Insight Focus

- US corn plantings at 96% vs 93% a year ago.

- 85% has emerged vs 76% last year.

- However, only 64% is in good/excellent condition vs 73% last year.

Forecast

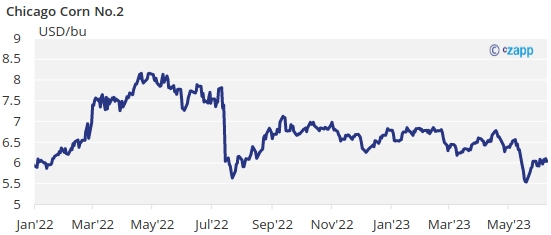

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,56 USD/bu.

Market Commentary

Mixed week for grains in all geographies after a neutral June WASDE, but a rally in European grains on the back of some spec buying.

We had the June WASDE last Friday and was basically a non-event.

While the market has been worrying of persistent dry weather in the Corn Belt, the WASDE did no changes to their 23/24 US Corn forecast leaving their very aggressive yield of 181,5 bpa unchanged which we think it could be lowered in any of the coming reports. But ending stocks for the actual 22/23 crop were revised higher as the export forecast was reduced which makes sense given the multiple cancelations of exports done by China, who turned around to buy cheaper Brazilian Corn. World Corn stocks for 23/24 were increased by 1 mill ton all of it coming from higher Ukrainian production.

US Corn planting is now almost done with 96% planted vs. 93% last year and vs. 91% of the five year average. This continues to favor crop development with 85% of Corn already having emerged vs. 76% of last year and 77% of the five year average. The second reading of crop condition showed a drop of 5 percentual points in the week with only 64% in good or excellent conditions vs. 73% last year.

In Brazil, safrinha Corn is 0,7% harvested slower than the 3% progress of last year. In Argentina Corn is 32,6% harvested.

In Russia, Corn planting is 84,4% complete making just 2 points of progress in the week. In France Corn planting has virtually finished having reached 99% of the area, and conditions fell 4 points and is now 88% good or excellent.

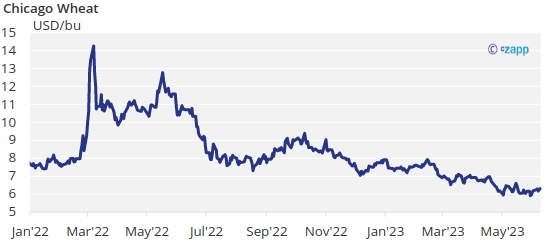

In the Wheat front, the June WASDE increased US ending stocks for the new 23/24 crop by a marginal 10 mill bu all coming from an upward revision to yield from 44,7 bpa before to 44,9 now. All other items were left unchanged.

World Wheat ending stocks for 23/24 were revised 6,4 mill ton higher in a combination of 10 mill ton of higher production and 4 mill ton of higher consumption. The higher production was shared between the EU, Russia, Ukraine and India.

US Wheat condition improved by 2 pts and was 36% good or excellent vs. 30% last year and is 4% harvested in line with last year and the five year average. French Wheat condition fell 3 points to 88% good or excellent and is the third week in a row with conditions worsening. Russian spring Wheat resulted to have surpassed the expected number of acres by 3,8%.

In the weather front, the US weather office declared El Niño has started, and the Australian weather offices said there is a 70% chance of El Niño. In the short term, the forecast for the US is for rains in the Corn Belt which should help to improve Corn condition. Brazil is expected to be cold and a bit rainy in the center south. Europe same as the last few weeks: dry in the south and wet in the north west.

All eyes will now be looking at the June 30 quarterly stock report and obviously at weather potentially impacting crop condition. The June WASDE showed higher stocks for the actual 22/23 crop but somehow Corn basis continues to be very expensive and not behaving like we are in a 10,6% stock to use environment which is what the WASDE is showing. We wouldn’t rule out a surprise in quarterly stocks being less than expected.

We also think Corn yield for the new crop will be revised lower sooner or later. Dry weather has been perfect for a quick pace in planting but the first two readings of crop condition are not showing a situation where we could have a record yield.

Expect further consolidation around 6 USD/bu for US Corn with volatility on the back of weather. We continue to think the bulk of the downside may have occurred already.

Mixed week for grains in all geographies after a neutral June WASDE, but a rally in European grains on the back of some spec buying. All eyes will now be looking at the June 30 quarterly stock report and obviously at weather potentially impacting crop condition. Expect further consolidation around 6 USD/bu for US Corn with volatility on the back of weather. We continue to think the bulk of the downside may have occurred already. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,56 USD/bu.