Insight Focus

- Europe’s warmer winter could be bad news for beet growers.

- Aphids, which carry Beet Yellows Virus, thrive in warmer conditions.

- Neonicotinoid treatments are banned, leaving crops more exposed to outbreaks.

Will Beet Yellows Virus Hit European Beet in 2022/23?

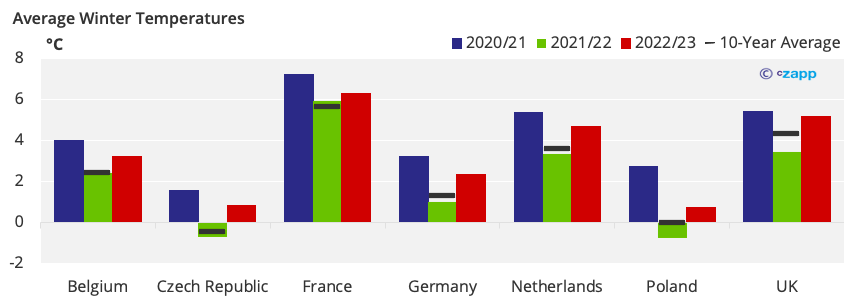

Warmer winters with fewer frosts allow more aphids, which carry Beet Yellows Virus, to survive into spring.

And whilst so far this year none of the main European producers have seen temperatures as warm as those before the last outbreak in 2020/21, it may be warm enough to raise alarm bells for growers in these regions.

A milder winter means aphid populations in some European beet-producing countries could already be larger, though potentially not as large as those in spring 2020.

Without a swing towards a cold, wet spring, some European producers could face outbreaks of Beet Yellows Virus.

This risk is lower in the UK as it recently authorised one-time use of neonicotinoid pesticides for the 2022/23 beet crop. Emergency authorisation was passed as beet regions in the UK were experiencing warmer, drier conditions throughout the previous three months of winter.

French farmers too continue to have permission to use neonics to prevent a repeat of 2020/21, when yields dropped to 2-3 tonnes per hectare below average.

For other European growers, the ban on this group of pesticides remains in place, leaving a lot of beet area exposed to an outbreak. If spring follows the warmer trend of the last few months, the risk will grow as aphids can migrate to the beet crops sooner.

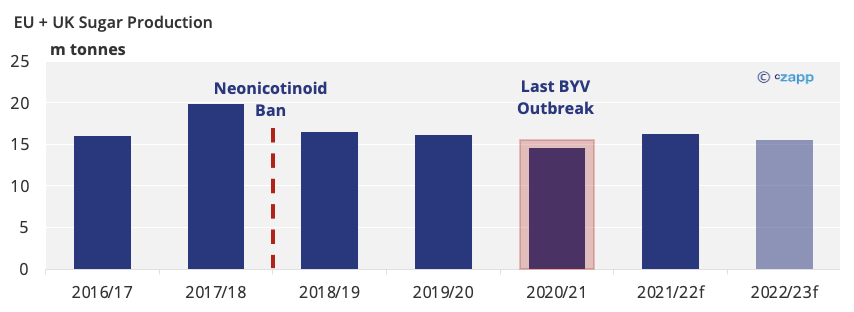

Our current forecast for the EU and UK’s sugar production is 15.5m tonnes in 2022/23, similar to the level seen in 2021/22 (16.2mmt).

This estimate doesn’t include any abnormal losses to Beet Yellows Virus, and so could be adjusted if reports of infection occur later in the year.

With consumption set to outstrip production in 2022/23, any downside to EU production could necessitate additional imports, ramping up global sugar demand.

Finding a Longer-Term Solution to the Neonicotinoid Ban

Neonicotinoids were first banned in the EU and UK before the 2018/19 season due to the threat they pose to honeybees and other pollinators.

With this, the risk of Beet Yellows Virus outbreaks are far more widespread than they have been in the past. This is exacerbated by the fact that climate change is gradually raising average temperatures.

Even if emergency one-off use of neonicotinoids can be authorised, this is not an ideal long-term solution.

So, varieties of sugar beet are currently being developed that offer increased resistance to BYV without being noticeably less productive than the current leading varieties.

If these prove to be successful, it could help form a better long-term solution to beet crop management now neonicotinoids cannot be relied on to minimise the risk of large crop losses.

Explainers That May Be of Interest…