Insight Focus

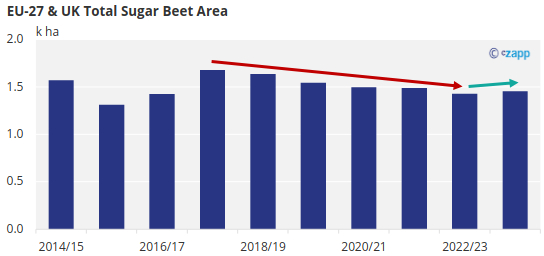

- European area planted to sugar beet is the 2nd lowest in 6 years.

- Beet prices paid to farmers have risen by as much as 50% this year.

- High beet prices need to be sustained for growers to commit further to the crop.

Beet Prices Up, Area Barely Follows

The price paid to farmers for their sugar beet has risen sharply across the EU and UK over the last year. British beet farmers will earn almost 50% more for their beet in 2023/24 than in 2022/23. Prices paid to farmers across the EU have risen to a similar degree.

This should result in the first year-on-year increase in European planted area in 6 years. However, we forecast the area will only increase by around 2%. 2023/24 beet area will therefore be the 2nd worst of the last 6 years. Why aren’t farmers following the money?

Growers Need Confidence that Price Strength will Sustain

Sugar beet has been gradually falling out of favour with EU and UK farmers. Planted area has declined on average 3% a year every season since production quotas were abolished in 2017/18. This was partly because European and world sugar prices fell to 2020, and so beet prices paid to farmers also stagnated. Farmers will need more sustained high prices to encourage them to grow beet again, especially seeing as prices paid for other crops have also risen since 2020.

There are also agronomic reasons why beet has been falling out of favour. Simply put, it’s become harder to grow beet well.

French Growers Face Neonicotinoid Pesticide Ban

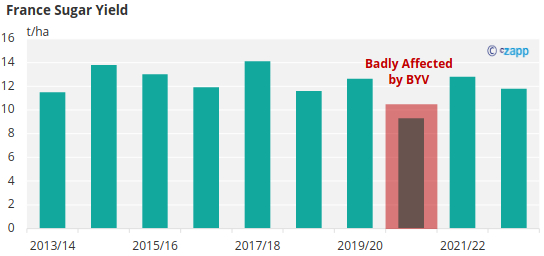

France accounts for over 25% of total EU + UK sugar production. From 2023 French sugar beet growers will not be able to use neonicotinoid pesticides. The last time this happened was 2020/21, and that crop had severe yield losses as from Beet Yellows Virus (BYV), carried by aphids.

This will bring France in line with most of the rest of the EU, where neonics have already been banned since 2018.

Higher beet prices are not enough to offset the loss of confidence in sugar beet now they are not easily protected from BYV. We are expecting acreage in France to shrink this year as a result.

Yields Have Been Gradually Declining

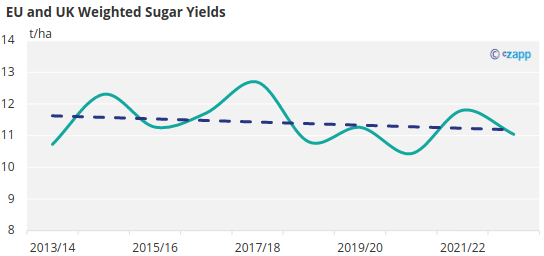

Aside from the neonicotinoid ban, four of the last five European beet crops have been affected by adverse growing conditions. With a greater frequency of hotter, drier summers in recent years, yields across the EU and UK have slowly been declining.

Looking at the weighted average since the 2013/14 season, yields have fallen by roughly 0.5t/ha in the years since.

Again, this means that growers need confidence that higher beet prices will sustain over more than one season in order for EU and UK sugar beet area to properly recover, if they can then 2024/25 will be a better judge of whether the price rise has been successful.