Insight Focus

- Corn planting in Brazil delayed by rain.

- Higher US corn stocks as less corn used to make ethanol.

- Favourable weather expected in most wheat growing countries.

Forecast

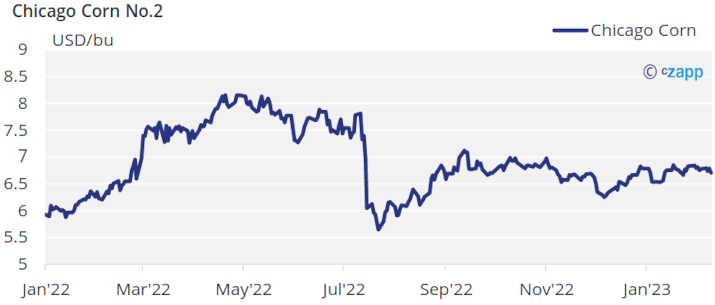

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

Small gains for Corn in Chicago but bigger gains for EU Corn and Wheat in all geographies. The Feb WASDE was a nonevent.

US Corn inspections continue to disappoint. FOB Gulf prices are not competitive vs. other origins, mainly Brazil. Also rains in Argentina continue to benefit Corn condition which improved again last week. Both element put some pressure at the beginning of last week which ended with a Friday rally pulled by external markets, mainly Crude Oil.

The Feb WASDE left US production unchanged as expected but ending stocks were increased by 25 mill bu due to less Corn to Ethanol usage. US stock to use is now of 9,1% vs. 8,9% before. World Corn stocks were reduced marginally by 1 mill ton. Argentinian production was lowered by 5 mill ton to 47 mill ton still above local estimates of 44 mill ton of BAGE and 42,5 mill ton of BCR which we expect will be revised higher due to favorable weather of the last few weeks improving Corn condition. There were no other major changes.

Conab in Brazil lowered their Corn production forecast by 1,3 mill ton to 123,7 mill ton which is vs. 125 of the WASDE.

In Brazil, the Soybean harvest continues to run slow with just 8,9% complete vs. 16,8% last year. The second corn crop is 10,7% planted vs. 22,4% last year. First Corn crop is 9,1% harvested vs. 14,6% last year. Corn planting in Argentina has virtually finished and condition was 20% good or excellent.

In the Wheat front, the Feb WASDE left US production and stocks unchanged within expectations. World ending stocks were increased marginally by 1 mill ton most of it coming from 2 mill ton of higher production and all of it coming from Australia. Russian production was increased by just 1 mill ton to 92 mill ton vs. 105 mill ton of official data.

Weather is expected to be favorable in almost all regions. Rains are expected in the center west of Brazil as well as in Argentina. Europe is expected to stay dry while the US is expected to have mild weather and some rains.

The export corridor out of Ukraine was stopped for two days due to bad weather in Istanbul, but Ukraine reported 1,3 mill ton of all grain exports for the week ending Feb 10. The number of vessels waiting to be inspected was of 108.

No fundamental changes emerged from the WASDE, thus the focus continue to be South American weather impacting Corn planting in Brazil, and the backlog of vessels in Ukraine limiting supply.

We would expect further consolidation around actual prices. Maybe some downside in Wheat after last week’s rally, but just a correction. We don’t see any serious downside risk.