This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- Warm weather prevented outside piling of beets.

- Factories ran uninterrupted while the harvest slowed.

- The harvest delay gives beet more time to increase sucrose content.

Bulk refined sugar prices mostly were unchanged in the week ended Oct. 6 as the 2023-24 marketing year began Oct. 1. Sugar beet and cane harvests progressed slowly, as did corn sweetener contracting for 2024.

Sugar beet harvesting that typically is in full swing across the nation was delayed in several areas due to warm weather that prevented the outside piling of beets during active harvest. Enough beets were harvested to keep factories running. Harvest resumed in most areas by weeks end as temperatures dropped, but at least one cooperative was expected to delay full harvest a couple more weeks.

The delayed beet harvest was viewed as positive as it gave plants more time to deposit additional sugar in roots. While the later harvest increases the risk from a damaging early freeze, no severely cold weather was in forecasts.

Sugar cane harvest started late in Louisiana and was progressing slowly, with growers giving plants more time to recover after recent rainfall, but most expected the rain was “too little, too late” after the summer’s severe drought. Florida cane harvest was stalled by up to 7 inches of rainfall in some areas.

Beet processors were slicing enough beets and producing enough sugar to meet delivery obligations. But none were rushing to sell the remainder of their 2023-24 production until the campaign gets further along. One processor remained out of the market, another was expected to return to the market in early November, and most others were in the market but noted light sales.

Bulk beet and cane sugar prices mostly were unchanged, but comparisons with a week earlier and a year ago were muddled by the start of the new marketing year Oct. 1. Some sellers offered the same prices spot through calendar 2024. Others had higher spot prices but a lower price for calendar 2024 (though unchanged from a week earlier in both cases).

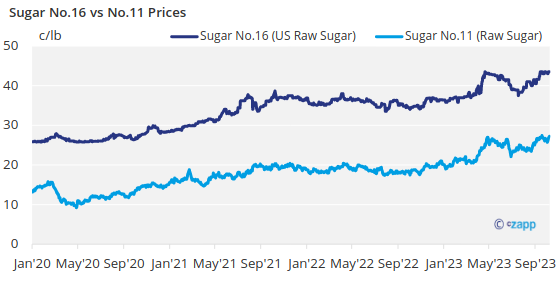

While refined sugar price changes were difficult to pinpoint, the general tone to the market was steady to firm. There was no indication of price weakness as sometimes occurs in October when the beet and cane harvests are active. Delays in the beet harvest and uncertainty about the Louisiana cane crop have emboldened sellers to hold prices steady after some increased offers a few weeks ago.

Annual flat-price contracting of corn sweeteners for 2024 was off to a slow start. One major supplier was said to still not be active in the market for 2024. Some others have pulled back after issuing offers at steady to slightly firmer prices to existing customers in September. Users, hoping for lower prices due to ample corn supplies and lower corn prices, were in no rush to buy, and refiners indicated they also were willing to re-evaluate and wait until users are ready to do business. Price offers were unchanged from September. Record-high sugar prices in Mexico could boost export demand for high-fructose corn syrup from the United States.