Insight Focus

The sugar market is in a downtrend. This will be driven by speculators’ willingness to short. A new factor worth watching is the rise of GLP-1 receptor agonist drugs.

Click here for the full webinar!

Hi everyone, it’s Stephen from CZ with a long-overdue update on the sugar market.

I am sorry for the delay between videos; the team here have done a couple of chunky consulting projects and I’ve also been travelling in recent weeks.

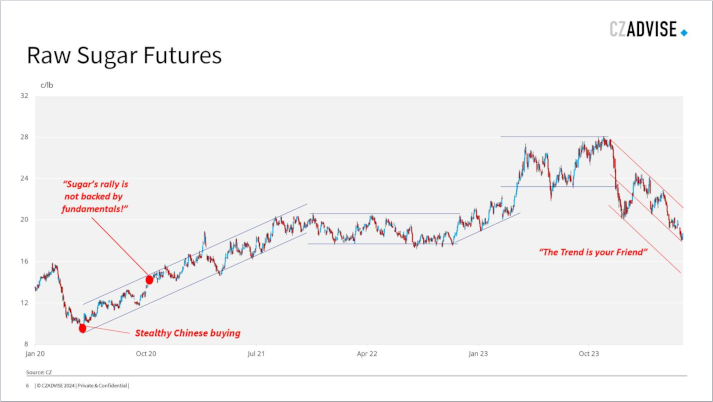

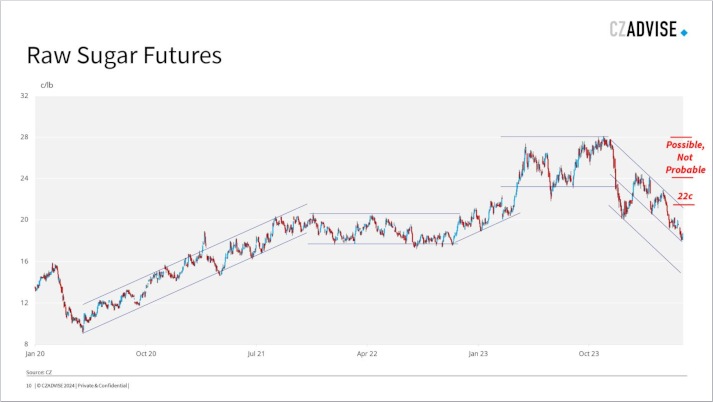

Speaking of travel, I’d said after the Dubai Sugar Conference that maybe the raw sugar market would spend a short while between 20-24c. The while was definitely short. The market is in a new downtrend and we simply have to accept this fact, not cling on to the old bull market.

I well remember a very well-respected analyst saying as late as November 2020 that the price rally we’d seen for the last 6 months wasn’t based on fundamentals and would soon be over. He’d completely missed the huge Chinese refinery buying below 10c which didn’t become obvious to the market until much later. Don’t be that person. As the old saying goes, the trend is your friend.

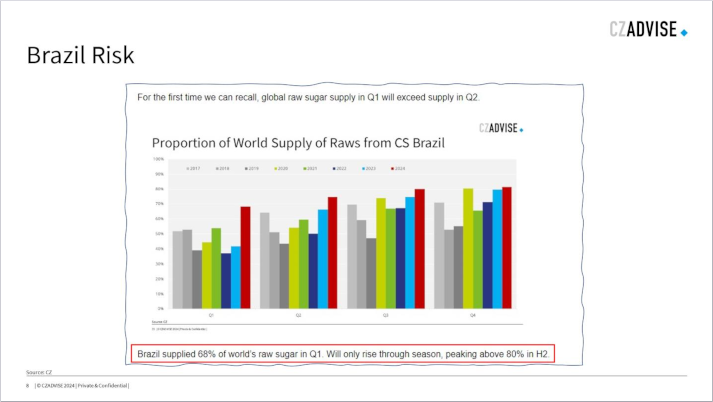

Today, I know that all analysts are trying to cover themselves by saying that there’s huge concentration of supply in Brazil and this means there’s bull risks to the market. This is 100% true – I’ve been saying this in my recent videos too, but also everyone in the market is well aware of this risk so saying it isn’t really helpful any more.

Besides, a rally to 22c would be a major achievement at this point, let alone back towards the highs at 28c. Getting to the mid-20s would take a major problem in Brazil which is possible, but not probable. Be aware of the outlier risks, but also don’t frame your whole risk management strategy around them.

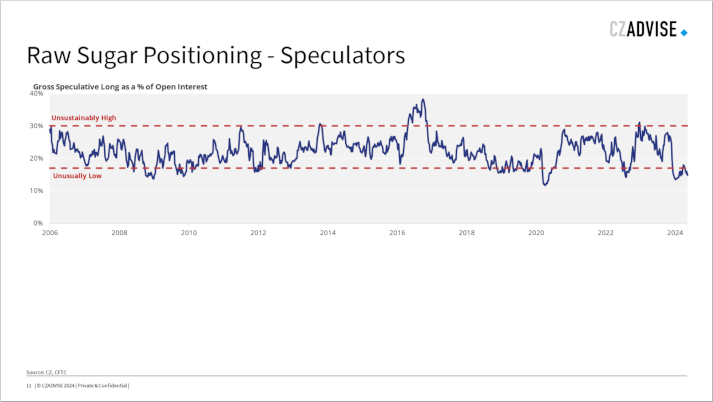

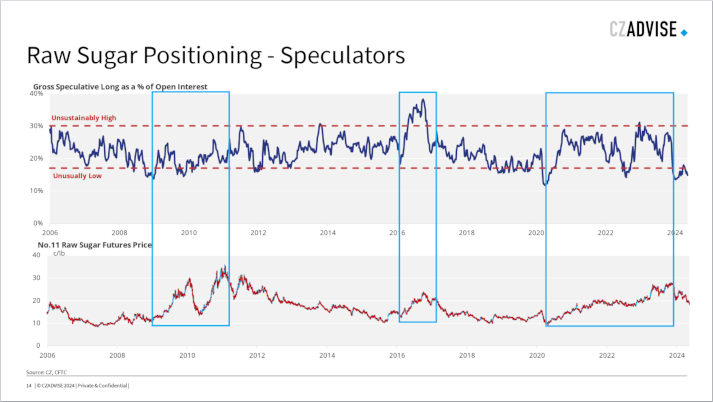

Something else that’s interesting to me right now is market positioning. Check this out.

Here’s a chart of the gross speculative long position as a percentage of open interest. The higher the percentage, the more pronounced the speculator long is in the market. Spot the bull markets.

You don’t get any points for spotting the 2016 rally to 24c, that one’s obvious. But how about the 2009-11 rally to 36c? How about the 2020s rally to 28c? They’re not obvious from the data.

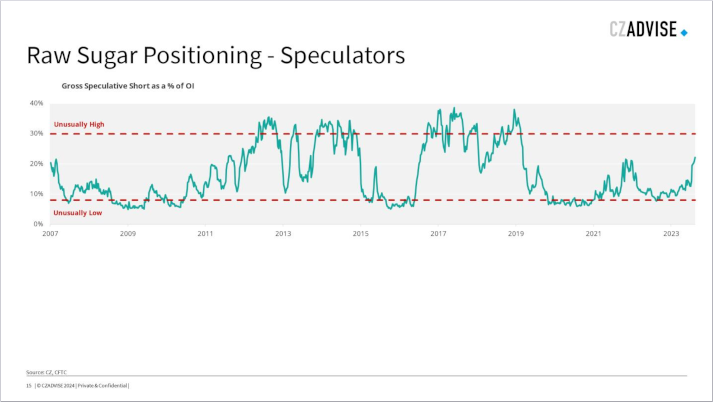

Now let’s do the same thing in reverse. Here’s a chart of the gross speculative short position as a percentage of open interest. Spot the bear markets.

It’s easy. It’s also easy to spot the bull markets too. This means that in the past, speculators have driven bull and bear markets not so much by their positioning to the long side, but instead by their willingness to short.

I don’t think this point is widely understood in the sugar market, I find it weird too, but it’s there on the chart for anyone to see.

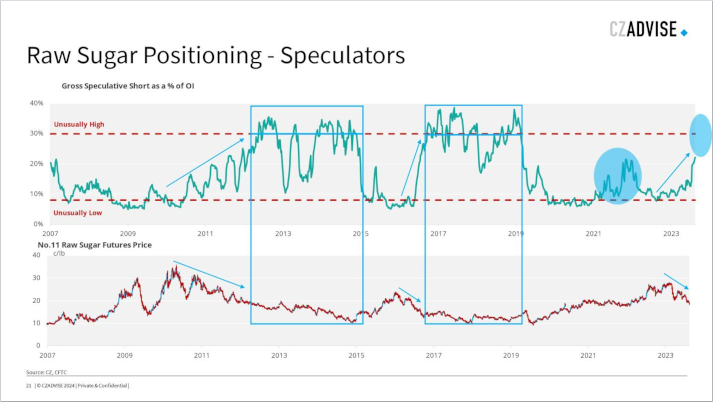

Today you can see that they are building up towards bear market territory, but we’re not quite at levels we’ve seen in the past. Not yet. So speculators look like they’re building towards a major new bear market, but they still don’t quite have full confidence yet, perhaps because of the Brazil concentration risk.

As time moves on, they may well grow in conviction, especially if northern hemisphere cane and beet crops develop well. But the increase in conviction doesn’t have to be linear. They can easily dump their shorts before rebuilding, as they did in 2022.

So do pay attention to the top edges of the downtrend as well as the bottom of the range. Producers have plenty of 2025 and 2026 tonnage to sell too, and I’d recommend hedging as much as you are comfortable doing at the upper end of the downtrend, especially if you can sell into speculative buying.

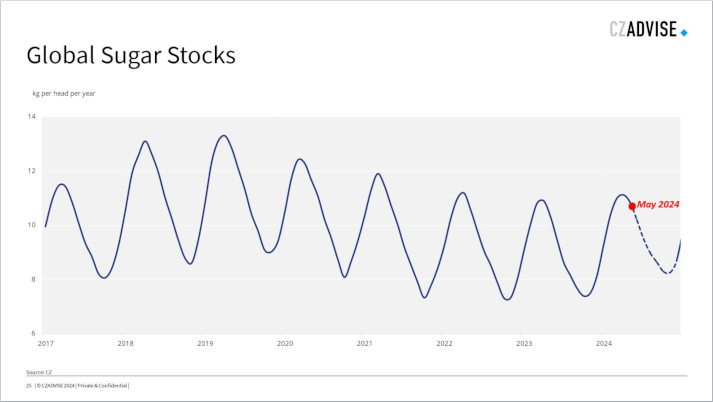

The major question to my mind is whether the speculators have taken their position too soon. Even as we enter the peak of the Brazilian crush, we’ve already passed the peak of global sugar stocks this cycle.

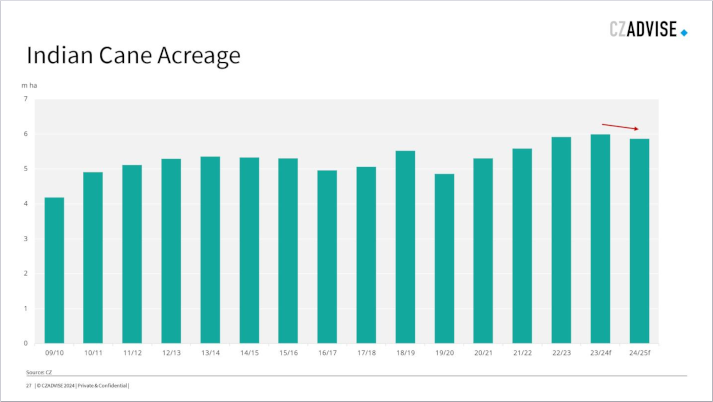

India’s monsoon is just beginning and there are still some millers there talking about lower cane plantings for next year. We’re assuming a 2% drop due to the dry weather in the south west last year, nothing too drastic. The government is unlikely to make any decisions on sugar exports for another year or so.

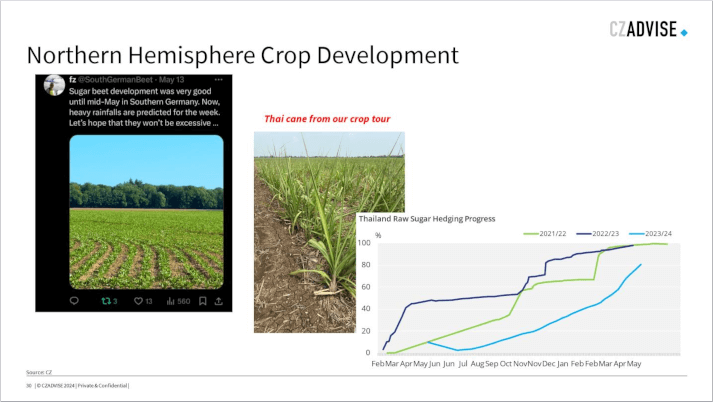

The European beet crop is developing nicely and the weather is good for plant growth. But refined sugar from this crop won’t be physically available until much later this year, even if producers continue to try to make sales.

It’s a similar story in Thailand. The cane crop is developing well but the sugar won’t be available until next year and the Thai mills aren’t able to make heavy sales today because the benchmark hedging for 2025 that comes through the B Quota tender system hasn’t started yet.

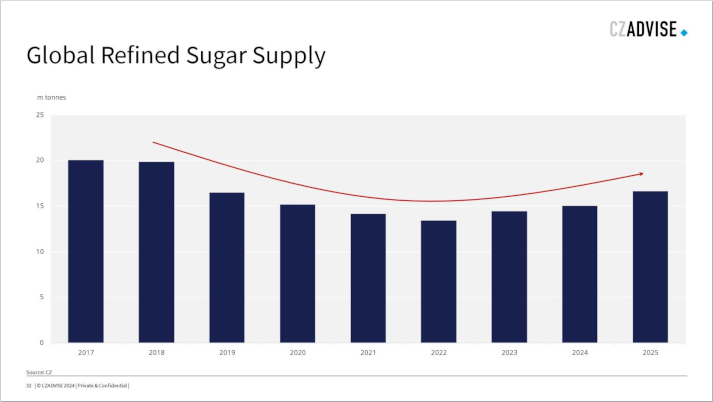

So if we just accept the downtrend is happening, I guess the main question will be “why”? Just because speculators have gone short and there will be more refined supply in 9 months time doesn’t necessarily call for such major price weakness today.

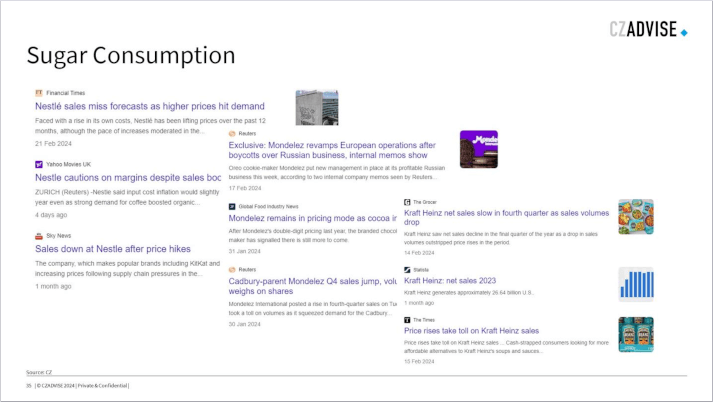

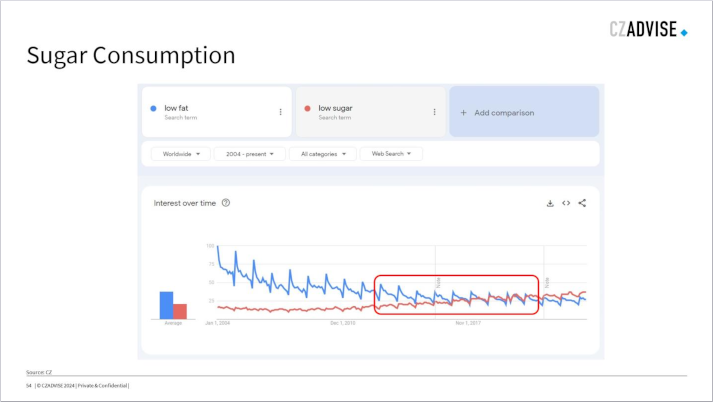

I’ll finish with a few words on sugar consumption. I suspect there’s something important happening here that’s hard for us to see. I’ve given this a lot of thought recently, especially after several major food and beverage companies reported weak sales in Europe.

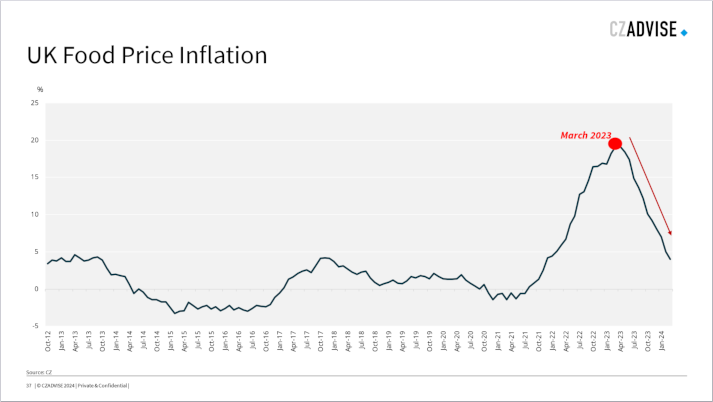

We’d wondered if this might be due to food price inflation, but I didn’t think this could be true.

Food price inflation peaked in March 2023. Would it really take a year for consumers to cut back? Besides, sugary foods tend to be cheap relative to meat, so why cut treats and snacks now? Worldwide google searches for food prices peaked in mid-2022, so it had been on the public’s mind for a while.

Our EU trading team wondered if we were seeing consumers swapping from branded goods to unbranded, which is possible, but many major food and beverage companies also make unbranded products alongside their own brands.

We wondered if in the EU we were seeing import substitution, with finished products arriving from outside the bloc, but we couldn’t find customs data to support this.

This just highlights how little we know about consumption as sugar market analysts.

Last week I attended the TXF Global Natural Resources and Commodities Finance conference in Amsterdam. Sadly I was too busy making notes to take many photos. But Kona Haque, who is a wonderful analyst at ED&F Man, was also there and in a Q&A session said something along the lines of “supply is the major factor for soft commodity prices, and demand is a residual consideration”.

This is where I disagree, and it’s good to disagree, right? This is a market, after all. One thing which may be worth highlighting is the wider use of GLP-1 receptor agonists, drugs like Ozempic and Wegovy.

I know, you’re probably thinking I’m crazy. But no-one in the sugar markets is talking about this and I think maybe we should.

These are the new wonder drugs which seem to stop impulsive human behaviour. They were originally prescribed for insulin control in Type-2 diabetes patients but are now widely used for weight loss. Several things are happening here.

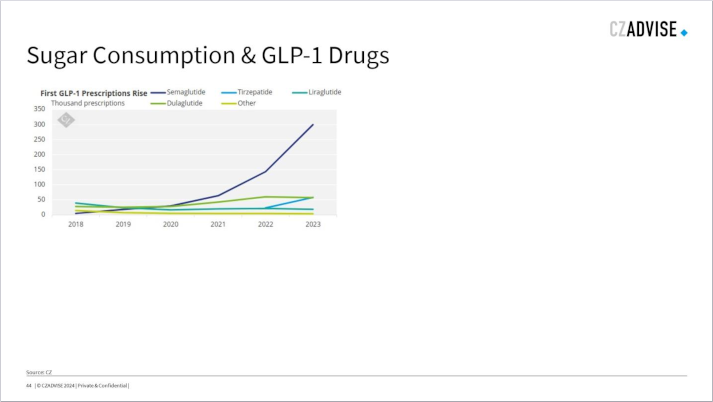

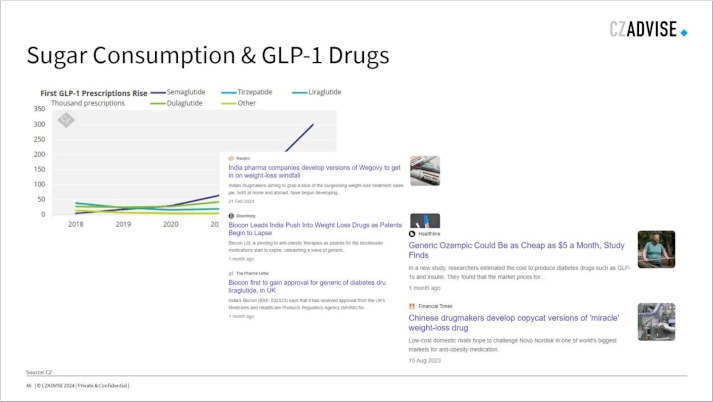

The number of prescriptions of GLP-1 drugs is growing rapidly. This chart shows data for the USA. Consider that in the USA, more than 40% of the population is obese, and the FDA now allows GLP-1 drugs to be prescribed to treat this. By some measures, there are 3b overweight and obese people in the world today, which is a huge addressable market for these drugs.

These drugs are expensive today, as much a thousand dollars per month. Clearly, they remain the preserve of rich people or rich nations.

But generics are coming. And the drugs are evolving so quickly that we may not be waiting for generics of the first wave. Cheaper 2nd and 3rd generation GLP-1s may arrive before the 1st wave go off-patent.

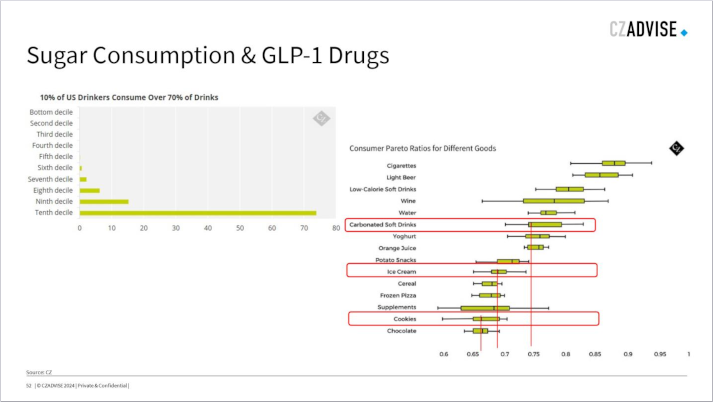

Finally, I’m not sure how many people appreciate how important super-users are to so many categories of consumer goods.

Think of the 80.20 rule. Where, for example, 20% of the people in a company derive 80% of the revenue. This happens in many consumer goods too.

Cigarettes are an obvious one. Nonsmokers don’t buy cigarettes, smokers buy cigarettes. 15% of the UK population smoke. It’s the same with alcohol. There are a few people in the population who drink every single day, and they will account for most alcohol sales. One study found that 10% of American drinkers drank more than 70% of the alcohol sold.

One study I found on consumer goods shows that 20% of the population are responsible for 75% of soda sales, 68% of ice cream sales and 66% of cookie sales. I suspect that these super users may also tend to be more overweight than the general population, by virtue of their consumption, and so more likely to ultimately be prescribed GLP-1 drugs.

If being on GLP-1 drugs reduces their consumption of snack foods, this might start to diminish sugar consumption, perhaps not drastically, maybe by a few percent. But these marginal effects may not be linear in how they affect things like sugar prices.

I know, I know, stop rolling your eyes. We were all too slow to take the anti-sugar trend seriously in the early 2010s, and it had a major impact on the market, making the 2010s bear market longer and deeper than it otherwise would have been.

No-one else in the sugar market seems to be taking this seriously, I am and so the team here will do a bit more digging. At the very least I’m hopefully giving you something to think about.

Good luck with managing your market risk in the new downtrend, and hopefully we’ll speak soon.