Insight Focus

- Brazil will harvest a large corn crop this year.

- Argentina’s corn crop could rebound next year.

- China has begun to buy Brazilian corn.

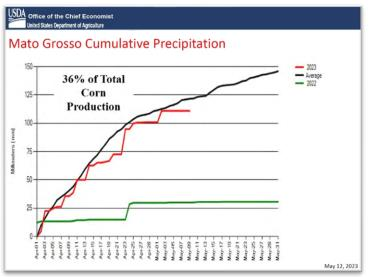

I have attached the USDA Office of the Chief Economist’s briefing associated with the release of the World Agricultural Supply and Demand Estimates (WASDE) update issued Friday. Slides 18-28 of the briefing cover the current weather situation for the Brazilian second corn crop, the larger of the two crops (double cropped behind soybeans) and the one that will influence global corn pricing in the coming months.

Keeping in mind the size of this year’s record Brazilian soybean crop, the warehousing and logistical impossibilities it brought to Brazilian industry that ultimately led to a collapse in basis levels FOB Brazil so that the soybeans could in effect find any home, one’s imagination can only anticipate a similar outcome for Brazilian corn basis values after scrolling through slides 18-28 and especially this one below.

And, as I have noted recently about the Brazilian soybean crop, big crops have long tails, i.e. they tend to be underestimated and more production gets found as the crop gets commercialized. More corn coming?

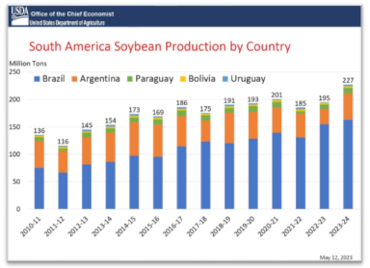

And what about sequential record Brazilian soybean production if USDA economists’ forecasts are right AND Argentina catches a weather break (see world oilseeds in 6 pictures sent Friday) next year? As the above chart shows, 32 million metric tons of additional South American production in 2023/24 is good news for the global soybean processor INCLUDING the US soybean processor. As the 2023 July versus November soybean spread chart below might suggest, this year’s record soybean production in Brazil did not “break” US supply tightness and the sharp inverse continues to get sharper.

Source: Refinitiv Eikon

So one could argue that in the US we have not really “felt” this year’s monstrous Brazilian soybean crop, due primarily to crop losses in Argentina, but USDA economists currently posit that is all about to change in the coming marketing year. So moving forward in time, does the twin impact of Brazil taking over US market share in primary global soybean export destinations (hmmm…I wonder if the number one global importer China is planning to take as much Brazilian stem as possible at the expense of US stem…okay I have stopped wondering and concluded the answer is a resounding, clear throated “yes!”) PLUS US soybean processors importing cheap Brazilian soybeans (hmmm…I wonder if US soybean processors, including all the majors, would love to stick their collective thumb in the collective eye of the US railroads and leverage water conveyance over rail conveyance for soybean stem… okay I have stopped wondering and concluded the answer is a resounding, clear throated “yes!”) prove to be a major new margin expanding factor for US soybean processors (a black swan of sorts for certain readers).

US soybean processors get the benefit of:

- Not competing with US soybean exporters during peak OND new crop origination

- Constant pressure on US domestic soybean basis due sequential Brazilian production

- A chance that Argentine soybean production has a miracle normalizes back up to the mean putting even more pressure on soybean basis

- A chance that Argentine soybean production continues in its current doom loop and global meal consumers continue to rely on US soybean meal supplies

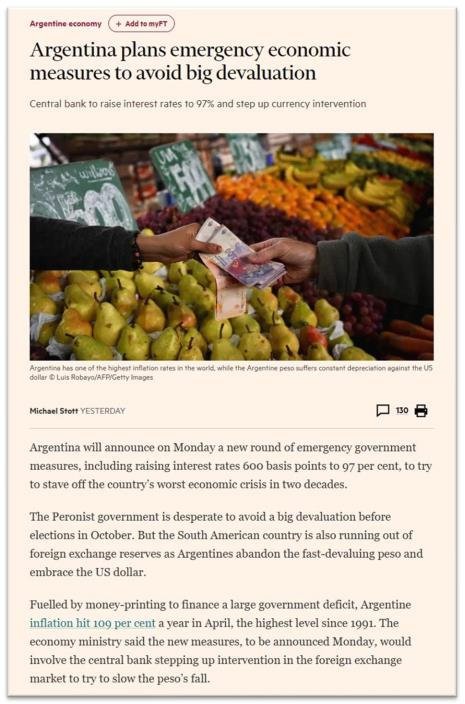

- Yes, the above is a multi-year “heads I win, tails I win” outcome because global consumers just can’t bring themselves to rely upon/nor industrials to invest in Argentina due ongoing systemic mayhem:

Back to corn. Could all the same South American feedstock surplus supply benefits apply to US domestic corn consumers as well? Given normalized rains in Mato Grosso this year (chart on page one) and normalization in Argentine corn production (USDA economists posit that as well) in the future, US domestic corn consumers may get similar benefits of import pricing leverage on the US farmer and US railroads while losing global export share (think about all that export infrastructure on the US PNW that no longer needs 1,000’s of unit trains and now they have to find a domestic home).

Is Henry Ford now potentially right about the US ethanol corn dry milling industry, mostly owned by the US farmer?

These are small musings about big, tectonic grain and oilseed plates shifting that I will develop in time.

Cargill’s delivered soybean oil is in the hands of ADM and Bunge so we watch what happens next (they need to cancel the receipts and order Cargill to load out the oil to fill in the blanks on their CEO’s collective earnings call story of excellent demand for RD feedstock), lots of presentations this week in NYC by all the major publicly listed agricultural processors (I will be there to listen), pray for world peace, and have a great trading week.