Insight Focus

- Record sugar production in CS Brazil does not mean necessarily record exports.

- Competition with grains is an issue for sugar flow.

- Weather has a direct impact for loading operations.

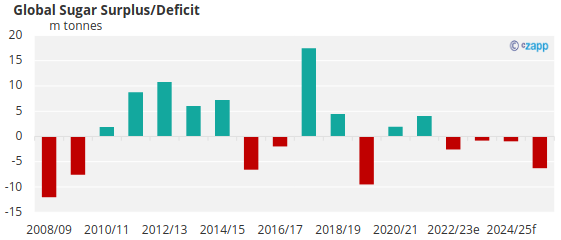

The world hasn’t made enough sugar to meet consumption since 2021/22.

Worse, this year there isn’t enough sugar available for everyone who needs to buy it. Prices remain close to 12-year highs.

At first glance, Centre-South Brazil’s record sugar output this year should be helpful. We think the region will make 41.5m tonnes of sugar in 2023/24, by far a record output.

However, it’s one thing to make the sugar. It’s another to get it to where it’s needed.

In CS Brazil, sugar and many other crops are grown inland, upcountry. The land here is elevated, ranging at around 200-1,000m above sea level in a broad, southern upland. These crops need to be transported to ports for export.

Brazil’s geography makes this challenging. There is no major coastal plain in Brazil and few deep-water natural harbours. Ports tend to be located on river estuaries. Meanwhile, the southern uplands descend to the narrow coastal plain by a steep escarpment. The rapidity of the descent means the rivers are not navigable and so are unsuitable for transporting agricultural products from inland, as happens on the Mississippi and Western European rivers.

The steepness also makes road and rail building challenging. As a result, there are few routes from upcountry to the major ports of Santos and Paranagua in CS Brazil, and all of the region’s vast agricultural output has to proceed through the same routes.

In this report, we go into a bit more detail about why record sugar production this season won’t lead to record sugar exports.

Grains

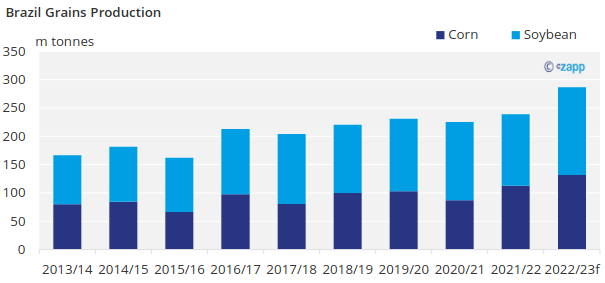

In 2022/23, Brazil made a record 286m tonnes of soybeans and corn. Corn production increased by 16% and soybeans by 23%. The combined year on year increase of grains production was 48m tonnes, more than a full year’s sugar output!

This meant there was more corn and soy to export, as almost all of the additional production was shipped overseas.

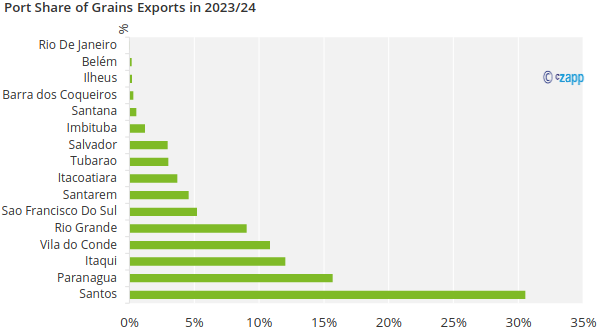

Although most grains are grown in the frontier states of Mato Grosso and Goias, the majority is exported through the port of Santos, which is also Brazil’s primary port for sugar exports.

This means sugar competes with grains for inland road and rail transport and elevation at port terminals. Sugar is the minor commodity in this relationship; around 150m tonnes of grains are exported each year compared to 25m tonnes of sugar. Sugar exports are 6x smaller than grains.

Terminals

Before 2015, all of Santos’ sugar terminals only elevated sugar. But from 2015 the terminals became mixed-use, and therefore more flexible. While this was good for terminal operators, it’s limited sugar elevation capacity.

Copersucar, Rumo, Tiplam and Teag – Santos Terminals Exports

The average capacity for raw sugar elevation since 2018 at Santos has been 18m tonnes. Paranagua has a further 5m tonnes available, meaning total CS Brazilian sugar export capacity is 23m tonnes. This year, we think terminals will be able to allocate a bit of extra capacity in Q1’24, so we think total exports will be 25m tonnes, the highest volume since 2020/21.

But in 2020/21 there was an additional terminal loading sugar, which is why that’s year’s export record won’t be breached. Even at 25m tonnes of sugar exports, there will still be 3m tonnes of raw sugar which is made in 2023/24, but unshipped. Therefore, CS Brazilian mills will start the 2024/25 cane crushing campaign with higher initial stocks than normal.

The impact of these higher stocks on sugar production in 2024/25 remains to be seen.

Weather – Again

At the port, sugar is loaded into a vessel’s hold by a ship loader. The port loading facilities are uncovered; when it rains, loadings stop so that the ship’s hatches can be covered to stop the sugar from spoiling or caking.

It’s irrelevant how heavy the rainfall is. A captain will shut the holds even if there’s only drizzle in the air. Around a decade ago there was talk of some of the terminal at Santos installing a rain cover over the vessel berths, but nothing came of this.

Ship loading remains at the mercy of the weather.

So far in 2023/24, rains have been 9% above average. But October’23 was wet. Rains were 140% higher than average, affecting sugar export volumes. We had hoped 2.8m tonnes of raw sugar would be shipped in October, but only 2.4m tonnes actually sailed.

The remaining 400k tonnes raw sugar was carried into November, and port efficiency will need to be high in order to accommodate this extra volume before the end of the season.