Insight Focus

- The economic recovery is less than expected, and people are cautious about spending.

- High sugar prices have dampened crystalized sugar demand, which could be same as 2022.

- Liquid sugar and premix imports remained high in May but were below April record.

China consumes 15 to 16 million tonnes of sugar and produces 10m tonnes of sugar annually.

Since the Chinese New Year, the sugar market has been full of joy with sugar prices rising rapidly and optimistic expectations for sugar consumption in 2023. Three years of consumer enthusiasm erupted after China lifted its COVID controls at the end of 2022, and everyone seemed to believe that 2023 would be at least back to pre-COVID levels, but now confidence seems to be starting to fade away.

From an ultra-low base in 2022, growth in 2023 is a given. However, after the tourism revenue of the May Day holiday broke through the level of 2019, the revenue of the just-past Dragon Boat Festival dropped below the level of 2019.

Consumption Season Is Coming

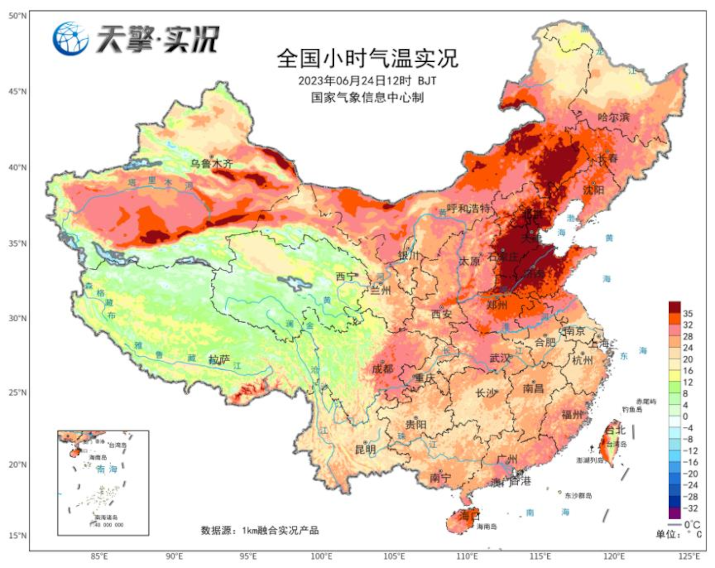

Affected by the El Nino phenomenon, during the Dragon Boat Festival, the north was covered by unusually high temperatures, up to 40 degrees Celsius; 30 degrees Celsius is more ‘normal’. High temperatures activated summer cold drink consumption, the question is how much share of this can white sugar grab?

Domestic Sugar Sales Exceeded Expectations in May

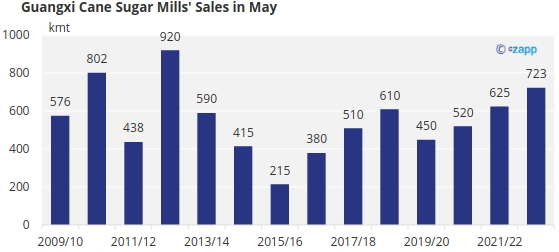

Some held low expectations for sugar mills’ sales in May, but the results ended up being the highest in a decade. This may be due to purchases by traders and end-users (consumers).

- We think that some of the stocks may have been transferred from sugar mills to traders.

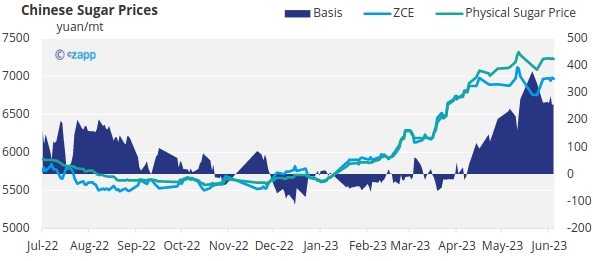

- Both spot and basis (the difference between physical and futures prices) traders have built up stocks in May with both flat price and premiums rising.

- But now, both are balking at high prices and turning to selling stocks.

Sugar mills sold 1.1 million tonnes of sugar in May, with Guangxi accounting for 723k tonnes, the highest May sales in a decade.

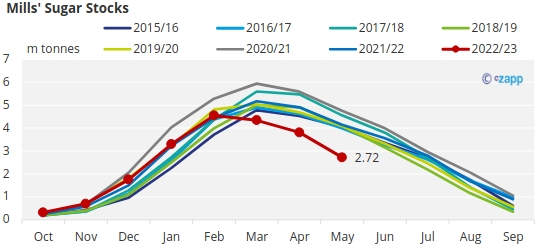

The sales rate in 22/23 has reached 70%, and the stock is at a historical low of 2.72 million tonnes.

Changes In Consumer’s Purchasing Pattern

Another reason may also be a shift in end-user’s patterns, where we see them finally starting to accept high sugar prices.

- They are shifting from hand-to-mouth to longer term purchasing.

- The purchase cycle of large consumers changed from weekly/monthly to quarterly/half-year.

- The price of other raw materials is down, and the overall cost is under control.

Traders, however, are beginning to worry because they find demand for white sugar isn’t growing as expected, and demand for small and medium-sized consumers is shrinking.

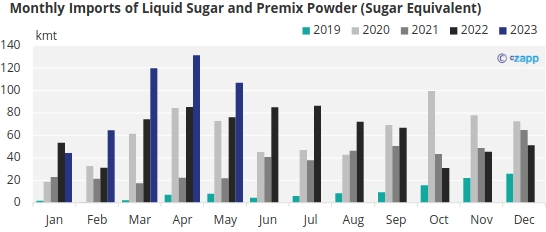

Liquid Sugar and Premix Powder Imports Stay High

The weak demand for white sugar is inseparable from the strong existence of substitutes. We discussed in previous report that high sugar prices would drive consumers to substitutes, and this point has not changed. We have also stressed that demand of liquid sugar and premix is not the problem, supply is.

Imports of liquid sugar and premix powder in May were 145.1k tonnes. Although they have fallen from the high in April, they are still at a high level.

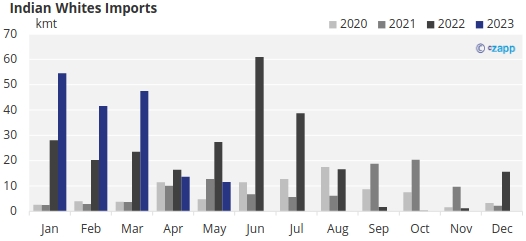

Indian white sugar imports, which are often used in the production of premix, have also declined since April. This is because India’s sugar exports have reached their quota limit this year.

HFCS: A Lump in The Throat

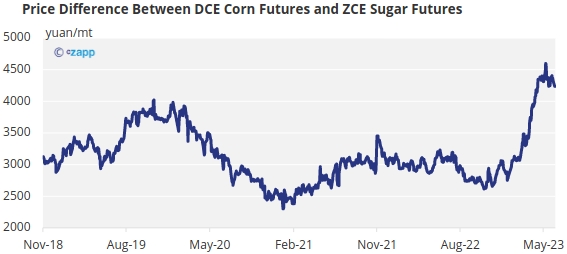

Corn syrup (HFCS) is an old rival, capturing more than half of the market in beverages and expanding into other products, including canned fruit etc. Since our update in March, the price difference between corn and sugar has continued to widen, reaching as high as 4589 yuan/mt.

And the spot price difference between HFCS and sugar is now at 3510yuan/mt. This spurs end-users to adjust their formulations – increasing HFCS use without compromising flavor.

National Economic Data Are Not Encouraging

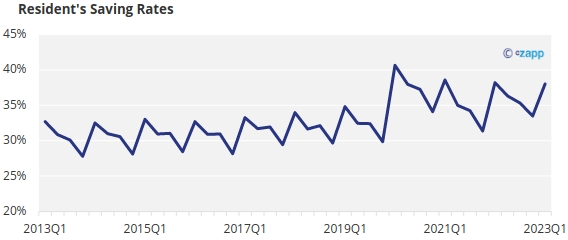

The background color of the whole painting is also slightly gray. The post-COVID optimism has died down. Residents’ savings has continued to rise, reflecting the decline of residents’ willingness to spend and the psychology of preventive savings.

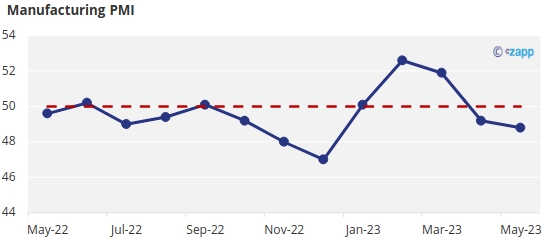

The business situation of the manufacturing industry has declined. The manufacturing PMI fell below the 50-point line that separates expansion from contraction.

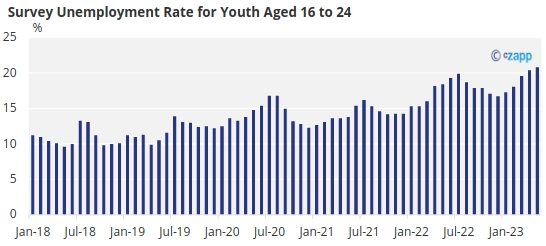

Against the backdrop of sluggish production, youth unemployment has reached a new high.