Insight Focus

- Brazil has increased its sesame exports hugely in the past year.

- Brazilian farmers could be more willing to sacrifice corn area due to low prices.

- As El Nino weakens, onset of La Nina could favour sesame over corn.

Brazil Shoots Up Export Rankings

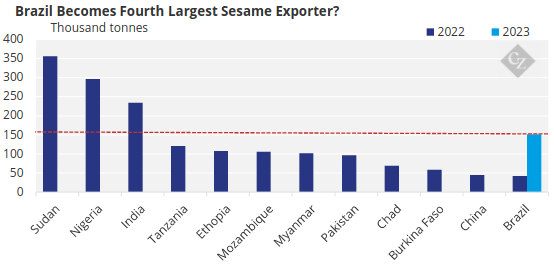

Although Brazil is traditionally a relatively small player in the sesame export market, it has increased its exports hugely in the past year. According to UN Comtrade, it went from exporting 42,400 tonnes in 2022 to 151,215 tonnes in 2023.

That’s almost a fourfold increase in the space of a year and means Brazil has gone from being the world’s twelfth-largest sesame exporter to the world’s fourth largest. Although it is important to note that sesame export figures for 2023 are not available for all countries, these volumes place Brazil after only Sudan, Nigeria and India in terms of 2022 rankings.

Source: FAO, UN Comtrade

Brazil is not a major consumption market for sesame. This means that, as production has gradually increased, so too have exports. Due to increases in production, Brazil is even undercutting Indian sesame prices despite the fact India is a much more seasoned producer.

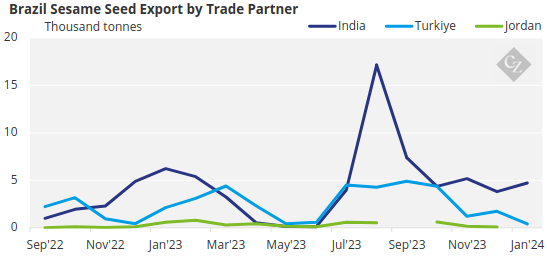

In July 2023, India’s average sesame seed export price was USD 1,975/tonne FOB. Export prices peaked in April at USD 2,329/tonne FOB, then stalled from May to July. In August 2023, the Brazilian sesame seed price was USD 1,492/tonne FOB.

Brazil has even managed to sell competitively into India. Exports peaked in August 2023, with shipments abroad increasing by 173%. India received the majority of Brazil’s sesame seed, accounting for 56% of the total exports.

Source: UN Comtrade

New Estimates for the 2023/24 Harvest

One explanation for the rapid increase in Brazilian sesame exports is due to the increase in planted areas as corn prices dip, as mentioned in our previous article.

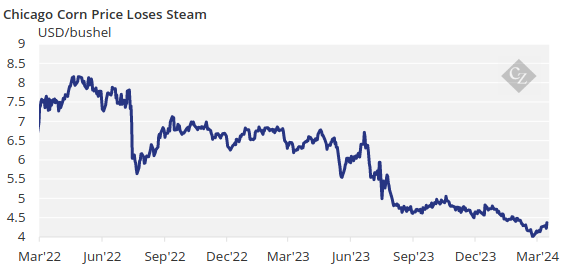

Since the end of 2023, global corn prices have been losing competitiveness. On the Chicago stock exchange, corn is now priced at around USD 4.30/bushel compared with about USD 6.20/bushel a year ago and USD 7.30/bushel at the same time in 2022.

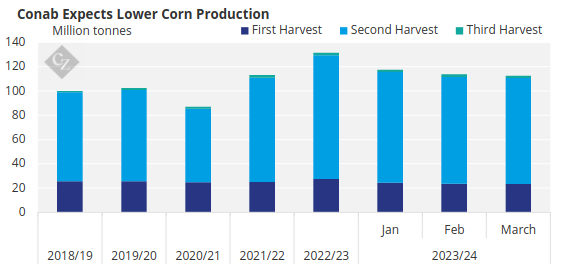

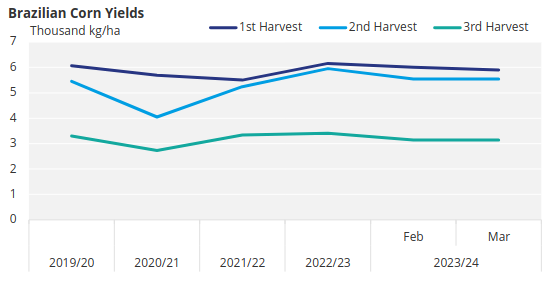

According to Conab, Brazil produced a record corn crop in 2022/23, totalling 131.8 million tonnes. However, for the 2023/24 harvest, total production is expected to be 112.8 million tonnes, a decrease of 14.5%.

Source: Conab

Conab projects that the planted area will shrink by 8.6%, while the sector’s productivity will fall by 6.5%. A study by Woodwell Climate Research Center found that part of the reason for lower productivity is an expansion into areas with lower soil suitability, meaning the soil is depleted more quickly.

In order to provide stability to corn prices and obtain better returns, farmers are now looking at sacrificing some corn area in favour of alternative crops. This is where sesame comes in.

As previously noted, sesame farmers in Brazil are expanding their planted area by nearly 250%. Not only does sesame prove a good cash crop, but it is also well-suited to rotation with corn. This pairing can reduce incidence of bacterial wilt, fusarium wilt and sesame gall midge.

The municipality of Canarana in Mato Grosso is one of Brazil’s largest sesame producers, located 633 kilometres from the city of Cuiabá in a transition zone between the Cerrado and Amazon biomes. The region is expected to be the location of a new surge in sesame cultivation.

The market expects the 2023/24 harvest to be twice as large as the previous season, which produced 174,000 tonnes of sesame across 361,000 hectares.

Brazil Faces Yield, Weather Challenges

Although maize and sesame are said to be ideal partners for crop rotation to reduce the incidence of pest and disease, some studies suggest that planting them together can actually reduce yield. This is a concern given that corn yields are already decreasing.

Source: Conab

One study conducted in Tanzania showed that maize-sesame intercropping could reduce the corn yield by an average of 27% when planted simultaneously with sesame. When sesame was planted later, corn yields held up but sesame yields were dramatically reduced. Another study conducted in Nigeria showed that intercropping sesame with corn caused yield reductions of up to 36% compared to a corn monocrop.

However, as weather patterns begin to change, sesame could offer some insulation to farmers against climate impacts. The latest La Niña, between 2020 and 2023, resulted in historic droughts in corn and soybean crops. Conversely, Sesame flourishes in hot and dry locations, with optimal temperatures ranging from 25°C to 30°C.

At the moment, scientists say the world is experiencing El Nino conditions, which are set to last at least until the second quarter of the year. However, La Niña is likely to emerge in the second half, with a probability of above 50%.

With the end of El Niño, we can expect less rain in the North and Northeast regions, and more rain in the South regions. Most sections of the country will continue to experience above-average temperatures, with the chance of scorching days. Monitoring La Niña is crucial given its potential impact on southern Brazil.

Concluding Thoughts

- Brazil has increased sesame exports by almost fourfold in the space of just a year.

- It has turned into a formidable player in the international market, challenging even India on price.

- An increase in land dedicated to sesame can help farmers during times of low corn profitability.

- If just a small number of farmers switch corn land over to sesame, availability will shoot up exponentially.

- The imminent switch to a La Nina weather pattern is also likely to favour sesame over corn.

- However, long term reliance on sesame-corn intercropping can lead to reduced yields.