Insight Focus

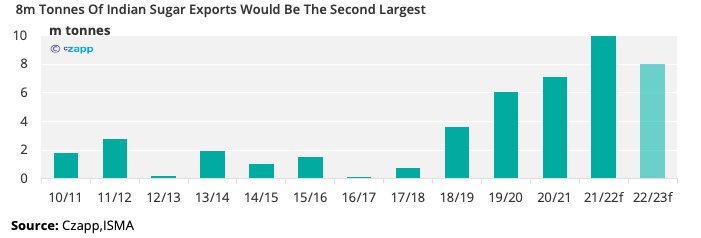

- The Indian sugar industry is seeking permission to export 8m tonnes of sugar 2022/23.

- In this week’s Ask the Analyst, we ask is this achievable.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

The Indian Sugar Mills Association (ISMA) is seeking approval from the food ministry to allow its members to export up to 8m tonnes in 2022/23.

As this season’s exports have been restricted at 10m tonnes to preserve domestic sugar stocks, any exports will need to come from next season’s production.

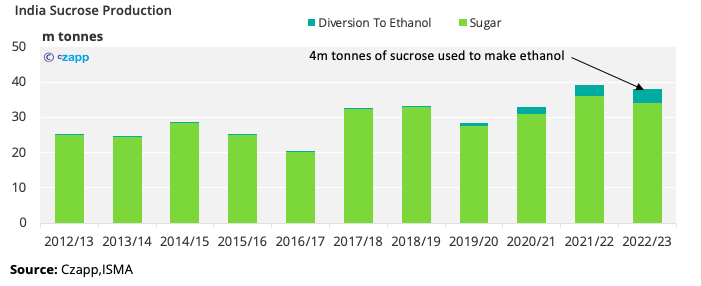

With India’s sugar consumption over 26m tonnes this implies that at least 34m tonnes of sugar would need to be produced, not including the 4m tonnes of sucrose that is set to be diverted to ethanol. Total sucrose production would need to reach 38m tonnes which is about 1m tonnes less than in 2021/22.

We believe that the cane area could increase by 2% in 2022/23 which should make this production target very achievable, provided that water availability remains sufficient.

What Does It Mean?

This has two major implications: the first for the global sugar market and the second for food security In India.

World Sugar Market

If India does export 8m tonnes this should help shore up sugar supply over the next year. Indian export parity in (now at 18.75c/lb) could remain a key level for sugar prices.

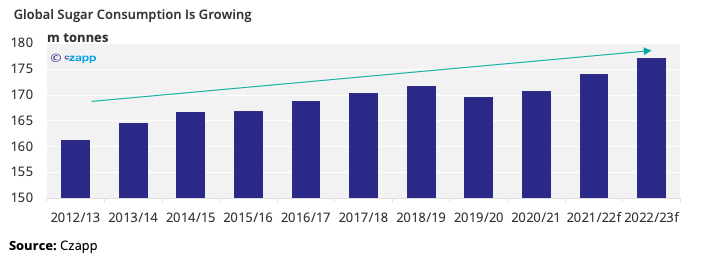

It also gives more time for other countries to increase their cane or beet area: Apart from India we haven’t yet seen any signs of increasing cane or beet acreage in any of the main growing regions. Meanwhile sucrose consumption continues to increase with population growth and diversion to ethanol for road fuel.

We are therefore worried that the world sugar market is approaching the point where global consumption outstrips global production.

Indian Food Security

India’s E20 ethanol plan was initially conceived as a way of using up surplus sucrose, and the approach made sense in the 2010s when food prices globally were falling. As well as solving sugar overproduction it enhanced energy security and reduced greenhouse gas emissions.

So far it seems that the programme has just encouraged farmers to plant more sugarcane at the expense of other food crops . This is becuase cane returns have been set so high that cane is often grown on marginally suitable land.

Other Insights That May Be of Interest…

Can India Sustain High Sugar Production?

Bangladesh’s Growing Sugar Demand Adds to Need for Production Investment

Explainers That May Be of Interest…

Czapp Explains: The Sugar Industry in Uttar Pradesh

Czapp Explains: The Sugar Industry in Maharashtra and Karnataka