Insight Focus

- In times of crisis, safe-haven currencies such as the dollar tend to rise, particularly against emerging market currencies.

- In this week’s Ask the Analyst, we discuss how currency fluctuations impact Indian sugar prices.

- If you’d like us to answer one of your questions in an upcoming edition, please email will@czapp.com.

How Do Fluctuations in the Value of the Rupee Impact Indian Sugar Prices?

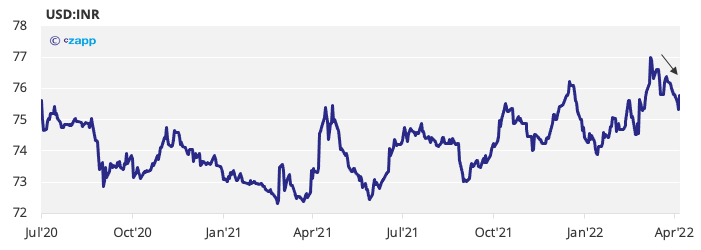

Movements in the Indian Rupee (INR) affect the viability of Indian sugar exports to the world market. For example, if the INR strengthens against the US Dollar, it is harder for exports to happen for a given world market sugar price.

Note: You can monitor the USD:INR in this weekly update.

Indian sugar prices are largely determined by the supply of sugar in the country. This, in turn, is heavily influenced by government policy seeing as the government sets cane prices, minimum sugar prices and also dictates how much sugar is released into the local market each month. Therefore, the Rupee doesn’t have much impact on local sugar prices, except for when it influences the volume of sugar sold for export. This ultimately feeds back to how much sugar stock there is in India.

Other Insights That May Be of Interest…

Market View: Sugar & Soy Struggle for Space at Santos

Explainers That May Be of Interest…