Insight Focus

- Record cane availability in Centre-South Brazil.

- Weather will determine if it’s all harvested.

- If it is, sugar production could surpass our current forecast of 38.2m tonnes.

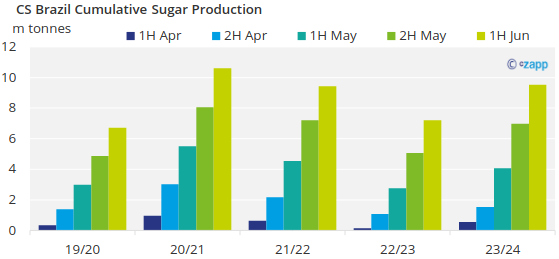

Centre-South (CS) Brazil is the world’s largest cane region. Its harvest this year has started at a rapid pace, despite wet weather in April. Sugar output by the middle of June was 9.5m tonnes, the second highest on record behind only 2020/21. That year CS Brazil made 38.4m tonnes of sugar.

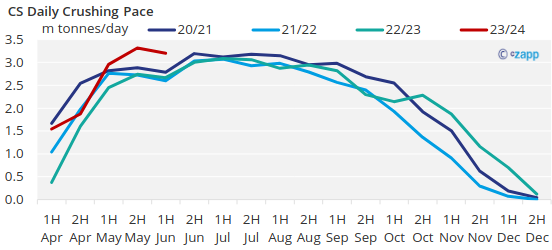

More interesting is the fast pace mills have been crushing at. Considering the volume of cane and operational days, in 2H May CS Brazil registered the highest daily crush in more than a decade. If this continues, what is the upside?

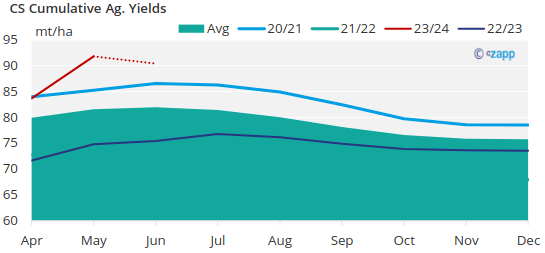

Cane availability will not be an issue this season. According to UNICA (Union of the Sugar Cane and Bioenergy), agricultural yields in May reached 95mt/ha! This was mostly driven by 1st cut cane, that tends to have a higher TCH (ton of cane per hectare), but it is still a striking figure. Of course, this will not be the case for the remainder of the season and TCH tends to come down as the harvest proceeds.

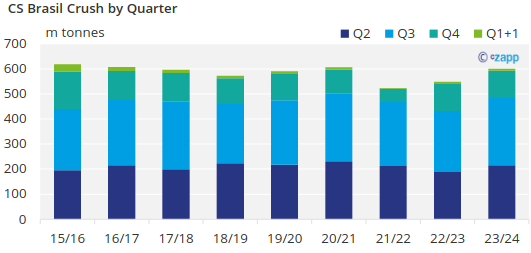

Depending on how agricultural yields behave in the upcoming months, CS Brazil might have a similar amount of cane available as it did in 2015/16. That year was also marked by rains, and the region was not able to crush all the cane leaving a big chunk in the fields for the next season. In fact, by the end of December, 588m tonnes had been crushed, 4m tonnes less than what we are expecting for this season.

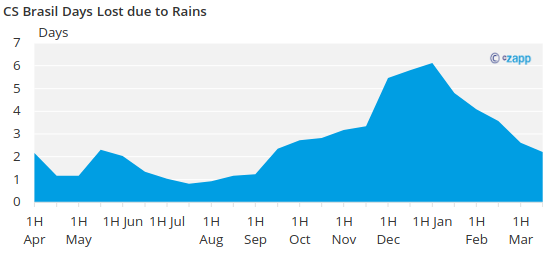

As always, weather will play a crucial role. If the upcoming months are wetter than normal, mills will be forced to stop and wait for the fields to dry before resuming operations. At the peak of the season, each day lost results in 220k tonnes less sugar output. This is a volume they might not be able to recover at the tail of the season, when the rainy season begins.

In short, what matters this year is weather behavior, it needs to be dry to allow the massive cane availability to be crushed.

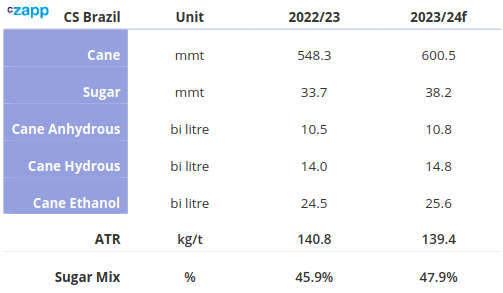

Nevertheless, we have revised our forecast due to the crushing pace and better-than-expected ATR (sucrose content). Please see below our new estimates: