Insight Focus

- In this week’s Ask the Analyst we answer why the sugar futures spreads are so backwardated.

- Spreads (and the forward curve) can help resolve supply and demand imbalances.

- The sugar markets are still undersupplied, backwardated spreads can resolve this.

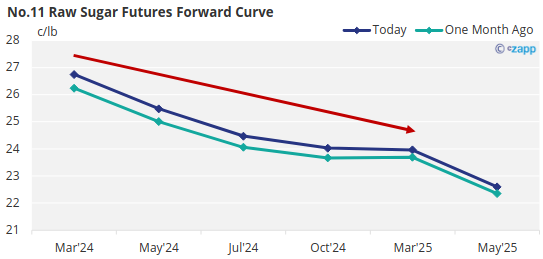

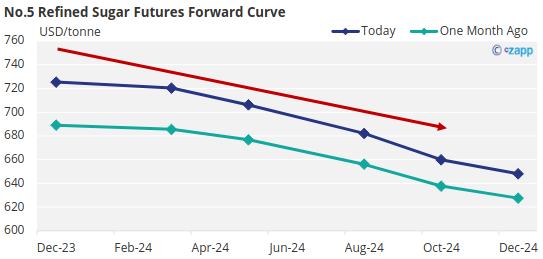

The forward curves for both the raw and refined sugar futures markets are strongly downward sloping (backwardated) and have been for at least the last 12 months.

This is because we think each market remains severely undersupplied. We are currently publishing a series of explainers covering futures market spreads and what influences them if you’d like to understand more.

Raw and Refined Sugar Forward Curves are Downwards Sloping

For the No.11 raw sugar futures, the March’24 contract is trading at an almost 300-point (3c/lb) premium to the March’25 contract.

The No.5 refined sugar December’23 contract is trading almost 80USD/tonne higher than the December’24 contract too.

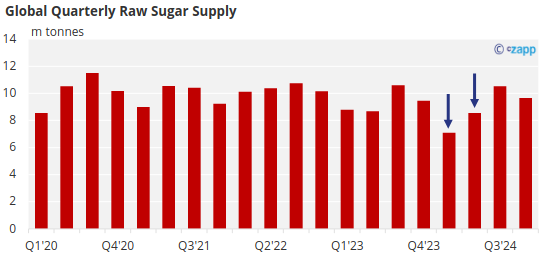

The Sugar Markets are Undersupplied

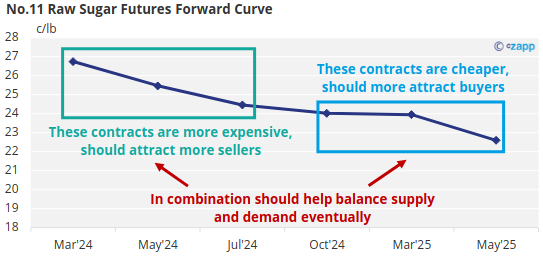

in general, a forward curve tends to be driven by the fundamental picture of the underlying commodity if there is sufficient liquidity in the contracts.

This means that since the nearby contracts are relatively more expensive than the later-dated ones, each market is strongly trying to encourage more supply closer to become available toward the present, and push more demand into the future.

An El Niño has brought drier weather to several major northern hemisphere sugar producers meaning raw sugar supply early next year is looking far weaker than normal.

Meanwhile, whilst many buyers have been drawing down stocks we think there isn’t much room for this to continue.

And since the refined sugar market is undersupplied too means that refineries are still keen to maintain their raw sugar demand to maximise their refined sugar supply.

This is all making it challenging for the raw sugar market deficit to resolve and means that the raw sugar futures market forward curve need to remain downward sloping to try and balance out the supply and demand differences.

The case is the same for the refined sugar futures spreads too.

Global sugar consumption seemingly remains robust in the face of high prices and the inflation problems facing many countries at the moment.

The refined sugar spreads should continue to encourage greater selling closer to the present, and greater buying further into the future to help combat this too.