At the moment, the big unknown is what path Petrobras will take once the new President steps in.

So far, the company has adjusted according to international prices, even after the CEO change was determined by Bolsonaro.

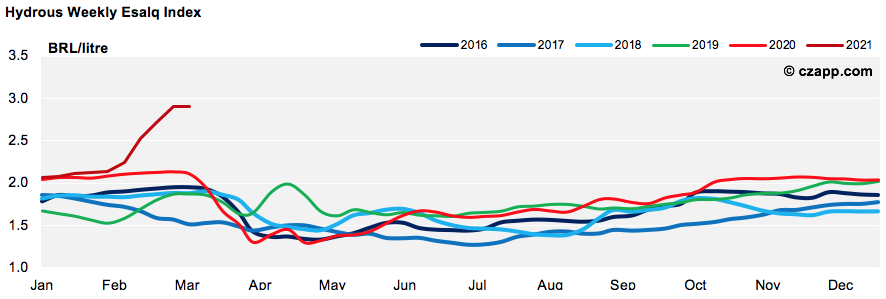

This means ethanol prices have held strong until now and are being negotiated at around 2.9 BRL/litre (net of taxes, ex-works); this is 15.8 c/lb on a No.11 basis.

However, we’re in the off-season and tight ethanol stocks are helping keep prices up. The tendency is for prices to fall in the upcoming weeks, as the new season starts in Brazil.

Nonetheless, if Petrobras’ policy changes in the coming months, we don’t see this bearing a significant impact on the mills’ production mix in 2021/22. The strategy is already defined as max sugar, and we think most of CS Brazil’s mills have already priced over 80% of their sugar.

However, we do believe any additional sucrose availability (either through higher cane availability and/or increased sucrose yields) will be diverted towards sugar, if gasoline’s international parity is suspended.

We’ve written extensively about the risks here and here.

Other Opinions You Might Be Interested In…

- Ethanol: The Sugar Sector and Interventionism in Petrobras

- Brazil Ethanol Market: So Far Without Interventions