Insight Focus

- Smallest Mexican sugar production in several years.

- More Central American exports into Mexico in 2023/24.

- Will Central American countries face shortages of refined sugar?

Mexican Production Down; Central America Production Normal

Mexico is set to produce around 5m tonnes of sugar for the upcoming season. However, we have heard rumours that the crop could fall to 4.7m tonnes, which would make it the lowest in several years. Cane yields have been badly affected by a lack of rainfall as there is little irrigation in Mexico.

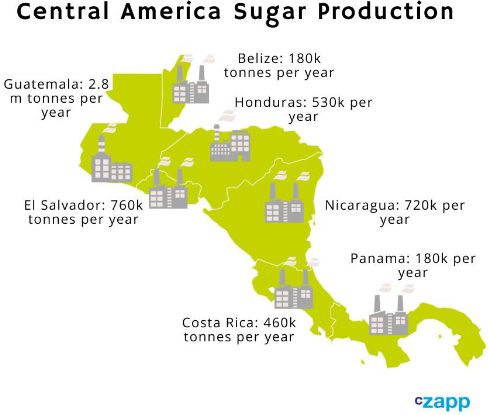

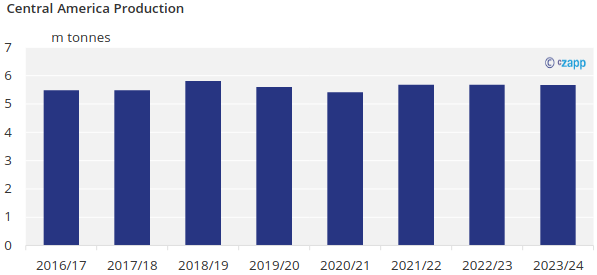

Production in Central America has been less affected by conditions. We think Central America will produce 5.7m tonnes of sugar in 2023/24 which is normal for the region.

With a normal sugar production, we forecast exports of 3.3m tonnes of sugar. Usually, countries in Central America export to fill their quotas with other countries. Instead this year, most exports from Central America will go into Mexico to make up for their poor crop.

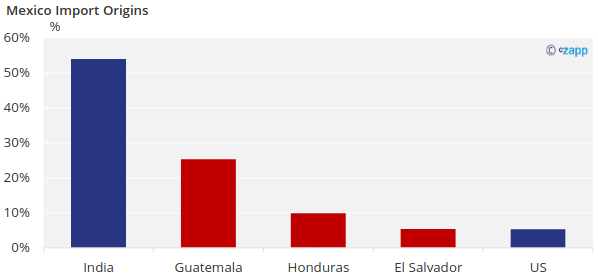

Mexico has been looking for more sugar imports from its neighbors to be able to fulfill as much of their export quota to the US as possible, despite reduced production.

Three out of the five countries that Mexico is importing most of its sugar from are in Central America. In addition, sugar from Central America will continue to enter the US as there is a very high possibility that there will be another TRQ reallocation due to reduced Mexican availability.

With exports to Mexico and the US increasing, this means that there will be less sugar available from Central America to the world market.

Will There be Enough Refined Sugar in the Central American Region?

Central American countries need to fulfil their domestic demand before exporting sugar which may mean they stop exports to Mexico.

However, sugar is being smuggled into Mexico from Central America which means that even if formal exports are stopped, we could continue to see flows of sugar from Central American countries into Mexico. Domestic sugar prices in Mexico have almost doubled in the last year making smuggling very attractive.

Central America is an interesting region because there are no refineries. This means that domestic demand relies heavily on domestic production and cannot easily import raw sugar for refining.

If we see more and more sugar going to Mexico, we could see that countries in Central America struggle to maintain refined sugar supply. This means that they will need to focus on producing more refined sugar rather than raw sugar which would leave less available to export.

In a worst case scenario imports may be required from other origins like the North of Africa, the Middle East or Europe. This is not something we have seen before but could be necessary to ensure refined sugar supply in this region especially towards the end of the season.