Opinion Focus

- We’ve revised our forecast for Brazil’s 2023/24 soybean harvest lower.

- Crop yields are low due to scarce rainfall.

- Low prices and continued high costs are pressuring farm margins.

Harvesting of Brazil’s 2023/24 soybean crop has already begun, and attention is now turning to potential challenges that have negatively impacted its yield.

We revised our soybean production forecast to 149.14 million tonnes, a drop of 11 million tonnes compared to the 160.2 million tonnes estimated in December by CONAB, Brazil’s crop agency. Despite the reduction, our new estimate would still be close to last year’s record harvest – if realized.

Despite Tighter Margins, Increase in Area is Still Expected

In our review, we considered a 2% increase in the harvested soybean area, totalling 45 million hectares for the current harvest.

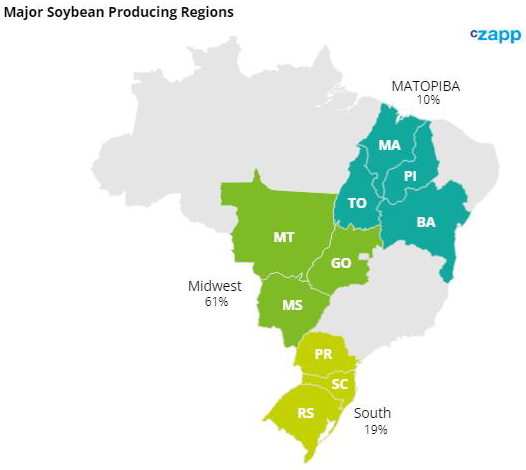

In the centre-west of the country, the states of Goiás and Mato Grosso do Sul grew their soybean area by 2.3% and 1.3% respectively. Mato Grosso, the leading state for national grain production, is expected to grow by 1%, to 12.2 million ha. The reason why the largest national producer kept its area practically unchanged is the significant drop in production margins from the last harvest, which negatively impacted rural producers’ returns and discouraged area expansion.

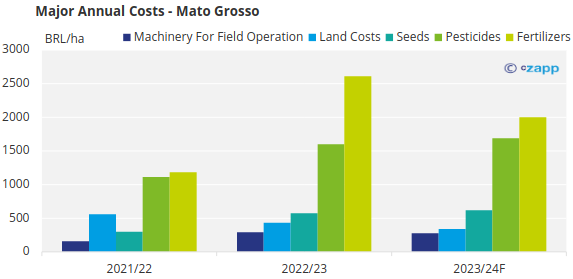

The drop in margin for producers in the Central West region is thanks to an increase in production costs in 2022/23 and the drop in commodity prices in 2023 and 2024. These factors are making it difficult for farmers to maintain positive margins. We think pesticide and seed costs have increased the most this season. The costs of fertilizers and leasing have fallen compared to the previous harvest.

Source: CONAB

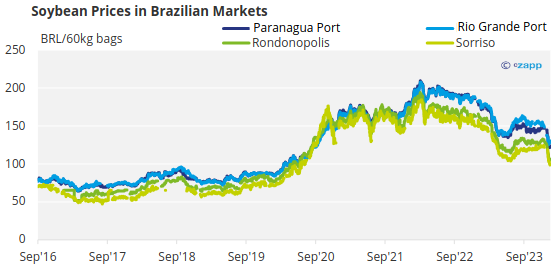

Overall, the total cost of growing and harvesting soybeans remains above recent years. Additionally, after reaching a historic record in 2022, soybean prices have continued to fall since then, and are 32% below the peak.

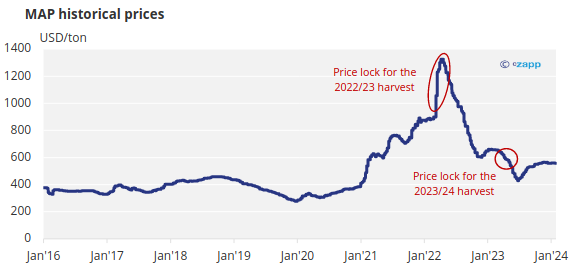

The price of fertilizers was the major factor pressuring farm margins in all states in the country. Following Russia’s invasion of Ukraine, fertilizer prices soared. Soybean producers in Brazil typically lock in prices for major production costs (such as fertilizers) in March-May of the year before harvest.

Thus, despite having already returned to normal, the planting of the 2022/23 harvest was marked by fertilizers at their historic peak, which drastically reduced producers’ profit margins.

Source: Bloomberg

The fall of fertilizer prices back to normal levels for the current harvest partially alleviates costs for producers.

Irregular Rains Harm Productivity

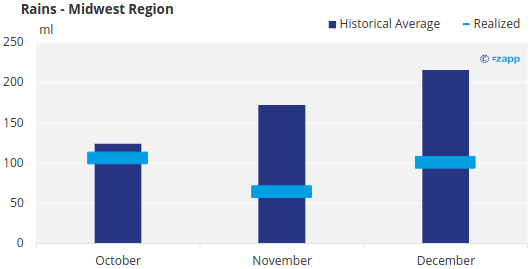

Despite the relative maintenance of the planted area, we believe that many states will see a drop in their production numbers. The El Niño phenomenon, still present in the 2023/24 harvest, now reduces expectations for agricultural productivity in most of the country’s states due to adverse weather, with significant damage in the central-west region.

Rainfall in the state of Mato Grosso was 82% below the region’s average in the months of October/November/December, a critical period with great water needs for the development of soybean pods. Goiás and Mato Grosso do Sul also recorded drier than normal weather.

With water stress taking over the country’s largest producing region, we expect a significant drop in agricultural yield.

For Mato Grosso, the state that is expected to suffer the greatest losses, we predict a 15% drop in productivity, from 45.6 million tonnes produced in the last harvest, to 39 million.

In Goiás and Mato Grosso do Sul, we also expect a 10% drop in both states.

Overall, the Central West should see a reduction of 9.2 million tonnes compared to the previous harvest, closing the 2023/24 harvest at 68.13 million tonnes.

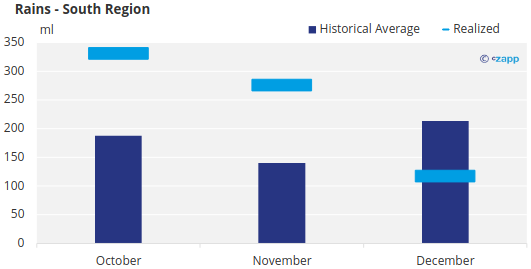

In southern Brazil, the scenario is reversed. Excessive rain during the planting season delayed operations, damaged plantations, and meant that some areas needed to be replanted. In our projection, we expect a drop in yields in the states of Santa Catarina and Paraná, by 8% and 5%, respectively.

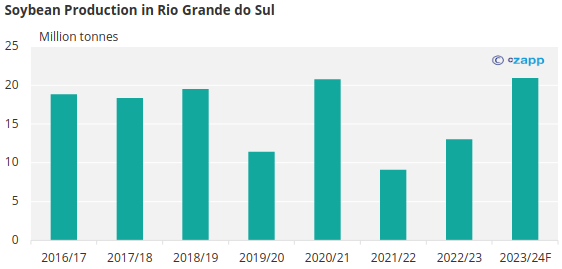

The situation in Rio Grande do Sul is contrary to the rest of the country. Despite rainfall 64% above average in the last quarter of 2023, the state expects a strong recovery in its production capacity.

After 2 harvests producing below 2 tonnes/ha, we now expect the state to increase its productivity by 59%, to 3.15 tonnes/ha. If carried out, we project that its production will increase from 13 million tonnes of the last harvest to 20.9 million tonnes, becoming the 3rd largest producing state in the country – today in 5th place.

The MATOPIBA region (Maranhão, Tocantins, Piauí and Bahia) had its planting carried out normally, with some regions delayed due to irregular rainfall. Although rainfall has returned to normal in January, planting areas still require more moisture for good recovery.

We predict a drop in productivity in the states of MATOPIBA, with production of 17.8 million tonnes – 2.1 million less compared to the last harvest.

Final Considerations

Despite the pessimistic scenario for the current soybean harvest, the numbers continue to be the highest, after the record of the last harvest. Despite the 3.2% reduction in production, on the global stage, Brazil will continue to hold the title of largest producer and supplier of soybeans.

The drop in exports will end up being beneficial for other commodities in terms of exports.

With lower production, we expect Brazil’s soybean exports to fall to 90 million tonnes. This leaves Brazilian ports with 5 million tonnes less soybeans to elevate compared to 2022/23. Logistical pressure will be alleviated for other commodities that compete in the export window alongside grain, as in the case of sugar.