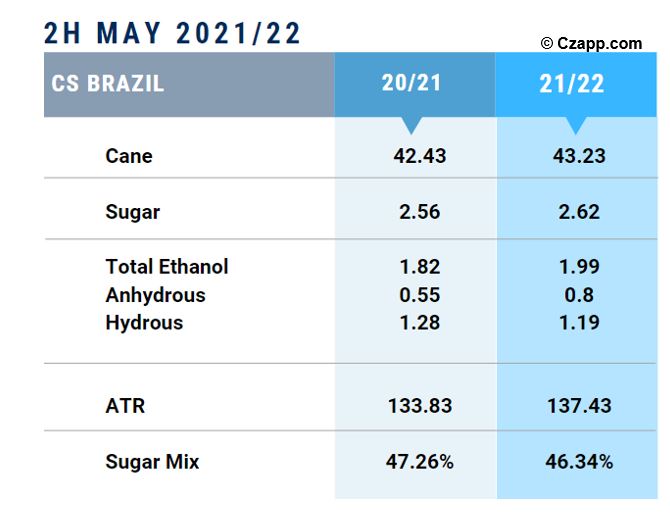

- The figures for the 2H May came similar to last fortnight:

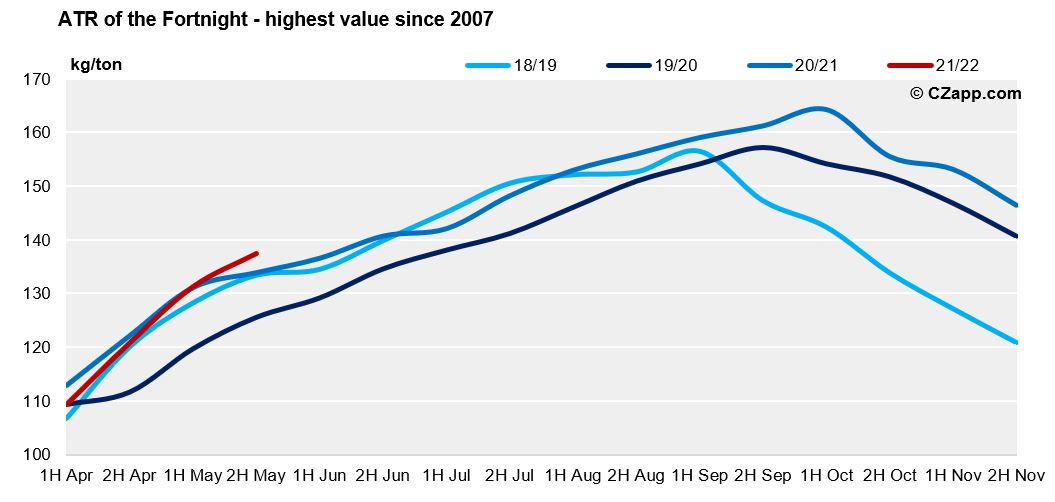

- Strong crush rate, poor agricultural productivity, and very high quality of the plant:

- ATR for this fortnight is again surprising, reaching the highest value since 2007 – 137.34kg/tc

Safra 2021/22 – 2H May

Same History

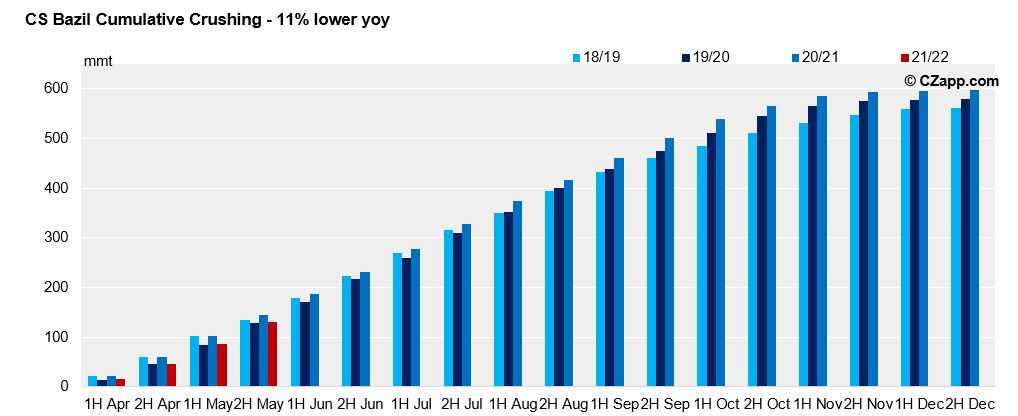

- CS crushing continues strong this fortnight – 43mmt were processed – slightly above the volume of 2H May of the previous year.

- However, the cumulative crush of this crop is still 11% lower yoy.

- This is due to the delay in the beginning of the harvest and the poor agricultural productivity due to the dry weather.

- For May, the CTC measured a drop in agricultural yields of 9.63% – 79.16 ton/ha against 87.60 ton/ha in the 20/21 crop

- The agricultural loss for May is in line with our estimates, and for now we are following reports from suppliers and mills in different regions.

- The downward bias for the sugarcane crush this crop still remains.

- On the other hand, the dry weather contributes to the sucrose concentration in the plant reaching 137.43kg/tc – the highest value since 2007

Ethanol Market

- The average parity in São Paulo remains at 76.6% – a level at which biofuel is no longer considered attractive to the driver

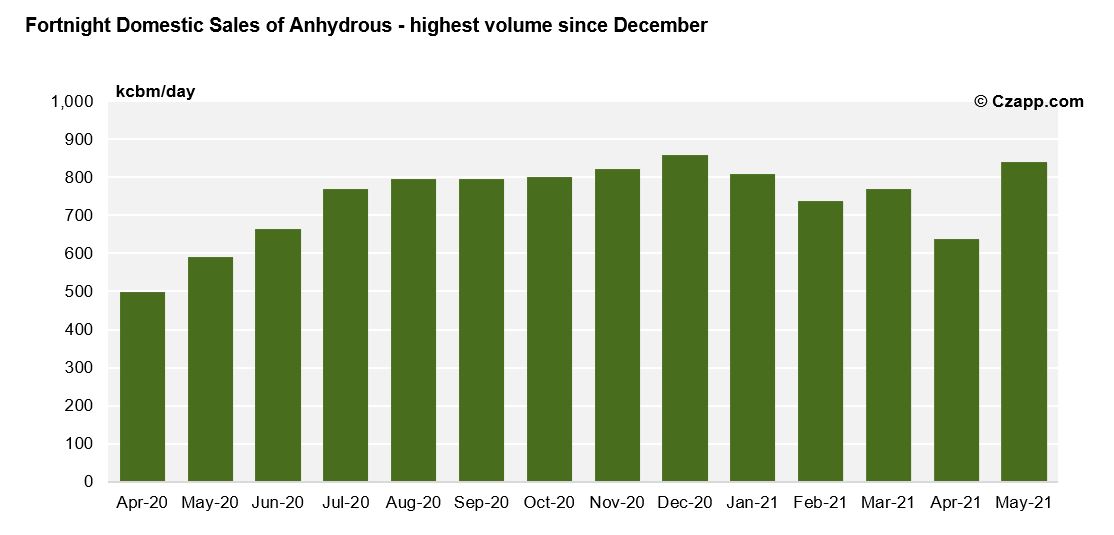

- Thus, the greater the demand for gasoline, the greater is for anhydrous – 840.35 m liters of anhydrous were sold this fortnight (42% higher than last season)

Reports that you might like

Dashboard that you might like