Insight Focus

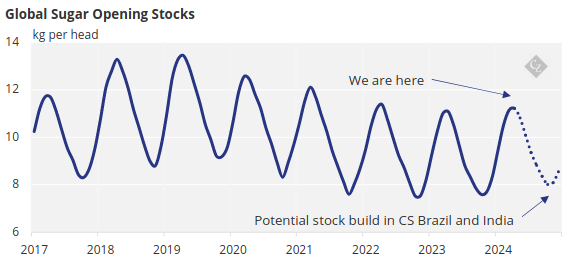

- Global per capita sugar stocks are the lowest in at least a decade.

- Stocks should start to rebuild as sugar production increases in 2024/25.

- But stocks are likely to be held in Brazil and India, rather than where they’re needed.

Stocks Building….But In The Wrong Place

Sugar stocks are low. This year, stocks will only peak at 11kg per person. This is one of the lowest levels in the past decade.

Even with small production surpluses in recent years, stock per capita has been flat or in decline because population and consumption to continue to grow.

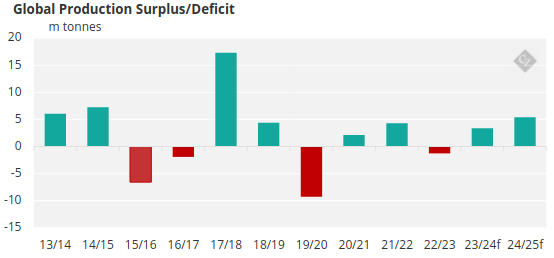

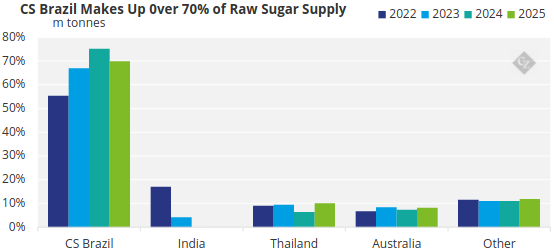

However, we expect sugar stocks to start growing (on a per capita basis) in 2024/25 due to the sizeable production surplus, led by a production rebounds in Thailand and another huge Centre South (CS) Brazil crop.

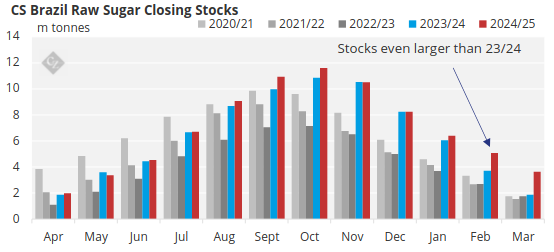

Whilst global stocks should build, much of this stock will be stuck in CS Brazil, with exports limited by logistics. Unless exports in Q1’25 benefit from the same dry weather as in 2024 that allowed a record export pace, stocks in CS Brazil could grow by 2m tonnes in a year.

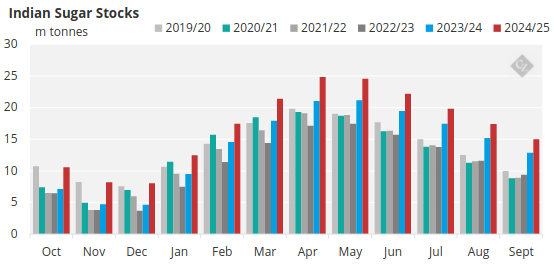

Similarly, we believe Indian stocks are building as sugar production this season isn’t as bad as first feared and the government has restricted how much sucrose can be converted into ethanol.

So whilst there may be more stocks of sugar, it will not be where it’s needed. Therefore, the sugar market (and prices) will still be vulnerable to the overreliance on CS Brazil for supply.

A Chance To Restock?

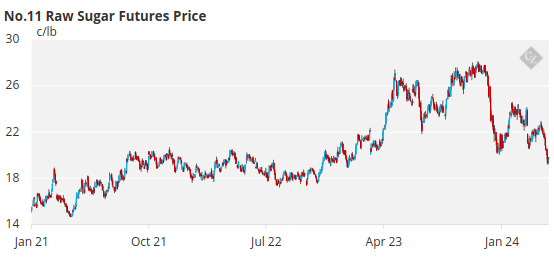

With global stocks being so low, we wonder if buyers will be looking to restock now that raw sugar prices have fallen below 20c.

If buyers wish to rebuild their stocks, we think there could be additional demand of between 5 and 12m tonnes (3-7 percentage point increase in STU) to get back to similar stocks levels as 2020 & 2021. This sort of volume is clearly significant for the sugar market but it doesn’t have to come all at once. This is something to watch in the months ahead.