Insight Focus

- The bull market for US soybean oil remains intact, energies as a whole have turned bullish

- Ukrainian farmers and processers continue producing in the middle of a war economy

- New market variable is US renewable diesel industry’s demand for feedstock

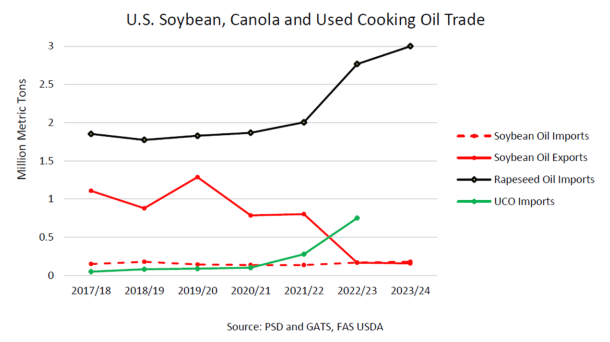

The juxtaposition of the below chart and the below table highlights the extent to which the demand for feedstock from the expanding US renewable diesel industry has transformed global vegetable oil trade flows, price relationships amongst the various global vegetable oils, and the future of global consumption of vegetable oils for food.

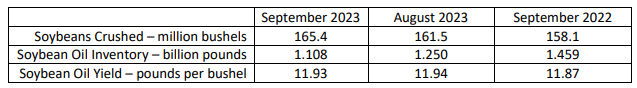

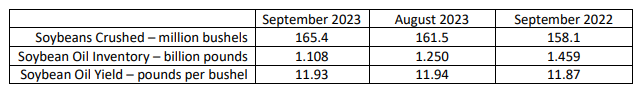

Let’s go in reverse chronological order and begin with a shocking (or at least I was shocked) statistical report issued yesterday by the National Oilseeds Processing Association (NOPA). For the month of September, NOPA indicated its membership crushed a record number of soybean bushels and those soybeans yielded the highest oil yield ever of any September; highest crush rate, highest oil yield means the most ever pounds of soybean oil ever produced in any September in history by the NOPA membership. “Whew,” the average citizen says, “I bet that built a lot of inventory for the US food and biofuel sector.” But in the words of a favorite US college football sports commentator after he has listened to others’ predictions and is about to provide his own aided by a slew of statistics, “Not so fast my friend, not so fast.” Take a look at the below table.

Now look at this chart issued last week by the USDA (remember we’re going in reverse chronology):

Wow!

The chartist has summarized the entire US vegetable oil market evolution into one easy to read chart:

- Collapsed US vegetable oil exports

- Record US vegetable oil imports accelerating in the last two years (renewable diesel demand growth)

The only problem? The chart title tells half the story. “And Drive Record Vegetable Oil Imports” needs to be added to “Biodiesel Policies Suppress U.S. Soybean Oil Exports”.

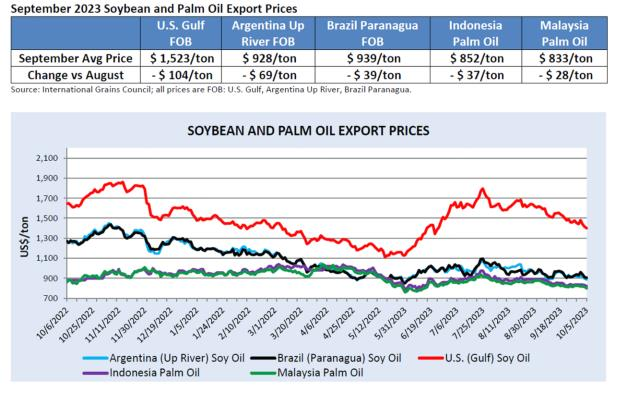

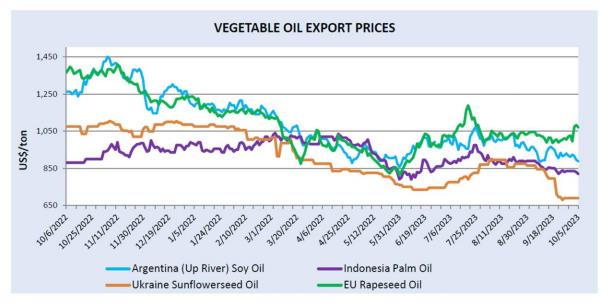

The markets have done their work to encourage the import/export situation to remain the same, i.e. keep US soybean oil at a huge premium to other global vegetable oil prices to encourage global food companies to consume other oils. I feature the below chart every month after the USDA updates it.

I forecasted last month that US soybean oil prices, trading at huge premiums to Brazilian and Argentine soy and Malaysian and Indonesian palm given the US renewable diesel industry’s demand for feedstock, would ultimately begin to pull those other oils’ prices higher to promote increased production and reduced usage. But the table above the price chart tells a different story: US soybean oil FOB the Gulf of Mexico declined $104 dollars per ton for the month while other global oils declined less.

What am I missing in the equation? It is the same factors I detailed in recent posts and which the USDA highlighted this month as well: Ukrainian sunflower oil getting dumped on global markets as producers there get their supplies out of harm’s way and palm production (record) expanding.

So the global situation is one of plentiful supplies for the world’s most consumed oil, palm, even with record consumption, and sunflower oil readily available from an eager seller with an unenviable, nochoice-but-to-sell situation. But the North American vegetable oil demand and the trade flows to the US of non-soy vegetable oils (fresh and used) that qualify under US, and specifically California, renewable fuel policies pull tremendously on other available supplies (another insightful chart below featured in USDA’s Oilseeds: World Markets and Trade September 2023).

Eventually the math does not work:

Inventory decline in one year: 1.459 -1.108 = 351

Inventory divided by the one year decline = 1.108/351 = 3.15

Available US soybean oil supplies in 3.15 years: not much

I absolutely marvel that US food companies are sitting by watching this happen and not taking action to secure their own vegetable oil supplies. Hello Pepsico? Hello McDonald’s? Did you read this announcement? Ummm…what will be left for you guys?

Global protein meal traders will have CNN on this weekend to see how this election plays out:

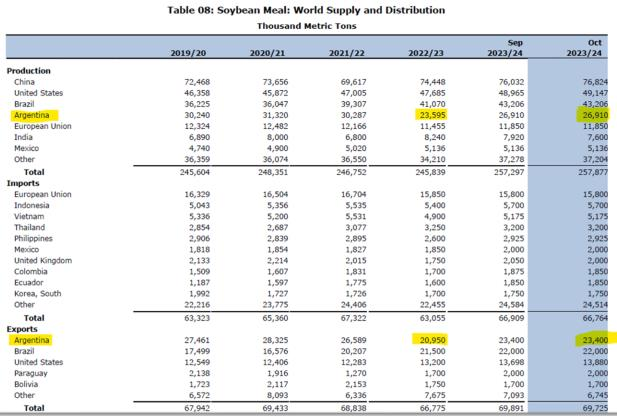

The Argentine election results this coming weekend have the chance to escalate an already dangerous financial and currency crisis into a political crisis and maybe into a global protein meal crisis as Argentina’s official currency has come unhinged from any relationship it had to the black-market version of itself as well to the US dollar (which has the chance to become the official currency of the country depending how elections go).

Remember that USDA’s soybean meal balance sheets reflect an important recovery in production and exports that proves problematic for the global soybean meal (and soybean oil!) consumer if the rosy forecast does not unfold should the election touch off significant political protests that interrupt imminent crop planting, fertilization, pesticide application, or harvest (and the potential for hoarding of a successful crop by an angry farmer protesting export taxes again as he did this past year).

Global soybean meal export prices have started to reflect consumer jumpiness, US export sales continue at the highest pace in years, and US domestic crush values have rallied significantly in the last week as the election nears. The Chicago Mercantile Exchange’s soybean meal curve remains inverted and the inverse has begun to steepen.

I will provide thoughts following the election.

(And you professional readers thought I was going to discuss why in the world is Cargill delivering soybean meal to the Chicago Mercantile Exchange, AGAIN! I am still scratching my head on this one just as I did this summer on that one.)