with an eventual high recorded at 19.82 on the closing call, which brings last weeks 19.92 high mark back into view. Elsewhere the May’24 contract saw spread gains on its penultimate day of trading as May/Kjul’24 pushed back out to 0.43 points widest, though with open interest now at 47,768 lots and another healthy volume today set to reduce that further most of the positioning has taken place. Jul’24 settlement was at 19.78, as we look to see whether today can lead to a break of the short-term 19/20 band in which we have found ourselves.  Higher opening levels were not sustained and Aug’24 was soon back trading towards $561.00 as small traders displayed nervousness considering Fridays performance. By later morning these had been allayed with the market finding a little more supportive interest flowing through and bringing the price back to the early highs, and in so doing this also gave some support back to the Aug/Jul’24 premium which had previously slipped beneath $140 having opened a couple of dollars above that. The rest of the morning proved calm; however, the picture then became more interesting with the arrival of some better volume buying (possibly some short covering) which steadily lifted values back up through the recent range. Nearby spreads were firmer as the due to the buying centring around the spot position, while for the premium there were mixed fortunes as trades above $143.00 preceded a drop back down into the upper $130’s. Having reached the lower $570’s the progress for Aug’24 proved trickier due to scale selling ahead of recent highs, though still the market looked to sustain and dug in to record an eventual settlement of $573.80, just 0.20c shy of the session high. This relative lack of progress led Aug/Jul’24 to drop back through its own range to end at $137.75 and we will resume tomorrow looking to see whether these efforts may yield an end to the recent ‘sideways’ pattern.

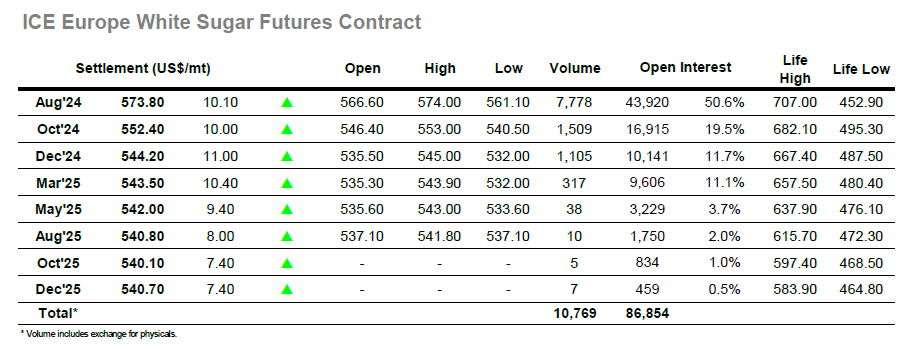

Higher opening levels were not sustained and Aug’24 was soon back trading towards $561.00 as small traders displayed nervousness considering Fridays performance. By later morning these had been allayed with the market finding a little more supportive interest flowing through and bringing the price back to the early highs, and in so doing this also gave some support back to the Aug/Jul’24 premium which had previously slipped beneath $140 having opened a couple of dollars above that. The rest of the morning proved calm; however, the picture then became more interesting with the arrival of some better volume buying (possibly some short covering) which steadily lifted values back up through the recent range. Nearby spreads were firmer as the due to the buying centring around the spot position, while for the premium there were mixed fortunes as trades above $143.00 preceded a drop back down into the upper $130’s. Having reached the lower $570’s the progress for Aug’24 proved trickier due to scale selling ahead of recent highs, though still the market looked to sustain and dug in to record an eventual settlement of $573.80, just 0.20c shy of the session high. This relative lack of progress led Aug/Jul’24 to drop back through its own range to end at $137.75 and we will resume tomorrow looking to see whether these efforts may yield an end to the recent ‘sideways’ pattern.