Insight Focus

- The difference between raw sugar and white sugar prices is known as the white premium.

- It directly impacts the availability of refined sugar.

- To calculate, first convert raw sugar into USD/mt.

What Is The White Premium?

Sugar’s white premium (often called the arb) is the difference between the price of raw sugar and white sugar. More specifically it is the difference between the No.11 raw sugar futures and No.5 refined sugar futures.

Therefore, it represents the futures market return that can be generated by buying raw sugar and selling white sugar. This is just what Re-export (toll) refiners do.

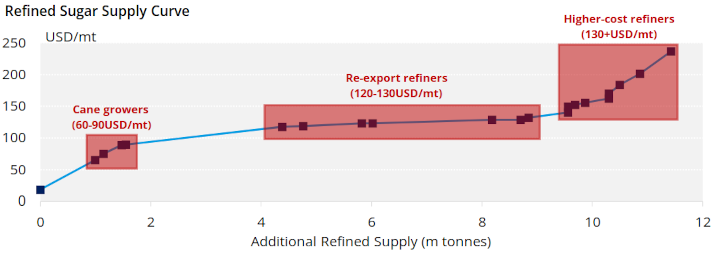

If the white premium is greater than a refiner’s costs, they will be profitable; if the white premium is below their costs, they will lose money on each tonne of sugar they process and will likely operate at a limited throughput (refiners will often operate as it’s very costly to stop and restart operations).

For some producers (such as Thai mills) the white premium will determine if it’s more profitable to sell raw sugar or remelt to sell as white sugar.

This means that the white premium affects refined sugar availability. You will often see us write about the Refined sugar supply curve which shows how white sugar supply varies depending on the premium over raw sugar.

In reality, the premium the white sugar market pays over the raw sugar market doesn’t have to be limited to the futures markets. Many of the world’s re-export refiners can also command strong regional physical premiums over the refined futures, which often reflect the cost of refined sugar made at origin.

How Is It Calculated?

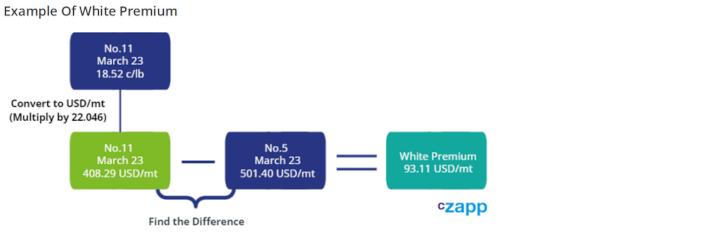

To calculate the white premium, raw sugar prices must first be converted from c/lb to USD/mt.

Luckily, it’s simple to convert from c/lb to USD/mt by multiplying by 22.046.

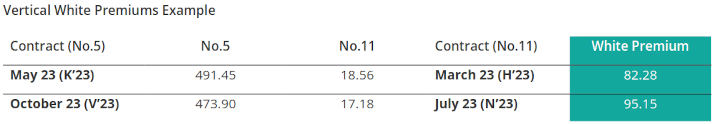

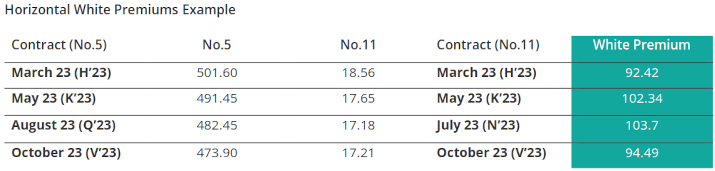

The white premium can be calculated against any combination of futures contracts. You are most likely to see the below combinations of No.5 and No.11 and contracts. These are known as horizontal white premiums because they compare prices for the same contract month (or closest match for August/July).

Sugar refineries often prefer to use diagonal white premiums when hedging their sugar. This is to account for the time it takes from shipping raw sugar to it arriving at the refinery and then being converted into white sugar for sale.