Insight Focus

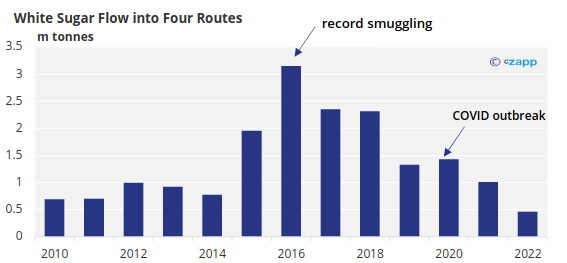

- Smuggling resumed after China lifted COVID restrictions.

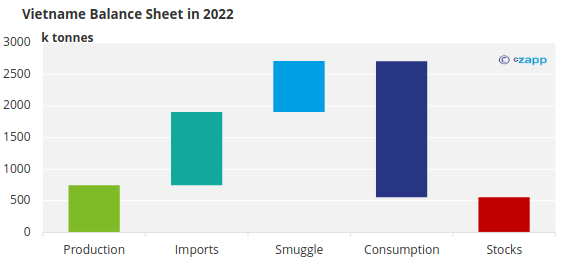

- The Vietnamese sugar market has a surplus of 500k tonnes.

- Might this sugar find its way into China?

China lifted COVID controls in December last year. In the first month of 2023, we heard that 60k tonnes of white sugar had been smuggled from Vietnam into Guangxi, China.

The question is, how much more will be smuggled into China in 2023?

Profit Driven as Always

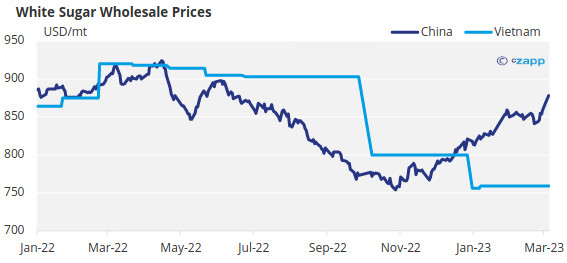

In Q1’23, domestic sugar prices in China, which relies on imports for one-third of its total consumption, also soared thanks to the strong global raw sugar market.

Today, the Guangxi price is around $878 per tonne, while the price of Vietnamese white sugar is $759 per tonne. The price gap has reached $119 a tonne.

Why Vietnam?

Because the country is currently in a surplus, and domestic prices have been relatively stable since 2023. As a result, profits may encourage smuggling to resume, with relaxed border control after COVID.

In 2022, it imported 1.156 million tonnes of sugar. In addition, sugar is smuggled into Vietnam from Cambodia and Laos, which we estimate to be about 804k tonnes. Therefore, the country could have a surplus of around 500k tonnes.

This sugar could be smuggled into China with price incentives.

What about other Smuggling Routes?

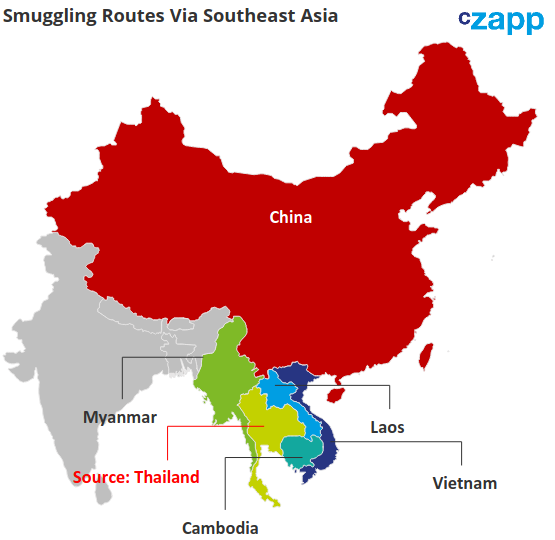

Generally, overland smuggling routes to China include Vietnam, Cambodia, Laos, and Myanmar. The main source of sugar is Thailand, but sometimes India and Pakistan.

So far, there has been no sign of a large influx of sugar into these routes. Other than Vietnam, there are no large stockpiles of sugar in the rest countries.

Besides, smuggled sugar is not the only cheap option. The sugar can also be made into premix powder or liquid sugar and legally entered China. Of course, these two products have disadvantages, premix powder is relatively a small market, and liquid sugar has a short shelf life.

All in all, we could continue to see Vietnamese sugar stocks being smuggled into China. But after the stock runs out, new sugar from Thailand needed to be imported to the neighboring countries. The current profit is probably around $70. We need to monitor if this is enough to stimulate smuggling.