Insight Focus

- Do you know which country, other than China, is the main destination for Brazilian raw sugar?

- Which continent saw most of Brazilian white sugar imports?

- Mexico imports raw sugar for the first time.

Brazil is not only the largest sugar producer in the world but is also the biggest sugar exporter. With a sugar production expected to surpass 41m tonnes this season, consumption is only around 10m tonnes. This leaves an almost 30m tonnes surplus of sugar to be exported.

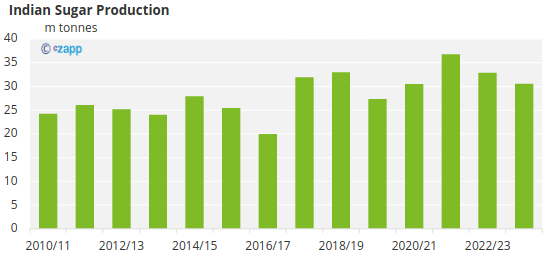

This is an important distinction to make, especially since the next biggest producer is India who won’t export any time soon.

So, where does Brazil export sugar to? Read below and have another topic of conversation over Christmas dinner.

Unusual Destinations in 2023

Brazil has exported raw sugar to Saudi Arabia before, on average 1m tonnes. However, in 2023 the volume increased by 44% YoY. Saudia Arabia usually sources sugar from Brazil and India. Since the latter has suffered with poor crop this past season, Brazil became the primary origin.

The same can be said of Iraq, which saw volume of Brazilian sugar at almost 1m tonnes – a 45% increase YoY.

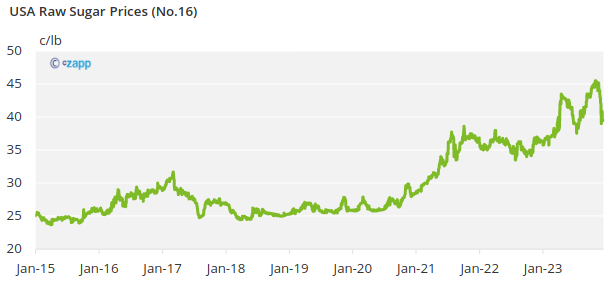

United States imported more than three times the usual volume, reaching a staggering 700kmt of imports. Although it is high duty sugar (meaning it pays USD360/ton, or 16.33c/lb), the domestic market (No.16) was high enough to allow US buyers to pay for the massive duty and still keep margins positive.

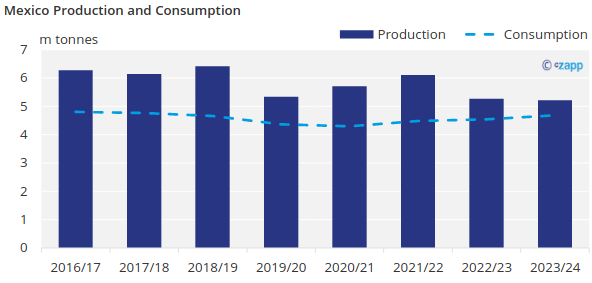

A very unusual destination was Mexico, that imported raw sugar for the first time, 160kmt. The El Niño impacted the sugar crop significantly, leading to drought and poor yields. A second year of production just a little over 5m tonnes has left the country relying on imports to meet domestic demand once exports to the US have been made.

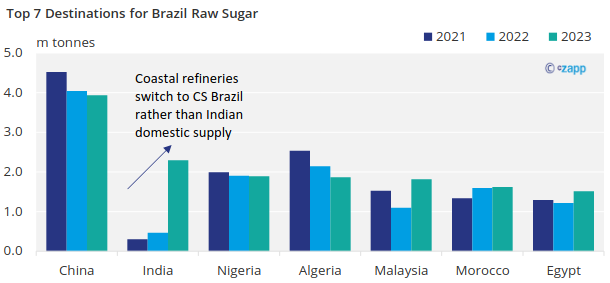

Top 7 Destinations for Brazil Raw Sugar

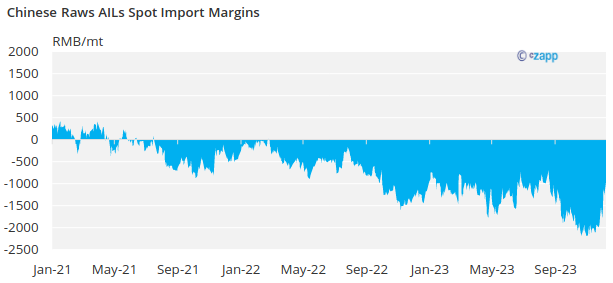

Since 2020, China has been the main destination for Brazilian raw sugar. Even though the refineries spot margins have been negative throughout the year, the system of AIL ended up forcing refineries to purchase even at a loss.

In second place, we saw India as a top destination for Brazilian sugar. This is a first since 2020, and a result of a poor season for the second largest producing country in the world. The raw sugar is exported to the coastal refineries, which in turn supply the world with refined sugar – specially Africa and Asia.

And unsurprisingly, Nigeria comes in third. Nigeria is a country with virtually no sugar production and highly dependent on imported raw sugar from Brazil, which is processed at its refineries. The country imports close to 2m tonnes each year, all of which is for domestic consumption.

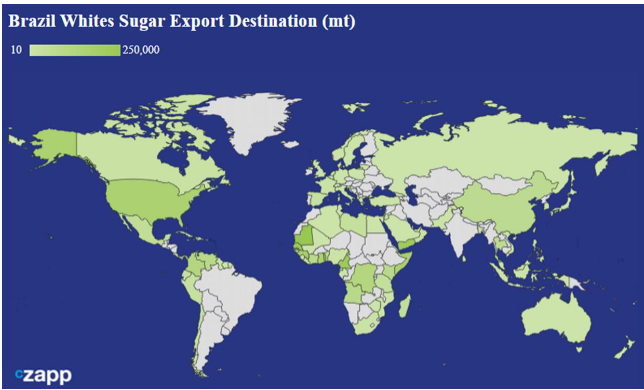

Top Destinations for Brazil White Sugar

Unlike raw sugar exports, where some destinations are dominant in volume, white sugar exports are more spread out. West and East Coast Africa are key destinations for this flow. For instance, the main white sugar destination in 2023 was Mauritania with 250kmt, but it represents just 7% of total whites exports from Brazil. The same for the second place this year, which was Senegal.

The top 9 destinations for Brazilian white sugar exports account for 50% of the volume. The other 50% are distributed around 96 countries, with volumes ranging from 200k tonnes to just 10 tonnes.

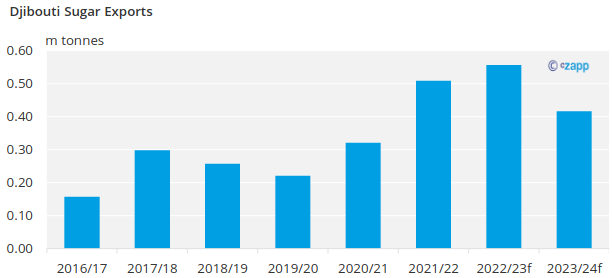

Out of the top 9 destinations, the country that saw the most significant increase YoY was Djibouti importing 192kmt – 8 times the usual volume. One of the reasons is that the country usually sources white sugar from India but had to find other origin given the reduced availability there. Another interesting fact is that while the country does not produce sugar, it exports close to 400kmt every season. The country serves as an entry point to supply the eastern part of Africa.

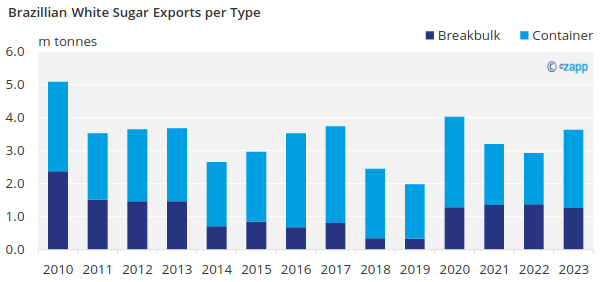

Brazil mainly exports sugar by container, but the proportion used to be much higher. During the pandemic, the lack of container availability shifted the exports to breakbulk – a modality where the sugar is stored in bags and loaded in a vessel hold. Since then, the container percentage has remained below 70% and failing to return to pre-pandemic levels. The large amount of white sugar exports results in the need of using all possible options, container and breakbulk.

The timing of the white sugar exports also coincided with the cotton exports. Owners of container vessels prefers to operate cotton due to the higher value of the operation and lower weight.

Conclusion…

Brazil is the main sugar supplier of the world, any disruption caused by logistics can have a significant impact on market sentiment. This is even more true now that India is not exporting; As seen above, most destinations saw an increase of Brazilian flow.

As we have been stressing in our long-term view, any weather disruptions, or the commitment to the ethanol program in India will make the world more and more dependent on Brazilian sugar. Prices need to remain at a level which production is incentivized but also, a route for exporting the sugar is expanded.