Insight Focus

- Argentina produces the world’s first GM (Genetically Modified) wheat seed

- The Brazilian government has approved to import the GM wheat, but flour millers are against it

- Brazil aims to become a net exporter in wheat but still years away.

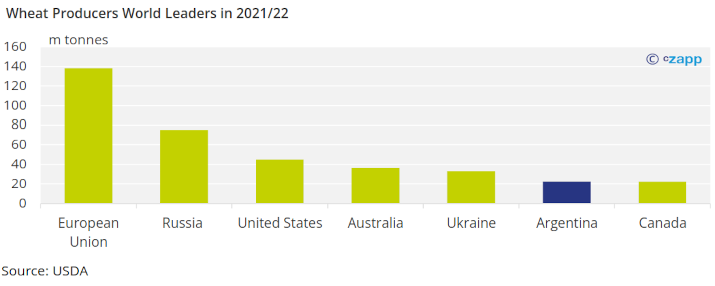

Argentina is the 6th largest wheat producer in the world. Argentina is expected to export 22.2 m tonnes of wheat in the 2021/22 season.

Argentina Develops GM Wheat Seed

The 2022/23 crop year has seen droughts and higher temperatures in various parts of the world. According to research from 2014, for every 1 percent increase in temperature, there is a 6% decline in wheat yields. To help maintain yields an Argentine biotech firm Bioceres developed the world’s first GM wheat seed. The seed is more drought and disease tolerant. Argentina plans to plant around 60,000 hectares of land with GM seeds, producing about 200,000 tonnes of wheat.

Other countries position on GM Wheat

So far, four countries have agreed to import Argentina’s wheat made from GM seeds: Nigeria, Australia, New Zealand, and Brazil. However, the flour millers in Brazil have been outspoken against it. The Brazilian flour millers are afraid that this Argentine GM wheat won’t be accepted by consumers and are threatening to boycott it. The flour millers claim that GM wheat has not been approved for human consumption. It is worth noting that Brazil has approved and is currently producing GM sugarcane for sugar production.

Argentina and Brazil wheat trade patterns

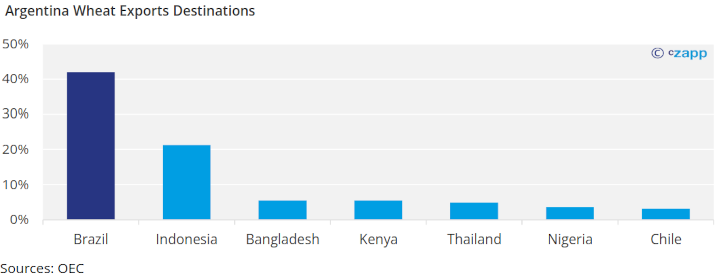

Argentina exports 42% of its wheat to Brazil, making it is most significant trade partner in this industry by a margin.

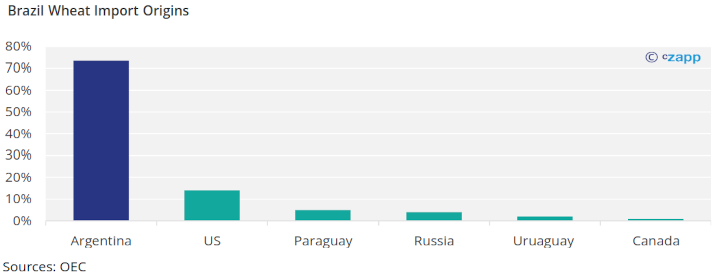

More importantly, 70% of Brazil’s wheat imports come from Argentina.

What Could Happen?

If Argentina continues to plant its GM wheat seed in the future, Brazil may start to have to look elsewhere for its wheat. This will be a difficult task due to the poor weather conditions across the world, supply chain issues, and the world’s largest (Russia) and 6th largest wheat producer (Ukraine) currently at war. Also, due to Argentina’s geographic proximity to Brazil, importing wheat from any other country would probably be more expensive than Argentina.

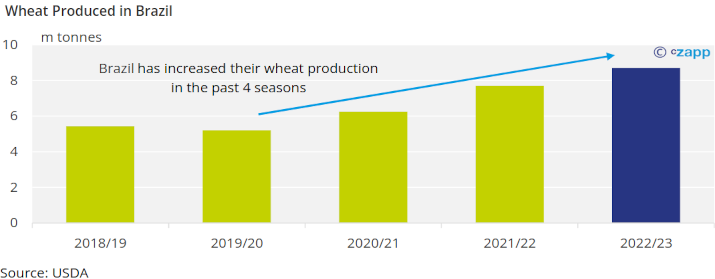

Another option for Brazil is to increase their domestic wheat production. Brazil has increased its wheat production by around 19% yearly over the past four seasons.

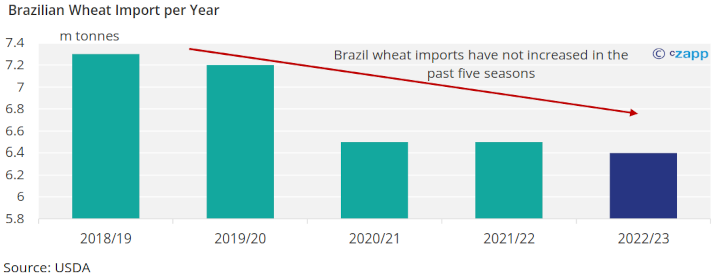

Also, Brazil wheat imports have not increased in the past five seasons. Brazil wants to increase the amount of wheat it exports to the world and become a net exporter. According to reports, Brazil could become a net exporter in wheat by producing 12.7 million tonnes. Brazil is estimated to produce 8.7 million tonnes of wheat in 2022/23 and could reach its net exporter target in the next few years.

Brazil wants to become a net wheat exporter to take advantage of the high prices due to the global disruption of the Russian invasion of Ukraine and droughts worldwide. Ukraine’s minister of agriculture claims that the Russian invasion will create a shortage of wheat for at least three seasons. Brazil is taking advantage of this shortage and is exporting to countries that usually import their wheat from Ukraine: Indonesia, Morroco, and Pakistan.

Around 80% of Brazil’s wheat is planted in the country’s southern region. It is estimated that Brazilian farmers increased their wheat-grown area by 30% this season. Wheat will compete with second-crop corn for acreage in Brazilian farms. Production cost and water availability (wheat is more water-intensive) will determine if farmers plant wheat or second-crop corn in this region.