This update is from Sosland Publishing Co.’s weekly Sweetener Report. This update is from Sosland Publishing’s Sweetener Report. For more information and subscription details, CLICK HERE.

Insight Focus

- A snowstorm in the Upper Midwest may delay Red River Valley beet plantings.

- Beet plantings have begun in Idaho and Oregon.

- Progress is below the 5-year average.

Focus in the sugar market shifted to beet planting during the week ended April 7 as the majority of business for 2023-24 was nearing completion, but concerns about late planting increased. Prices were firm.

A snowstorm moved across the Upper Midwest early in the week, adding to the already ample snow cover across the region. With soil temperatures still in the mid-20s in the Red River Valley, a late-planting scenario was developing as lots of snow still needs to melt, soils need to dry and soil temperatures need to rise.

Sugar beet planting in the Red River Valley typically begins in the third week of April with a goal of having 50% of the crop planted by the first week of May. It is unlikely that will happen this year.

The US Department of Agriculture’s first four-state aggregate beet planting report this week (as of April 9) is not expected to show any planting progress in the Red River Valley. The latest Northwest regional USDA crop update indicated 1% of beets were planted as of April 2 in Idaho and Oregon, well behind the prior year and the five-year average for both states.

It should be noted that large amounts of sugar beets can be planted in just a few days and there remains ample time to get this year’s crop in the ground. Concerns then turn to the impact of late planting on early harvest, sugar content and growing season weather.

Louisiana sugar cane ratings improved to 62% good to excellent as of April 2, compared with 54% a week earlier and 64% a year ago.

Beet sugar sales for 2023-24 have slowed considerably from the hectic pace in early March. While deals continued to be closed on outstanding requests, new sales were slower. Some processors are selling selectively until beets are planted and they have a better idea of potential 2023-24 sugar supply. One processor said it likely would be out of the market until harvest begins in October.

Adding to concerns was the USDA’s March 31 Prospective Plantings report that showed farmers intend to plant 4.2% fewer acres to sugar beets in 2023 than in 2022 and the fewest since 2008.

Beet sugar prices for 2023-24 ranged from 55¢ to 58¢ a lb f.o.b., steady to 1¢ higher than a week earlier, with beet sugar selling on par with cane sugar in some areas. Supplies of beet sugar will be limited going forward.

Refined cane sugar offers for 2024 were steady at 59¢ a lb f.o.b. Northeast and West Coast and at 56¢ to 57¢ a lb f.o.b. Gulf and Southeast. Strong prices for beet sugar have pushed more buyers to cane sugar in some areas. Cane refiners appear to have 50% to 60% of capacity booked for 2024, ahead of the average pace.

Spot prices were unchanged with refined cane sugar offered at 64¢ a lb f.o.b. nationwide and beet sugar nominal.

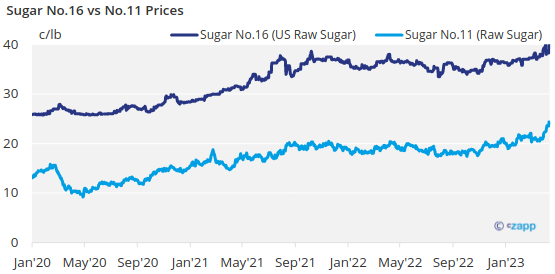

No. 11 world raw sugar futures were at 6½-year highs on tight global supplies.

The corn sweetener market mostly was quiet with limited if any supplies likely to available for spot sale.