Insight Focus

- Brazilian corn cheaper than American.

- Brazilian cash values fall on large corn crop.

- US sellers expect more Chinese cancellations.

Forecast

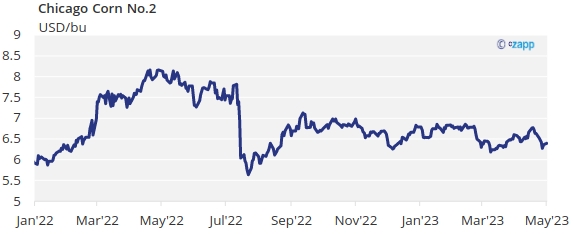

No changes to our Chicago Corn average price forecast for the 22/23 (Sep/Aug) crop in a range of 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.

Market Commentary

Favorable weather, quick planting pace in the US and cancelation of Chinese purchases pressed grains lower in all markets. Brazilian values plummeted again on the back of a big crop.

The quick planting pace of Corn in the US put pressure on prices last week but China cancelling at least two big purchases weighed a lot in the market with the reason apparently being cheaper Brazilian Corn availability. US sellers are now expecting more cancellations from Chinese buyers.

Brazilian Corn has certainly been falling in the past few weeks and is attracting buyers. This will probably result in the USDA making changes to their export forecast which could be published in the May WASDE next week.

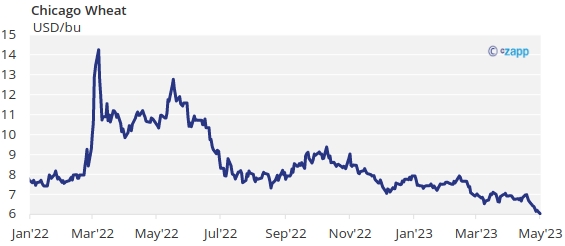

We also had good rains in the US Wheat area which alleviated concerns around spring planting and winter Wheat condition. Another element for downside pressure.

The EC reduced their Corn production forecast to 64,6 mill ton vs. 65,2 before still well above last years’ production of 52,2 mill ton.

US Corn planting showed a big advance last week being 14% planted vs. 7% last year and vs. 11% of the five year average. Another big weekly advance in planting is expected this week. French Corn is 44% planted vs. 56% last year.

In Brazil, the Soybean harvest is 89% complete vs. 90,8% last year. The second Corn crop planting has now finished. And the first Corn crop is 59,6% harvested vs. 65,7% last year.

In the Wheat front, US Wheat condition worsened 1 point and is now 26% good or excellent unchanged vs. 27% last year. French Wheat condition was 94% good or excellent one point higher week on week and vs. 91% last year.

The April MARS bulletin in Europe forecast Wheat yields of 5,74 ton/ha lower than their previous view of 5,77 ton/ha mostly due to much lower yields in Spain and Portugal as is being very dry with April expected to close with the lowest precipitation on record.

Canada reported the biggest Wheat area in 20 years which was another factor for the selling last week.

The EC reduced their Wheat production forecast to 131,1 mill ton vs. 131,9 before and this vs. 126 mill ton produced last year.

There were no news around the Black Sea corridor last week thus the uncertainty remains high around the extension of the agreement.

In the weather front, the US is seeing good rains in the growing areas which are alleviating the bad condition of Wheat and leaves good soil moisture for the Corn that is being planted these days. Brazil is expected to have dry weather which should help to make progress to the first Corn crop harvest. Europe is expecting to have warm and dry weather with another heat wave hitting the south.

Northern Europe has good soil moisture which is benefiting very much Wheat condition and leaves also a perfect situation for the Corn that is being planted these days.

The EU extended the suspension of import duties on Ukrainian agricultural goods against the protests of neighboring countries.

The question mark is where do we go from here. We were expecting downside risk and continue to think prices will continue to ease on the back of ample supply looking forward. We may see some upward correction after last week’s fall and strength around the extension or not of the Black Sea corridor, but overall expect the risk to be to the downside.

Favorable weather, quick planting pace in the US and cancelation of Chinese purchases pressed grains lower in all markets. Brazilian values plummeted again on the back of a big crop. The question mark is where do we go from here. We were expecting downside risk and continue to think prices will continue to ease on the back of ample supply looking forward. We may see some upward correction after last week’s fall and strength around the extension or not of the Black Sea corridor, but overall expect the risk to be to the downside. No changes to our average price forecast for Chicago Corn for the 22/23 (Sep/Aug) crop in a range 6 to 6,5 USD/bu. The average price since Sep 1 is running at 6,7 USD/bu.