Insight Focus

- The sugar market has rebounded 20% from recent lows.

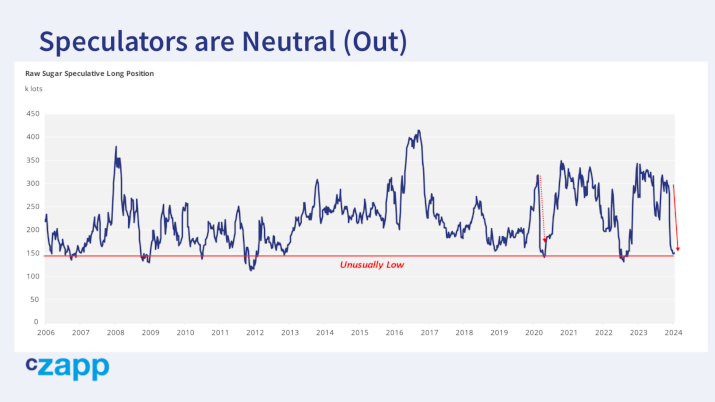

- Speculators are largely out of the raw sugar market.

- Trade houses are positioning ahead of the March expiries.

Hi everyone, it’s Stephen from CZ with an update on the sugar market.

Now this is a slightly crazy thing for an analyst to say, but this video is going to be quite brief because I don’t have a huge amount of insight on today’s market.

I’m not going to waste your time recapping things we already all know. Sometimes I find it fairly easy to see what the markets might do next.

In the middle of 2023 when the sugar market’s parabola broke, it was obvious to me that it would need to fall.

Likewise, you’ll know from my recent videos that in October and November last year I was increasingly concerned that the sugar rally had lost momentum and that people were remaining bullish even though the market had been expensive for a long time. It seemed to me there was a good chance things were happening out of view and this would lead to weaker prices.

As it happened, speculators sold a large amount of their long positions in raw sugar, with a speed of liquidation that we’ve not seen since the March 2020 covid panic. 150 thousand lots long is effectively the lowest that the speculative long has gone in the last 2 decades. The speculative buyers are out and prices have collapsed.

Now we’ve had a 20% bounce.

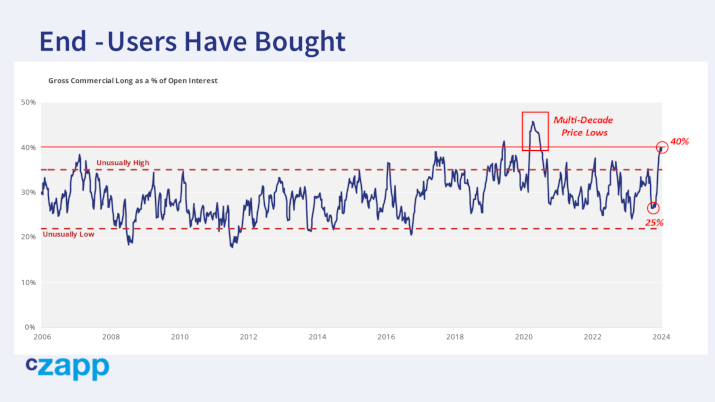

We know that sugar end-users bought the dip extremely aggressively. You can see that the commercial long has gone from being a low-ish 25% of open interest to an unusually high 40% of open interest. In fact, end-users have only accounted for this much long interest in raw sugar twice before, in the middle of 2019 when prices were around 12c/lb and then again in March and April 2020 when prices were below 10c for the first time in decades as the world panicked in the face of the covid pandemic. We’ve never seen consumers go this long the sugar market with the price above 20c.

But I feel it was a good move for the consumers. It was their first shot at 20c in almost a year.

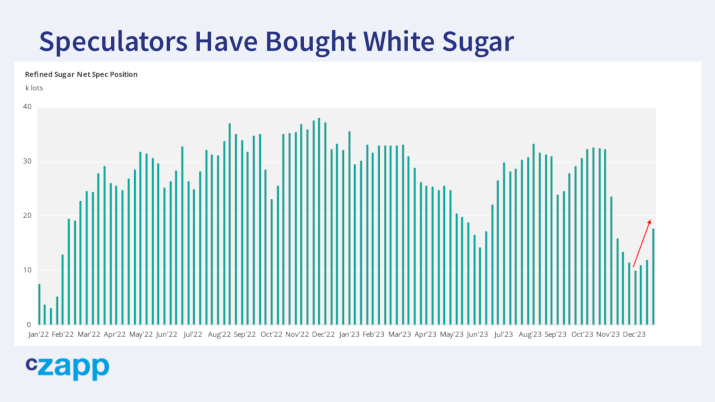

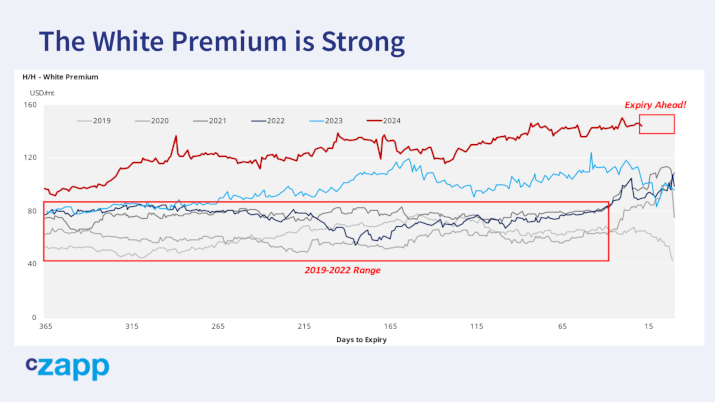

Interestingly, speculators have been extending their long in the white sugar market in recent weeks.

This means as a cohort, speculators have been going long of the white sugar premium – as in they’ve been selling the raws and buying the whites. This is an interesting move seeing as the March/March is close to $150/mt already. This is a high price. At this level almost every refiner on the planet will be looking to maximise their melt rates. I guess it’s possible there’s more upside to the white premium, but I’m a bit sceptical in the short term because it won’t achieve very much in the real world.

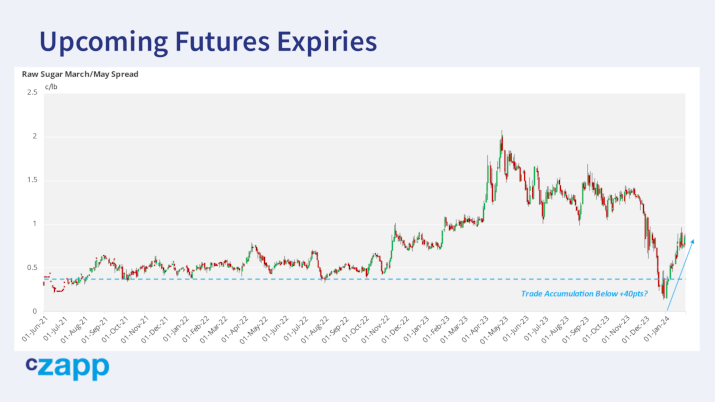

The chart also hints that the March futures expiries are close by. Coincidentally, there’s one group we’ve not yet talked about, and that’s the commodity trade. It’s possible that some of the trade have bought the sugar futures aggressively so they can receive the March contract on expiry.

First up it’s the whites, in the middle of February. The March/May spread doesn’t betray much fresh trade positioning; it’s mid-range.

But the raw sugar March/May spread looks entirely different. It’s possible that one or more major trade houses have bought the spread in order to receive.

The problem, then, is that for this price strength to be sustained after the expiry we presumably need the speculators to also jump in and buy. But so far they’ve not done that. They remain utterly out of the raw sugar market and will need a reason to get back in. A new reason – not talk of India’s sugar production being 31m tonnes or Brazil’s logistics working well in December. So maybe it’s a good time to look at what’s happening on the ground in sugar right now. It’s not going to be a hugely exciting recap.

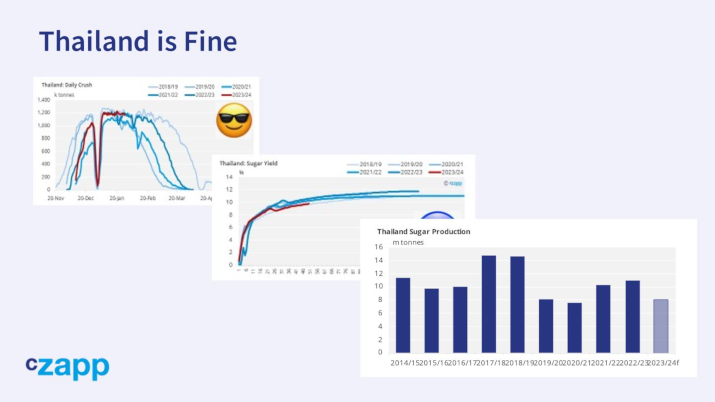

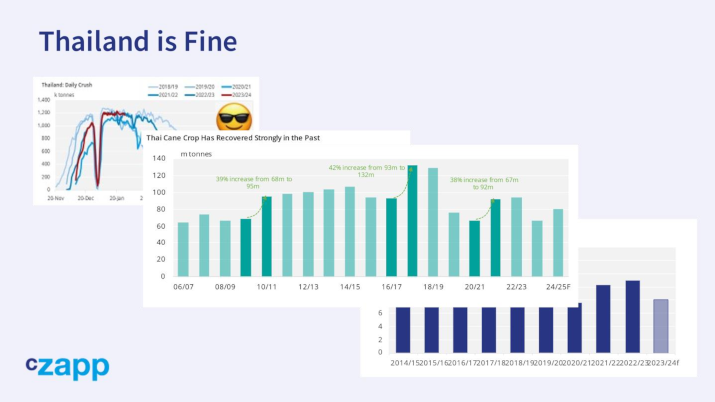

The Thai cane harvest is going fine. Sucrose yields are poor but the cane tonnage is good, so overall the crop is doing what everyone expected it to, broadly. That’s good news because Thailand is an important sugar supplier.

Next year we think cane output could rebound thanks to higher prices paid to farmers.

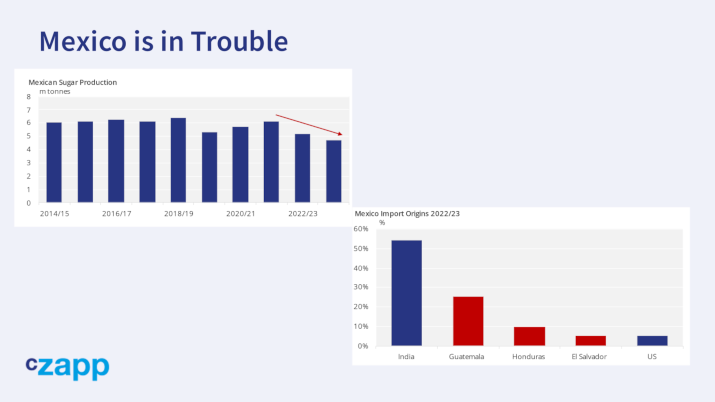

The Mexican harvest looks dreadful, so that probably means a fair amount of Central American sugar will go there rather than the world market.

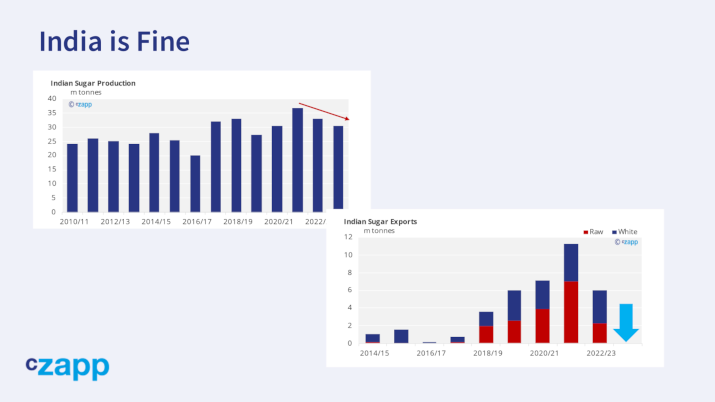

And yes, the cane crop in India, the world’s largest sugar consumer, isn’t as bad as everyone first feared, so probably won’t need to import sugar this year. Nor will it export, not ahead of an election in May. So there’s not a lot to go on here yet.

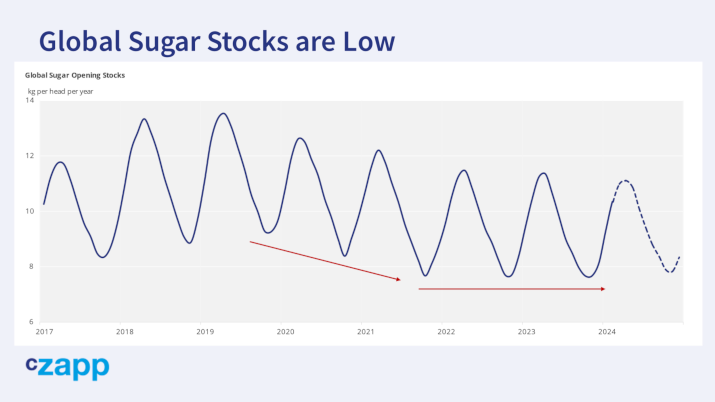

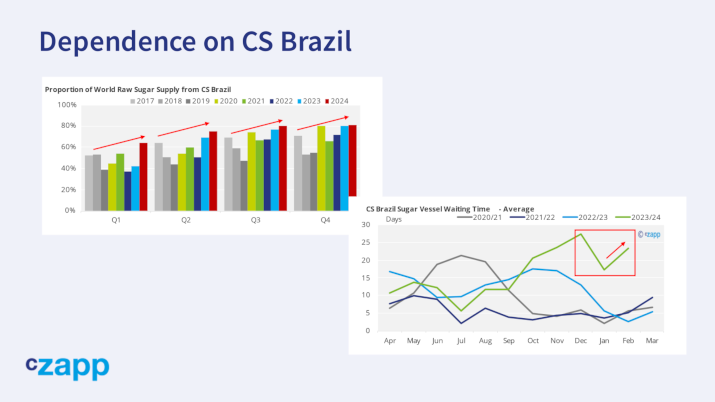

The world still has very low sugar stocks, which means that some buyers out there have nothing to fall back on. They either need to buy spot or go without. Any spot buyers don’t really have any choice, they’ve got to buy from Centre-South Brazil, the world’s largest sugar cane region.

The market will therefore continue to fixate on Brazil’s logistics performance in the coming months, especially what happens to sugar exports when the huge soy and corn crops flow from upcountry to the ports. Wait times at the ports remain high despite December’s huge sugar export flow. All this did was take the vessel queue from around 27 days to around 17 days in January, and as the grains crops begin the sugar wait time is creeping higher in February. For trade houses who are looking to deliver or receive into the March raw sugar futures expiry, the state of the vessel queue is a major part of the game.

If Brazil performs perfectly and the sugar flows are uninterrupted, 20-24c is probably a reasonable price given the low stocks and poor production. If something goes wrong in Brazil or anything else goes wrong anywhere else in the world the market probably trades higher.

That’s the market today…..but you probably knew all that anyway. All we’ve achieved in recent weeks is a transfer of the sugar long from flighty speculators to more robust end-users.

Consumers should probably continue to try to hedge 2024 tonnage in the low 20c area; it’s too soon to call the end of the sugar bull market.

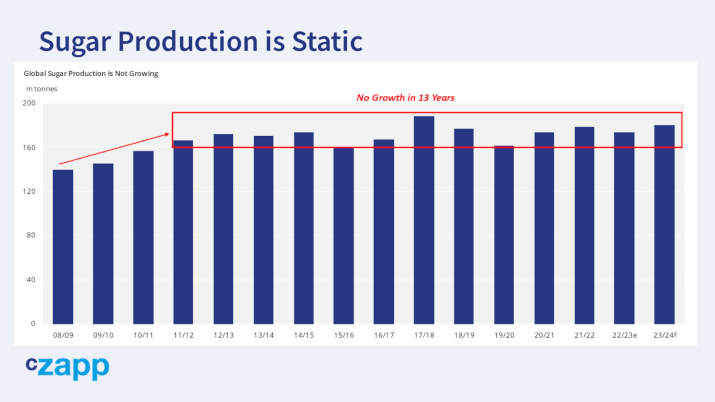

For a start, despite the heroics in Centre-South Brazil, which is delivering way more sugar than it ever has before, global sugar production is still stagnant, stuck in its 13-year old range. Until this changes, the world won’t rebuild its sugar stocks. CS Brazil can’t do this alone, you can’t even see the effect of its current vast crop on the global chart. The market needs to incentivize other major sugar producers to take the next step higher too.

Likewise producers still need to hedge. 24c isn’t 28c, but it’s still historically a high price. Producers should hedge as close to 25c as possible in 2024, but consider keeping some lots back in case the market trades higher once more. Remember the point isn’t to try to sell at the highest possible price, but to lock in an average price for the season which is consistent with your goals and budgets.

So, to recap, I don’t think the bull market is over yet; I think prices could easily trade to new highs in 2024.

But that doesn’t mean we need to see the price strengthen immediately. We could easily flop around between 19c and 25c for quite a few months before anything happens. The market doesn’t owe anyone anything. It’s not there to entertain you or to give analysts lots of exciting material with which to record videos. It’s there to help you hedge, but will also hurt you if you don’t approach it with a disciplined plan.

Good luck and we’ll speak soon.