Insight Focus

Raw sugar futures have continued to trade below 20c/lb. Speculators continue to short the market. The May’24 raw sugar futures will expire tomorrow.

New York No.11 Raw Sugar Futures

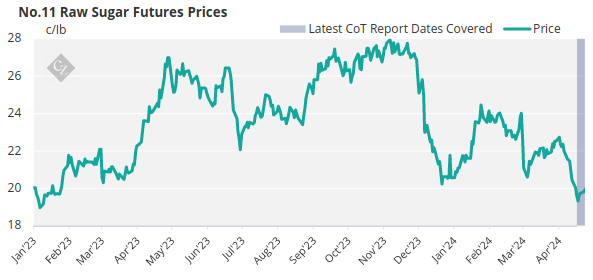

In the past week, the No.11 raw sugar futures traded between 19 and 20c/lb on reasonable volume.

The May’24 raw sugar futures expire tomorrow; expiries are often consequential events in the sugar market. It’s interesting that raw sugar prices are at 15-month lows and we are intrigued to see if the expiry brings a change of character to the price action.

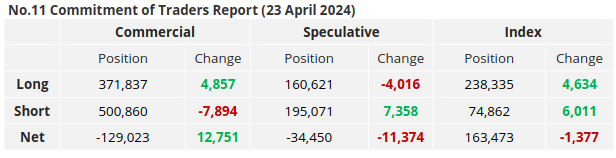

In recent sessions producers have been less willing to add new hedges given the low prices. Their level of hedge cover is adequate today and there’s no immediate rush to add to hedges. However, should prices lift in the coming days we can expect producers to take action.

Consumers are currently well positioned in the market and have less need to buy aggressively.

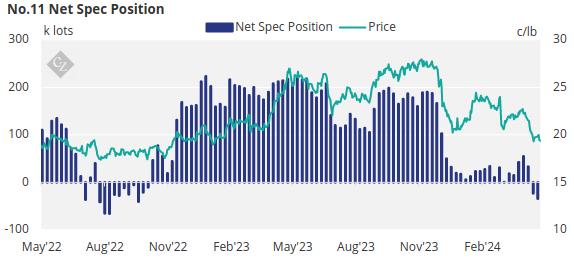

It’s probable that some aspects of the sugar trade and speculators are responsible for the weak prices today. Speculators are now 195k lots short of raw sugar futures. This is the largest short they’ve held since August 2022. If they continue to build their short in the coming days, they could return to levels last seen in the 2013-2019 bear market. As a result, speculators are also net short the sugar market, by 34k lots.

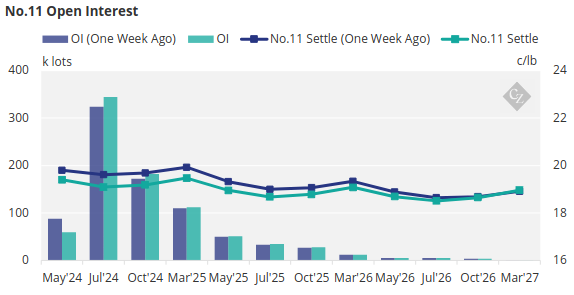

The No.11 curve is flat through to 2027, at around 19c.

London No.5 Refined Sugar Futures

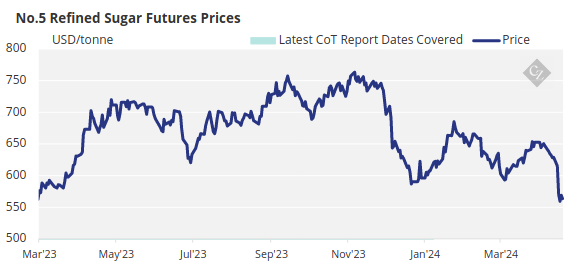

The No.5 refined sugar futures has traded sideways in the past week, going from 570USD/mt at the start of the week, briefly hitting 576.6USD/mt mid-week, before dropping back to 563.7USD/mt by Friday’s close.

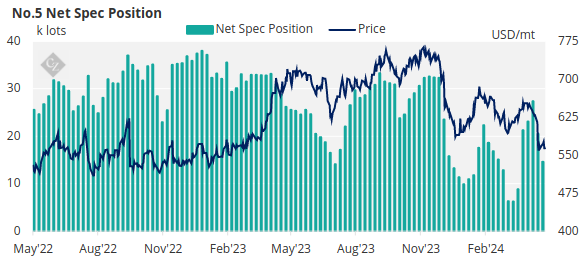

Speculators continued to close their longs over the past week, closing out 5.9k lots, causing the net spec position to fall to 14.6k lots.

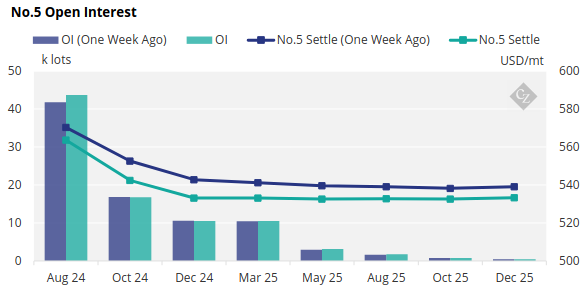

The refined sugar futures curve has flattened in the past week, with the curve remaining in backwardation through to Dec’24.

White Premium (Arbitrage)

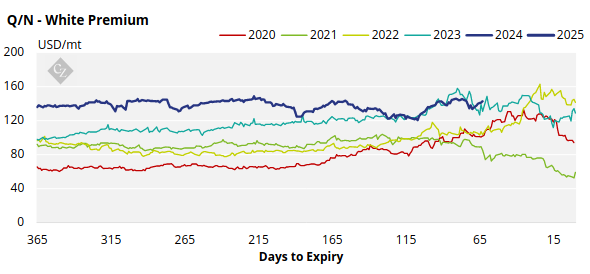

Over the last week, the Q/N White premium strengthened to 142.8USD/mt.

Many re-exports refiners need around 105-115USD/mt above the No.11 to profitably produce refined sugar. The current white premium is well above this level, which means we should theoretically see a pick up in demand soon.

For a more detailed view of the sugar futures and market data, please refer to the appendix below.

No.11 (Raw Sugar) Appendix

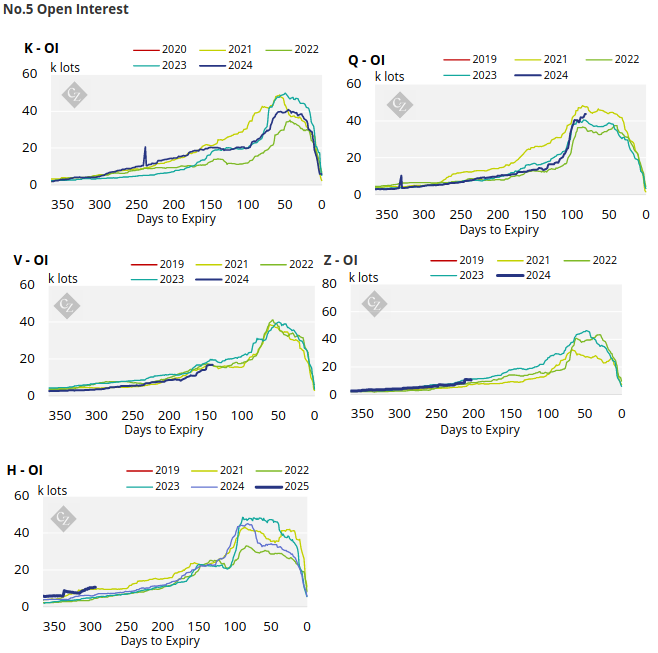

No.5 (White Sugar) Appendix

No.5 Spreads

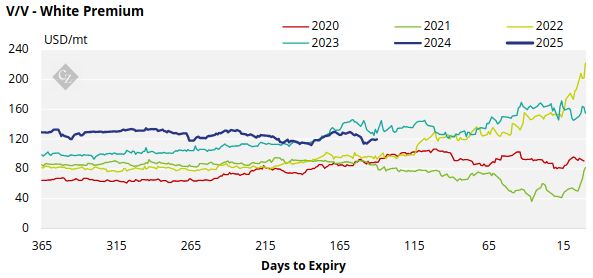

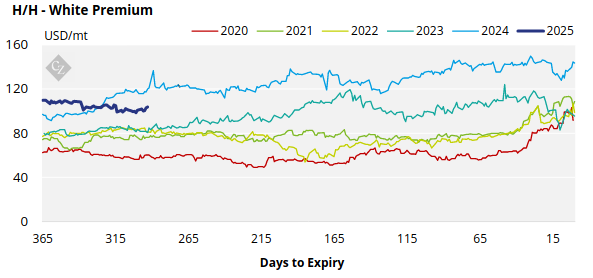

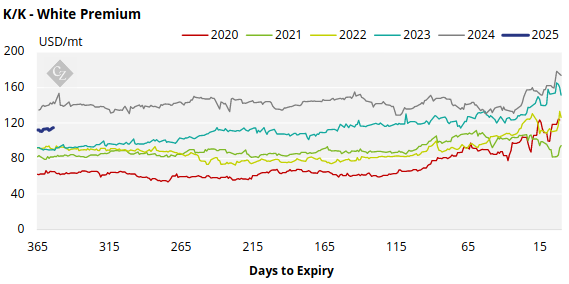

White Premium Appendix