Insight Focus

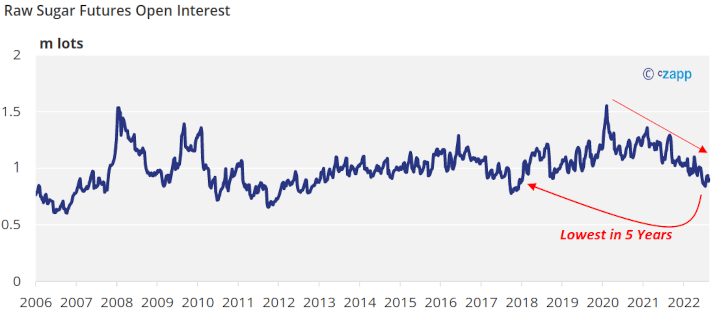

- Raw sugar open interest is the lowest in 5 years.

- Speculators may be struggling to navigate choppy markets.

- Hedgers might prefer even more volatility.

Open interest in the raw sugar futures market has been falling for more than 2 years and is the lowest it’s been in 5 years.

This isn’t just happening in the sugar market; we are also seeing open interest fall in some of the world’s largest energy futures markets. Yet inflation is the world’s major news story currently, much of it driven by higher commodity prices.

Why is participation in futures markets falling when they are generating so many headlines?

Speculators/Risk-Seekers: Low Activity

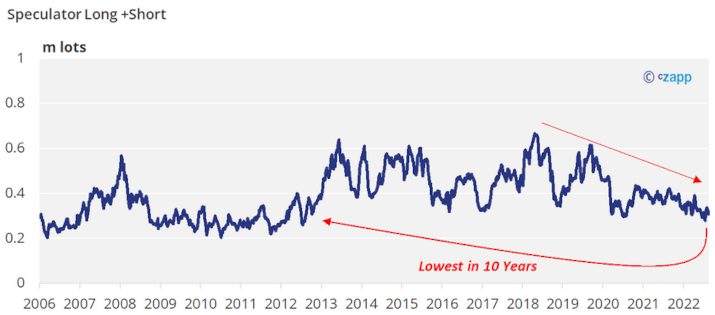

Speculative activity in the raw sugar market is the lowest in 10 years, when measured by combining total long and short positions.

You’d think that speculators would thrive in the current environment: physical dislocations, decent price volatility, plenty of fundamental analysis and narratives. Yet the low participation hints that many speculators are struggling to make money in this environment and might see better opportunities for returns in other asset classes.

Source: Refinitiv Eikon

In fact, speculative activity has been unexpectedly low since the peak of the COVID pandemic, even through 2020 and 2021’s commodity boom.

Even commodity index funds seem to be reducing their involvement in the raw sugar market.

Hedgers/Risk-Mitigators: On the Sidelines

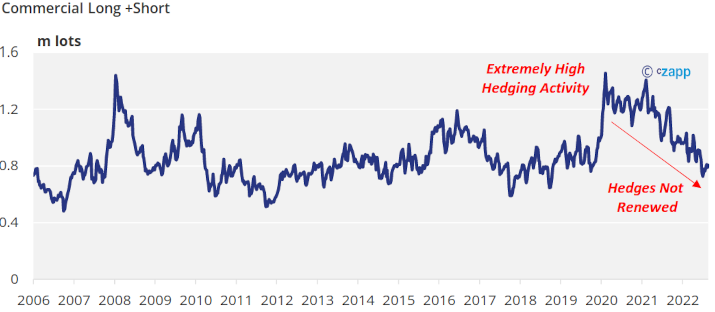

Hedging activity in raw sugar boomed as COVID swept around the world.

The huge commodity price collapses in Q2’20 gave consumers an excellent multi-year low to buy. This was the time of negatively priced WTI crude oil and 9c raw sugar.

The large commodity rallies from H2’20 into 2021 then also gave producers a chance to hedge at remunerative levels.

Since then, hedging activity has slowed down. As old hedges have rolled off the books they’ve not been replaced with the same fervour.

Consumers are clearly finding it much harder to hedge large volumes when raw sugar prices are so high. Risk managers at major food and beverage companies will be under acute pressure to deliver cost savings given wider inflationary pressures. In addition, no-one seems to be sure if sugar will be immune to demand destruction in the face of a cost of living crisis.

Meanwhile, producers also don’t seem to want to hedge when the market is drifting below recent highs, even though the US Dollar strength should be improving returns in home currencies.

Source: Refinitiv Eikon

Hedgers often don’t need to margin their futures positions; trade houses will manage this on their behalf. This should mean hedgers are less concerned about market volatility, but it seems that currently the raw sugar market isn’t volatile enough to offer producers or consumers an attractive opportunity to hedge!

The Advantage of Disciplined Risk Management

To summarise, the sugar market’s sideways drift has been difficult for almost everyone. It’s been too choppy for speculators, who are struggling after 2020/2021’s rally. It’s also not been volatile enough for producers or consumers to hedge large volumes.

In this environment, having a disciplined and long-term risk management programme is a real advantage. If you’d like advice in this area, please talk to me or to your usual Cz contact; they’ll be happy to help. We also publish a weekly Market View and Quarterly 5-Year Price Outlook to premium subscribers to help hedging.

Inflation and commodities might be the only news story in town, but the people who actually use the futures markets on a day to day basis are struggling to capitalise fully.