Insight Focus

- A price uptick encouraged producers to sell in July, taking the 2022 “safrinha” farmer selling to 47%

- Despite the improvement, farmers still have 43m tonnes of corn to be sold, up from 11m a year ago

- To avoid oversupply and further pressure on prices, Brazil needs to export 38-40m tonnes in the

2021-22 marketing year

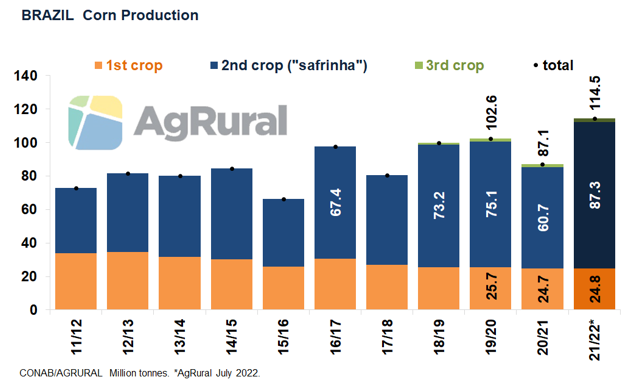

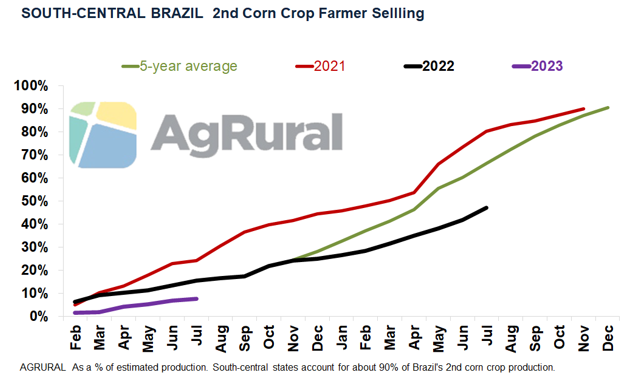

Higher quotes in Chicago in the last week of July – a result of a pause for breath in the macroeconomic woes and fears that hot, dry conditions could harm the US crop – led Brazilian corn farmers back to the market. AgRural is still putting together the farmer selling final numbers for July, but our daily and weekly market monitoring suggests that about 47% of the 2022 “safrinha” corn had been sold by the end of the month in south-central Brazil, a region that accounts for 90% of the country’s second crop production.

Although that figure is lower than the 80% sold by the same period a year ago (when production was much smaller) and also lags behind the 66% of the five-year average, it means that farmers sold about 4.3m tonnes of corn during July, the best monthly result for the 2022 second crop so far.

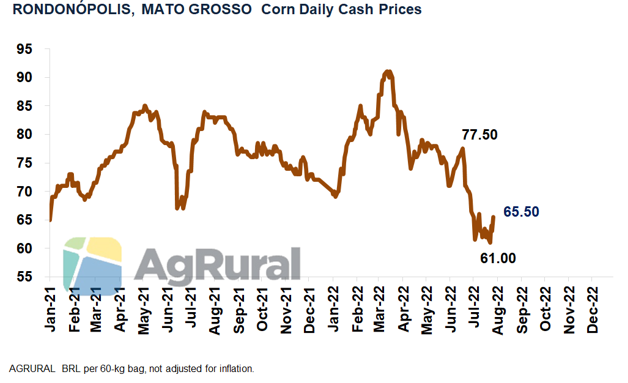

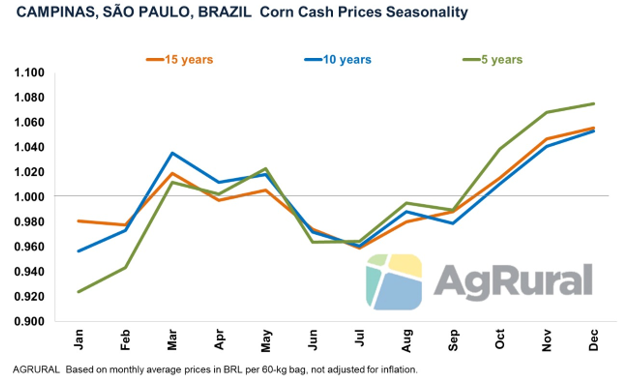

It is not that prices have risen much, since the uptrend in Chicago and higher export premiums were partially offset in the Brazilian corn market by the strengthening of the Real against the US dollar – the flip side of the pause for breath in macroeconomic risk aversion cited above. For that reason, Brazil’s average corn cash price surveyed by AgRural in 38 locations across the country ended July with an increase of just 4% over the lows of the month.

Dashboards That May Be of Interest…

Fear of Falling

Less confident in the strategy of waiting for higher prices down the road and fearing that prices might, in fact, end up falling further, many producers preferred to resume their sales as soon as prices began to show some reaction after the lows made in July.

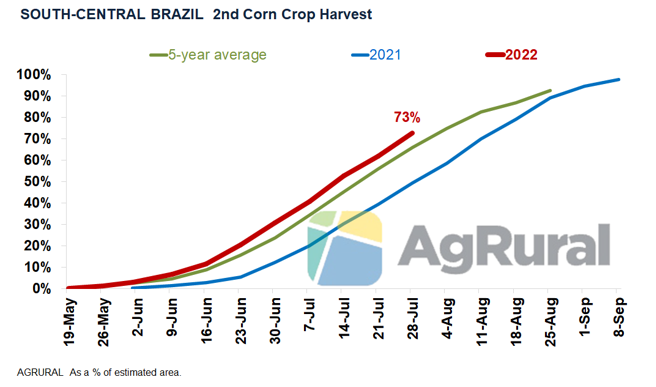

Those lows took Brazilian corn prices to their poorest level in nearly two years and were the result of the sell-off in Chicago during most of the month and the 2022 second corn crop harvest progress, which ended July at 73% complete in south-central Brazil, according to AgRural.

The difficulties in storing so much corn in a year in which there is still a lot of soybeans in the bins also encouraged some farmers to sell part of their freshly-harvested corn, especially in the second half of July.

Too Much Yet to Be Sold

Although the 2022 “safrinha” farmer selling has progressed well in July, the month ended with around 43m tonnes of corn still to be sold by producers in south-central Brazil, sharply up from the 11m tonnes they still had on hands in the same period last year, when production was smaller and the selling pace quicker. Due to the large volume still waiting to enter the market, it is hard to believe in significant increases in Brazilian prices over the coming months. The question is whether the second crop lows are already in place (they are usually seen in July, due to the harvest progress) or if there is still room for further losses.

Lower Prices…

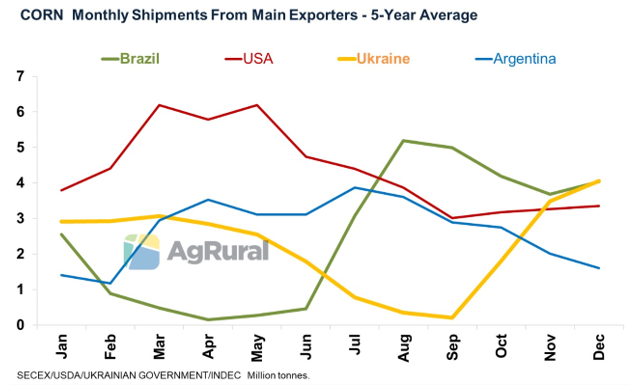

In addition to the record production that is being harvested this year and the large volume still to be sold, three other factors can make it difficult for Brazilian corn prices to rise: the unwillingness of local consumers to bid higher, being aware that the import parity is an effective ceiling for domestic prices (as confirmed by the crop failure and record imports from Paraguay and Argentina in 2021); the chance of a good crop in the US, despite the weather problems faced so far; and the possibility that corn dammed up in Ukraine since the Russian invasion will flow more easily into the international market in the coming months, limiting Brazilian exports in Q4.

…Or Higher Prices?

At the other end, Brazilian prices may benefit in the coming months from logistical and security issues involving Ukrainian shipments; yield losses in the US if hot, dry weather prevails throughout August; the possibility of exporting some volumes to China, in the wake of negotiations that have been underway between the two countries to speed up the practical terms of a phytosanitary agreement; and currency volatility, since the Brazilian Real tends to have important upswings caused by the fear of a global economic slowdown and by the anxiety brought on by the Brazilian presidential elections that take place in October .

Time to Make a Decision

Despite the good selling progress seen in the second half of July, it is unlikely that Brazilian producers, who are well capitalized, will accept to sell large volumes of corn at prices they consider unattractive. Therefore, if the price uptrend loses steam in August, most farmers will probably withdraw, waiting for a new upward movement to resume sales.

The existence of significant volumes of soybeans still to be sold and exported and the possibility of shipping larger quantities of corn in Q4, when soybean exports normally decrease, can also make producers choose to push the bulk of corn sales towards the end of the year, when the pressure of a new soybean harvest, which starts entering the market in January, will also stimulate corn sales in order to free up space in storage facilities.

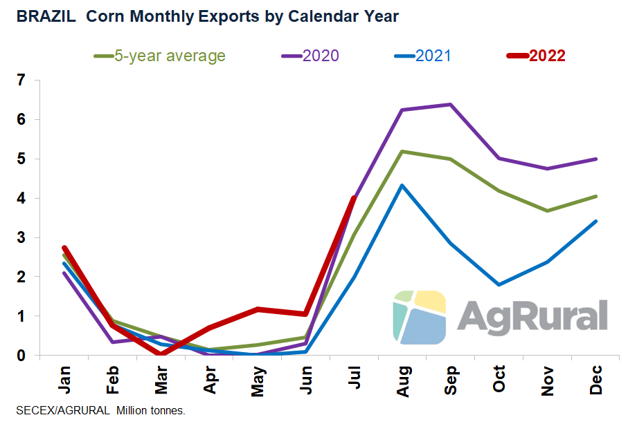

Export Pace

If that scenario confirms, and if international demand is not strong enough to result in higher export premiums at ports, it is possible that the curve of Brazilian corn shipments will be a little different this year, with a less pronounced peak in August and September (contrary to what is traditional) and volumes distributed more evenly throughout the second semester. Something similar has already happened with soybean exports, which peaked in March (instead of April or May) and now tend to be a little firmer than normal in July, August and September.

Ample Supplies

One way or another, Brazil is able to export between 38m and 40m tonnes of corn in the 2021-22 local marketing year (shipments from Feb 2022 to Jan 2023), beginning the 2022-23 season with stocks around 8m to 10m tonnes, in a relatively comfortable scenario. Any export volume below that range – caused by a weaker than expected international demand and/or producers’ unwillingness to continue selling at prices they consider unattractive – tends to lead to an oversupply situation and further pressure on prices, discouraging a large increase in the 2023 “safrinha” plantings, especially if the 2022-23 first corn crop, which will be harvested in early 2023, doesn’t face any significant weather stress.