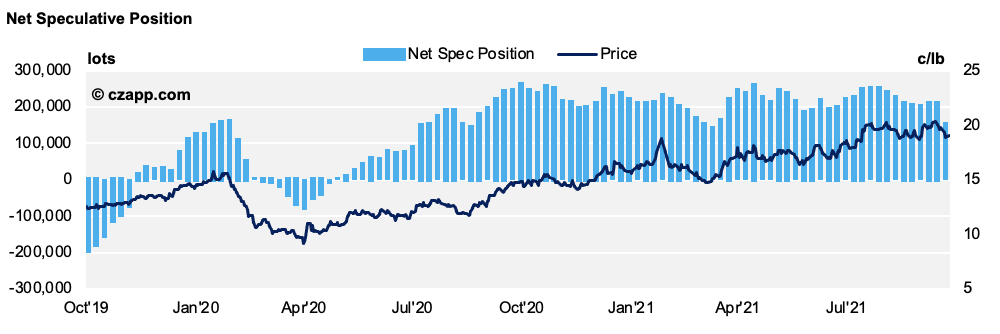

According to CFTC data, the net speculative position fell by 51k lots in the week up to the 19th October.

This is the largest fall since COVID-induced panic hit the markets in March 2020 and seems to represent a significant shift in speculator attitudes in raw sugar after months of bullishness.

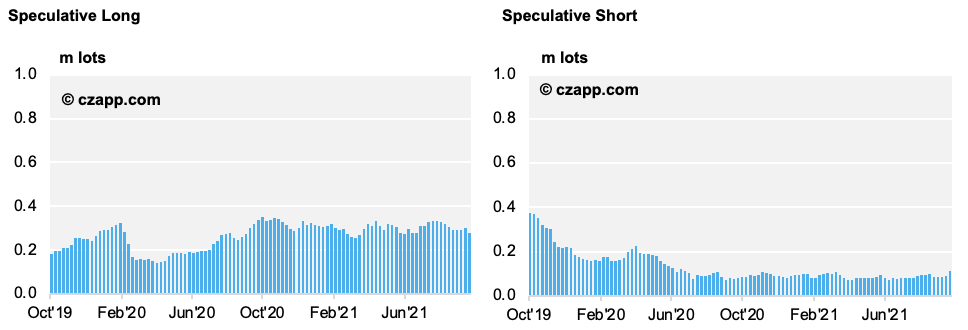

The drop was driven in almost equal measure by the closing of long positions and opening of new shorts, which could mean a couple of factors come into play.

Fundamentally, strong rains in Brazil are positive for the country’s cane crop and are ultimately bearish on price. This would explain the opening of new shorts as well as the closure of longs.

However, we also think there could be another factor at play.

The conditions for speculation are changing; inflation is appearing across the globe and, with it, discussions about raising interest rates. Along with the strengthening US Dollar, these would make holding positions more expensive and ultimately less attractive for funds. It could be that we’re seeing the beginnings of funds trimming their positions in the market.

Other Opinions You Might Be Interested In…

- Raw Sugar Hedging Update: October 2021

- October Trade Flows: Excess Raw Sugar

- Market View: Beware of Speculator Exit