Insight Focus

- Global sugar production in 2024/25 could be the second highest on record.

- Cane and beet growers are starting to respond to high prices.

- The world’s sugar stocks should start to rebuild from today’s low levels.

2023/24 at a Glance…

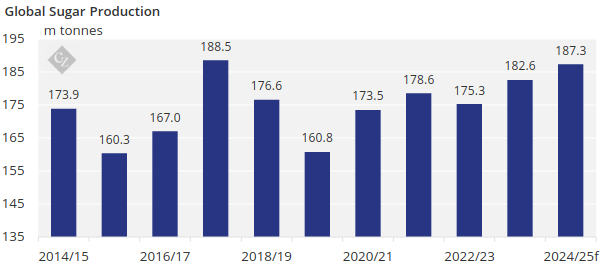

Global Sugar Production

With the 2023/24 season coming to a close, we expect global sugar production to reach 182.6m tonnes, up 1.3m tonnes from our previous estimate.

Looking ahead to 2024/25, global sugar production could be the second highest on record at 187m tonnes. A rebound in Thai cane acreage and EU beet plantings are helping to drive this growth, with CS Brazilian and Indian sugar production remaining broadly unchanged year on year.

This is an early estimate that is dependent on good weather in many of the world’s major sugar-producing regions. There are already concerns about the performance of cane in Centre-South Brazil (the world’s largest sugar producer) due to dry and hot weather in the summer.

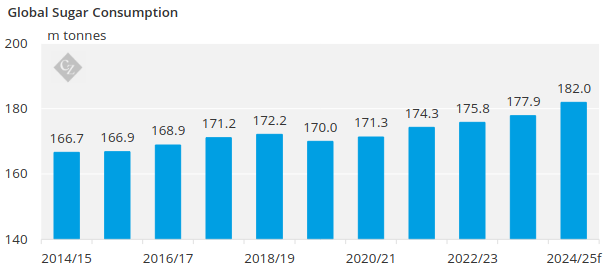

Global Sugar Consumption

Global sugar consumption has continued to rise broadly in line with population and will be close to 180m tonnes in 2024/25.

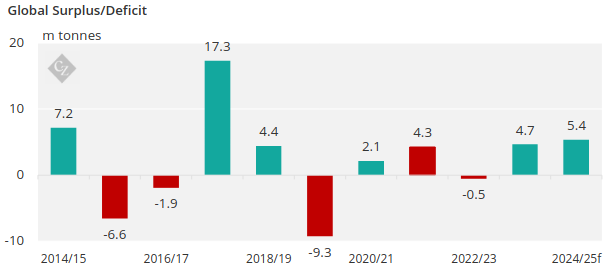

Large Production Surplus in 2024/25

Despite the fact that global consumption is at an all-time high, increased output from CS Brazil, Thailand, and the EU could result in a large production surplus.

Weather conditions through the middle of the year will be critical for northern hemisphere cane and beet development, which will need to be strong for this forecast to become reality.

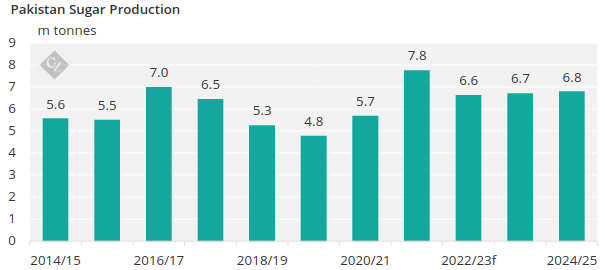

Production Update: Pakistan

In 2024/25, Pakistan we expect to produce 6.8m tonnes of sugar, a slight increase from the previous season.

This growth is driven by higher sugarcane support prices, encouraging growers to plant more sugarcane.

Sugar consumption should increase moderately in response to population growth and demand from the food processing sector. Exports will remain tightly controlled in 2024/25, as the government continues to emphasise domestic price and supply controls.

However, rumours suggest that the government is under increasing pressure to allow exports, driven by mills and refineries’ desire to capitalise on current world market prices.

Other Sugar Producers at a Glance…

If you have any questions, please get in touch with us at Will@czapp.com.