Insight Focus

- Russian corn production could reach new highs this season.

- US corn harvest continues; 59% of crop under drought.

- Wheat prices fall as more vessels leave Ukraine.

Forecast

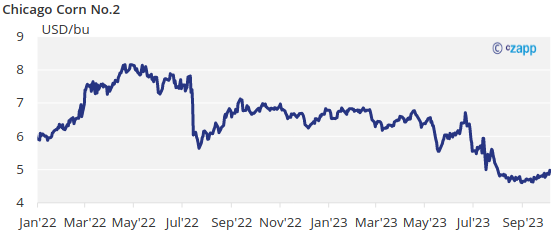

No changes to our forecast for Chicago Corn in a range of 3,9 to 4,15 USD/bu for the average of the 23/24 (Sep/Aug) crop. The average price since Sep 1 is running at 4,77 USD/bu.

Market Commentary

Corn and Wheat rallied in Chicago while European values fell in a combination of dry weather and strong sales in the US, and the trade flow in the Black Sea increasing.

The correction of the previous week in Chicago following the USDA quarterly stocks report proved to be exaggerated and both Corn and Wheat rallied this week. We do think the Corn damage of the previous week was not justified given stocks as of Sep 1 were lower – as we had expected – but the correction in Wheat was somehow justified.

The net spec short in Corn is sizable and short covering was part of the rally, boosted by the end of last week after Corn areas under drought conditions increased.

The MARS bulletin from the EU revised upwards Russian Corn production to an all-time high of 17 mill ton vs. 14,6 of the latest WASDE and vs. 15,9 produced last year which was already an all-time high.

In Ukraine, the Agricultural Ministry revised the Corn production to 28,5 mill ton vs. 27,67 produced last year still far from the 42 mill ton produced before the war started. The latest WASDE is also forecasting 28 mill ton.

Coceral lowered their Corn production forecast in the EU to 60,8 mill ton vs. 61,1 before which is to compared with 59,4 mill ton of the latest WASDE.

US Corn is 23% harvested vs. 19% last year and vs. 21% of the five-year average. Condition was unchanged at 53% good or excellent vs. 52% last year. Corn area under drought increased by 1 point and is now 59%. French Corn is 83% in good or excellent condition up two points week on week and vs. 42% last year. Harvesting is 27% complete very much delayed vs. last year’s 64%. Russian Corn is 21% harvested. Ukrainian Corn is 10% harvested. In Brazil, Safrinha Corn is 99,2% harvested, virtually completed, and first Corn crop is 22,6% planted vs. 22,7% last year.

In the Wheat front, European prices fell slightly mostly on expectation of higher supply out of Ukraine where more vessels were booked to arrive to ports in Ukraine signalling that trade flow is slowly but steady moving. There are also rumors of talks for reviving the Black Sea export corridor agreement unilaterally ended by Russia last July.

On top of that, the Ukrainian Agricultural Ministry revised their Wheat production forecast higher to 21,7 mill ton vs. 20,7 produced last year still far from the 33 mill ton produced before the war started. The latest WASDE is forecasting 22,5 mill ton.

Coceral lowered their Wheat production forecast in the EU to 126,9 mill ton vs. 123,3 before which is to compared with 134 mill ton of the latest WASDE.

The MARS bulletin from the EU revised upwards Russian Wheat production by 3 mill ton to 89,7 mill ton. The Russian Agricultural ministry also increased their Wheat production forecast to 90 mill ton. This is to compare with the 85 mill ton of the latest WASDE and vs. 104 mill ton produced last year which was an all-time high.

Prices in Chicago rallied on early frost forecast in Wheat areas by the end of last week which could damage the new crop being planted these days.

US spring Wheat is fully harvested now. The area of US Wheat under drought deteriorated 2 pts to 49%. Winter Wheat is now 40% planted vs. 39% last year and 43% of the five year average. Russian spring Wheat is 88% harvested. Winter Wheat planting has started in France and is 2% complete.

In the weather front, the US is expecting warmer than average temperatures and lower than normal rains. Brazil is expected to receive a cold wave with rains and Europe is having warmer than average temperatures.

The focus turns now to the October WASDE this week Thursday where we expect the USDA to bring old Corn stocks down to 1,36 bill bu and Wheat stocks up to 1,78 bill bu as per their quarterly stocks number as of Sep 1. But this is already priced in. The focus will be on new Corn crop and we have two doubts: yield and harvested acres. The first should have no upside we think given persistent dry weather is giving no change for better yields. If anything, there could be some downside risk. Harvested acres should also have some downside risk as the USDA is projecting a high percentage of harvested acres vs. planted ones when compared with historical values. But this is probably too soon to be published in the October WASDE and we may have to wait until harvesting is done.

Also low water in the Mississippi continues to be a concern as higher logistical cost for fob prices could pressure Chicago prices lower once fob Gulf needs to be competitive vs. fob Santos.

We should see some volatility previous the Oct WASDE but we don’t expect important changes with the only doubt being the potential downgrade to Corn yield. Harvest pressure and low water in the Mississippi should also weigh negatively sooner or later in Corn prices (Corn basis is now negative). No changes to our forecast for the new 23/24 crop for Chicago Corn in a range of 3,9 to 4,15 USD/bu. The average price since Sep 1 is running at 4,77 USD/bu.